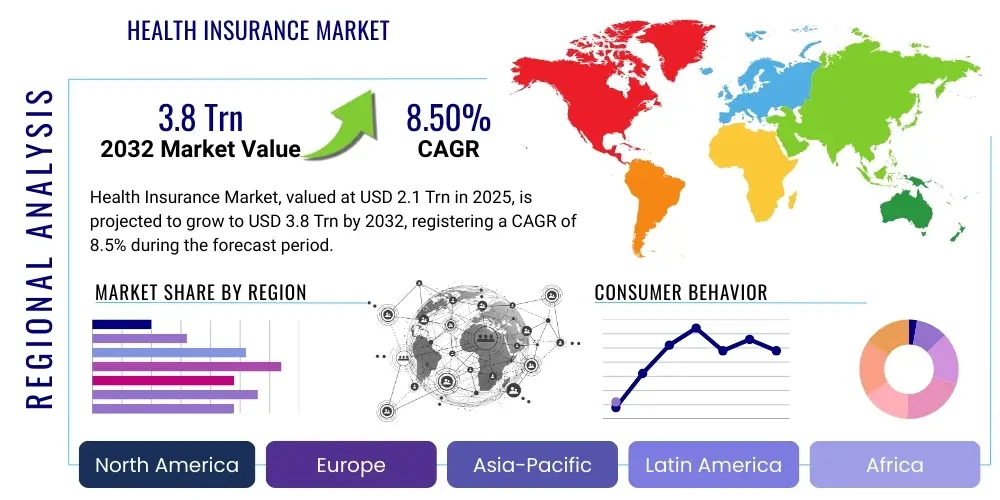

Health Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427790 | Date : Oct, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Health Insurance Market Size

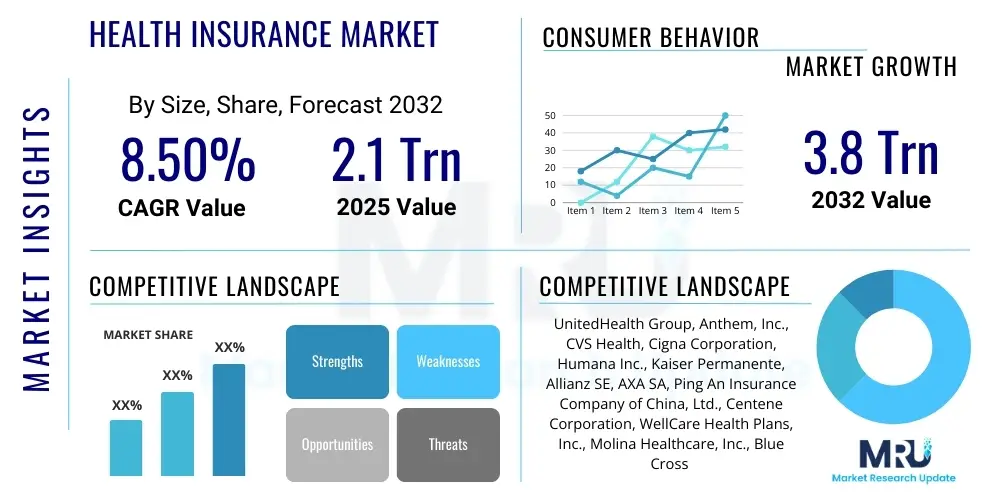

The Health Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2032. The market is estimated at USD 2.1 Trillion in 2025 and is projected to reach USD 3.8 Trillion by the end of the forecast period in 2032. This substantial growth is driven by a confluence of factors including increasing healthcare expenditure, a rising prevalence of chronic diseases, and a growing aging population globally. The evolving regulatory landscape and increasing awareness regarding the benefits of health coverage also significantly contribute to this upward trajectory, compelling both individuals and corporate entities to seek comprehensive insurance solutions.

Health Insurance Market introduction

The health insurance market encompasses a broad spectrum of products and services designed to cover medical expenses for illnesses, injuries, and preventive care. This vital sector provides financial protection against the high costs of healthcare, offering various plans such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Point of Service (POS) plans, and high-deductible health plans. These products are tailored to meet diverse consumer needs, ranging from individual coverage to extensive group plans offered by employers or government programs, all aiming to ensure access to necessary medical services.

Major applications of health insurance extend across hospitalizations, doctor visits, prescription drugs, emergency services, and rehabilitative care, serving as a critical component of personal and public health infrastructure. The primary benefit is financial security, alleviating the burden of unexpected medical bills, while also promoting proactive health management through coverage for preventive screenings and wellness programs. This proactive approach not only benefits individuals by improving health outcomes but also contributes to a healthier, more productive workforce and society at large.

Key driving factors for market expansion include the escalating costs of medical treatments and pharmaceuticals, which necessitate robust insurance coverage, alongside the increasing global awareness of health and wellness. Government mandates and subsidies in many regions also play a significant role in expanding access to health insurance, particularly for vulnerable populations. Furthermore, technological advancements in healthcare delivery, such as telemedicine and personalized medicine, are shaping new product offerings and enhancing the efficiency and accessibility of insurance services, further fueling market growth.

Health Insurance Market Executive Summary

The global health insurance market is currently experiencing robust growth, propelled by evolving business trends that emphasize greater personalization, digital transformation, and value-based care models. Insurers are increasingly leveraging data analytics and artificial intelligence to offer customized plans, enhance claims processing efficiency, and improve customer engagement. Strategic partnerships with healthcare providers and technology firms are becoming commonplace, aimed at creating integrated health ecosystems that offer seamless services and comprehensive wellness programs. These business model innovations are not only improving service delivery but also addressing the rising expectations of consumers for transparent, efficient, and accessible health coverage.

Regionally, distinct trends are observable, with developed markets like North America and Europe demonstrating maturity characterized by high penetration rates and a focus on cost containment and regulatory compliance. Emerging economies in Asia Pacific and Latin America, conversely, are exhibiting rapid expansion due to increasing disposable incomes, growing awareness of health insurance benefits, and supportive government initiatives aimed at universal healthcare coverage. These regions represent significant growth opportunities, attracting substantial investment and innovation, particularly in digital insurance solutions tailored to local market needs and infrastructure capabilities. The Middle East and Africa also show promising growth, driven by mandatory health insurance schemes and a rising demand for private healthcare services.

Segmentation trends reveal a persistent demand for employer-sponsored group health insurance plans, alongside a burgeoning market for individual and family plans, particularly post-pandemic. Product-wise, managed care organizations (HMOs, PPOs) continue to dominate, but there is an increasing shift towards more flexible, consumer-driven health plans and specialized coverage for chronic conditions. The adoption of digital distribution channels, including online portals and mobile applications, is accelerating, enhancing accessibility and convenience for policyholders. This diversification across segments underscores a dynamic market responding to varied consumer preferences, technological advancements, and a complex interplay of demographic and economic forces.

AI Impact Analysis on Health Insurance Market

Users frequently inquire about AIs transformative potential in health insurance, often expressing concerns about data privacy, job displacement, and the ethical implications of algorithmic decision-making, while simultaneously anticipating benefits such as personalized policies, reduced premiums, and expedited claims processing. The overarching theme is a strong expectation for AI to enhance efficiency and affordability, making health insurance more accessible and responsive to individual needs, yet with a critical eye towards ensuring fairness, transparency, and data security. There is particular interest in how AI can move beyond administrative tasks to truly revolutionize risk assessment and preventive care, offering proactive health management rather than just reactive coverage.

- AI significantly enhances fraud detection capabilities, employing machine learning algorithms to identify suspicious claim patterns that human analysts might miss, leading to substantial cost savings for insurers.

- Predictive analytics powered by AI allows for more accurate risk assessment and personalized premium calculations, offering tailored policies based on individual health profiles and lifestyle data.

- Automation of claims processing through AI and Robotic Process Automation (RPA) streamlines operations, reduces processing times, and improves the overall efficiency of insurance companies.

- AI-driven chatbots and virtual assistants provide 24/7 customer support, answering queries, guiding policyholders through processes, and improving engagement and satisfaction.

- Personalized health recommendations and preventive care programs can be developed using AI to analyze health data, encouraging healthier lifestyles and potentially reducing long-term healthcare costs.

- Development of innovative insurance products, such as on-demand insurance or micro-insurance, becomes feasible with AIs ability to analyze real-time data and dynamic risk factors.

- Improved underwriting processes through AI can lead to faster approvals and more competitive pricing by accurately assessing individual risk factors.

- AI facilitates better data security and compliance by monitoring for anomalies and ensuring adherence to regulatory standards like HIPAA and GDPR.

- Enhanced drug discovery and development, indirectly impacting insurance by potentially reducing the cost of new treatments and improving health outcomes over time.

- Telemedicine integration is bolstered by AI, enabling remote diagnostics, monitoring, and consultations, thereby expanding access to care and optimizing insurance coverage for virtual services.

DRO & Impact Forces Of Health Insurance Market

The health insurance market is shaped by a complex interplay of driving forces, significant restraints, and emerging opportunities, all interacting to create dynamic impact forces. Key drivers include the escalating global burden of chronic diseases, an aging population requiring more extensive medical care, and continuous advancements in medical technology leading to new, often expensive, treatment options. Furthermore, increasing healthcare expenditure, rising awareness about health and wellness, and supportive government policies promoting universal health coverage or mandating insurance coverage contribute significantly to market expansion. These factors collectively push both individuals and corporations towards comprehensive insurance solutions, making health insurance a critical component of financial planning and healthcare access.

Despite robust growth drivers, the market faces notable restraints such as the high cost of premiums, which can make insurance unaffordable for a significant portion of the population, especially in developing economies. Regulatory complexities, often varying by region and country, impose compliance burdens on insurers and can hinder market entry for new players. A lack of transparency in policy terms and claim procedures also erodes consumer trust, while the administrative burden associated with managing a large volume of claims presents operational challenges. Economic downturns and periods of high unemployment can further exacerbate these restraints, as individuals may prioritize other expenses over health insurance.

However, the market is rife with opportunities stemming from technological innovation, particularly in areas like artificial intelligence, big data analytics, and telemedicine. These technologies enable insurers to offer personalized products, enhance efficiency, reduce fraud, and improve customer engagement. The expansion into untapped emerging markets, the development of value-based care models, and the integration of wellness programs present significant avenues for growth. The impact forces are predominantly shaped by demographic shifts, technological disruptions, regulatory evolution, and macroeconomic conditions, all of which necessitate continuous adaptation and innovation from market participants to remain competitive and responsive to evolving societal needs.

Segmentation Analysis

The health insurance market is highly diversified, segmented across various parameters to address the heterogeneous needs of consumers and businesses. These segmentations are critical for understanding market dynamics, tailoring product offerings, and developing targeted marketing strategies. By categorizing the market based on aspects like type of insurance, coverage, end-user, and distribution channel, insurers can effectively identify niche markets, assess competitive landscapes, and optimize their service delivery. This granular approach allows for the development of highly specialized plans that cater to specific demographic, economic, and health-related requirements, ensuring broader market penetration and enhanced customer satisfaction.

- By Type: Individual Health Insurance, Group Health Insurance, Public/Social Health Insurance

- By Product Type: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Point of Service (POS) Plans, Indemnity Plans, Exclusive Provider Organizations (EPOs), High Deductible Health Plans (HDHPs) with Savings Accounts

- By Coverage Type: Medical Expenses (Inpatient, Outpatient), Prescription Drugs, Dental Care, Vision Care, Mental Health Services, Maternity Care, Critical Illness Coverage, Long-Term Care

- By End-User: Corporate (Large Enterprises, Small & Medium Enterprises), Individuals, Families, Senior Citizens, Government Employees

- By Distribution Channel: Insurance Agents/Brokers, Direct Sales (Online, Company Representatives), Bancassurance, Aggregators/Online Portals, Public & Private Exchanges

- By Age Group: Pediatric, Adult, Geriatric

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Health Insurance Market Value Chain Analysis

The value chain of the health insurance market begins with upstream activities primarily involving product development and risk assessment. This stage encompasses the actuarial analysis to determine premium structures, benefit designs, and policy terms, requiring extensive data collection and sophisticated analytical models. Research and development for new insurance products, often incorporating advanced analytics for personalized health plans or wellness programs, also fall within this initial segment. Providers of technology solutions, data analytics platforms, and regulatory compliance software are crucial upstream partners, enabling insurers to effectively design, price, and manage their offerings, while adhering to complex legal frameworks.

Midstream activities focus on the operational aspects of insurance, including underwriting, policy administration, and claims management. Underwriting involves evaluating individual or group risks to determine eligibility and appropriate premiums. Policy administration handles the lifecycle of policies, from issuance to renewals and modifications. Claims management, a critical function, involves receiving, processing, and settling claims, often requiring coordination with healthcare providers. This stage benefits significantly from automation and digital technologies, which streamline processes, reduce errors, and enhance efficiency, thereby improving the overall customer experience and operational cost-effectiveness. The integration of AI and machine learning in these processes is increasingly common, leading to faster and more accurate outcomes.

Downstream activities primarily involve distribution channels and customer service, connecting the insurance product to the end-user. Distribution can be direct, through company websites or salesforces, or indirect, via independent agents, brokers, bancassurance partners, or online aggregators. Each channel offers unique advantages in terms of reach and personalized service. Post-sales services, including customer support, grievance redressal, and policyholder education, are paramount for customer retention and brand loyalty. The overall value chain is a complex ecosystem that relies on seamless coordination between various stakeholders, from healthcare providers and technology vendors to distribution partners and regulatory bodies, all contributing to the delivery of comprehensive health insurance solutions to the final consumer.

Health Insurance Market Potential Customers

The potential customer base for the health insurance market is remarkably diverse, encompassing a wide array of individuals, families, and organizations, each with unique needs and motivations for seeking coverage. At the most fundamental level, individuals and families constitute a significant segment, driven by the desire for financial protection against unexpected medical expenses, access to quality healthcare services, and peace of mind. This group includes young adults, middle-aged individuals, and seniors, each often requiring different types of coverage based on their life stage, health status, and financial capacity. For instance, younger demographics might prioritize catastrophic coverage, while families often seek comprehensive plans including maternity and pediatric care, and seniors focus on extensive medical coverage for chronic conditions.

Corporate entities represent another substantial segment of potential customers, ranging from small and medium-sized enterprises (SMEs) to large multinational corporations. Employers often provide group health insurance as a crucial component of employee benefits packages, aiming to attract and retain talent, improve workforce productivity, and ensure employee well-being. The size and nature of the business typically dictate the type and breadth of coverage offered, with larger companies often providing more extensive and flexible plans. These corporate clients are increasingly looking for integrated wellness programs and value-added services that go beyond traditional medical coverage, contributing to a healthier and more engaged workforce.

Beyond individuals and corporations, governmental bodies, public sector organizations, and specific demographic groups also form key customer segments. Governments, in many regions, are significant buyers, either directly providing health insurance through national schemes or mandating private insurance for their employees or citizens. Furthermore, specialized populations such as students, expatriates, and military personnel often require tailored insurance products that address their specific circumstances and mobility. The emergence of digital platforms and personalized health management tools further expands the reach to these diverse segments, allowing insurers to offer highly customized and accessible solutions that cater to the distinct demands of each customer category, thereby maximizing market penetration.

Health Insurance Market Key Technology Landscape

The health insurance market is undergoing a profound technological transformation, with a wide array of advanced technologies reshaping its operational efficiencies, customer engagement models, and product innovation. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront, revolutionizing risk assessment, fraud detection, and claims processing. These technologies enable insurers to analyze vast datasets to identify complex patterns, predict future health outcomes, and personalize premium calculations with unprecedented accuracy. AI-powered chatbots and virtual assistants are enhancing customer service by providing instant support and guidance, thereby improving user experience and reducing operational costs. This shift towards intelligent automation is making insurance services faster, more efficient, and more responsive to individual needs.

Big Data Analytics plays a pivotal role by allowing insurers to derive actionable insights from diverse data sources, including electronic health records, wearable device data, and demographic information. This analytical capability facilitates the development of more targeted and effective wellness programs, predictive modeling for disease management, and precise market segmentation. Cloud computing provides the scalable and secure infrastructure necessary to store and process these massive datasets, enabling flexible deployment of applications and enhancing data accessibility across different platforms. The adoption of blockchain technology is also gaining traction, offering the potential for enhanced data security, transparent claims processing, and immutable record-keeping, which can significantly reduce administrative overheads and build greater trust among all stakeholders.

Furthermore, the integration of Telemedicine and remote monitoring technologies, often supported by AI and IoT (Internet of Things) devices, is expanding access to care and enabling proactive health management. Wearable technology, for instance, provides real-time health data that can be used for dynamic risk assessment and incentivizing healthy behaviors through personalized rewards. Digital payment systems and mobile applications are streamlining premium payments and claims submissions, offering convenience and accessibility to policyholders. Customer Relationship Management (CRM) software, enhanced with AI capabilities, helps insurers manage customer interactions more effectively, fostering stronger relationships. These technological advancements collectively contribute to a more dynamic, efficient, and customer-centric health insurance ecosystem, driving innovation and improving health outcomes.

Regional Highlights

- North America: Dominates the global market, primarily due to high healthcare expenditure, advanced technological adoption, and a robust regulatory framework. The United States leads in terms of market size and innovation, driven by a complex private and public insurance system and a strong emphasis on employer-sponsored plans. Canada also contributes significantly with its mixed public-private model.

- Europe: Characterized by diverse healthcare systems, including universal healthcare models with complementary private insurance (e.g., Germany, France) and more private-market-driven systems (e.g., UK). The region is focusing on integrating digital health solutions and addressing an aging population, with a strong emphasis on regulatory compliance and data privacy.

- Asia Pacific: Emerging as the fastest-growing market, propelled by increasing disposable incomes, a burgeoning middle class, growing health awareness, and expanding government initiatives for universal health coverage (e.g., China, India). Significant opportunities exist for digital insurance products and micro-insurance solutions in this diverse and populous region.

- Latin America: Demonstrates steady growth influenced by economic development, urbanization, and a gradual shift from public to private healthcare solutions. Countries like Brazil and Mexico are seeing increased adoption of private health insurance, driven by a demand for higher quality and faster access to medical services than public systems often provide.

- Middle East & Africa: Experiencing growth fueled by mandatory health insurance schemes (e.g., UAE, Saudi Arabia), a rising expatriate population, and increasing investment in healthcare infrastructure. The region presents opportunities for tailored plans and TPA (Third Party Administrator) services, with a growing demand for international coverage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Health Insurance Market.- UnitedHealth Group

- Anthem, Inc.

- CVS Health (Aetna)

- Cigna Corporation

- Humana Inc.

- Kaiser Permanente

- Allianz SE

- AXA SA

- Ping An Insurance (Group) Company of China, Ltd.

- Centene Corporation

- WellCare Health Plans, Inc.

- Molina Healthcare, Inc.

- Blue Cross Blue Shield Association

- Zurich Insurance Group

- Manulife Financial Corporation

Frequently Asked Questions

What are the primary drivers for the growth of the Health Insurance Market?

The primary drivers for the growth of the Health Insurance Market include the escalating global burden of chronic diseases, a rapidly aging population, continuous advancements in medical technology, and the rising costs of healthcare services. Additionally, increasing health awareness among consumers and supportive government policies mandating or incentivizing health coverage play a crucial role in expanding market demand and penetration globally.

How is AI impacting the Health Insurance Market?

AI is profoundly impacting the Health Insurance Market by enhancing fraud detection, enabling more personalized risk assessment and premium calculations, and automating claims processing for greater efficiency. It also powers chatbots for improved customer service, facilitates the development of preventive care programs, and helps create innovative insurance products, leading to more data-driven and customer-centric services.

What are the key types of health insurance plans available?

The key types of health insurance plans available typically include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Point of Service (POS) plans, and Indemnity plans. High-Deductible Health Plans (HDHPs) are also prevalent, often combined with health savings accounts (HSAs), offering various levels of flexibility, network restrictions, and cost structures to suit diverse needs.

Which regions offer the most significant growth opportunities in health insurance?

The Asia Pacific region, particularly countries like China and India, offers the most significant growth opportunities in health insurance. This is due to increasing disposable incomes, a growing middle class, rising health awareness, and expanding government initiatives aimed at increasing access to healthcare and insurance. Latin America and parts of the Middle East and Africa also present strong growth prospects.

What challenges does the Health Insurance Market face?

The Health Insurance Market faces several challenges, including the high cost of premiums, which can lead to affordability issues and low penetration in certain segments. Other significant challenges include complex regulatory environments, a lack of transparency in policy terms, the administrative burden of claims management, and the need to adapt to rapidly evolving healthcare technologies and consumer expectations while maintaining profitability and ethical standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Accident and Health Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Health Insurance Third Party Administrator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Private Health Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Teen Health Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Personal Accident and Health Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager