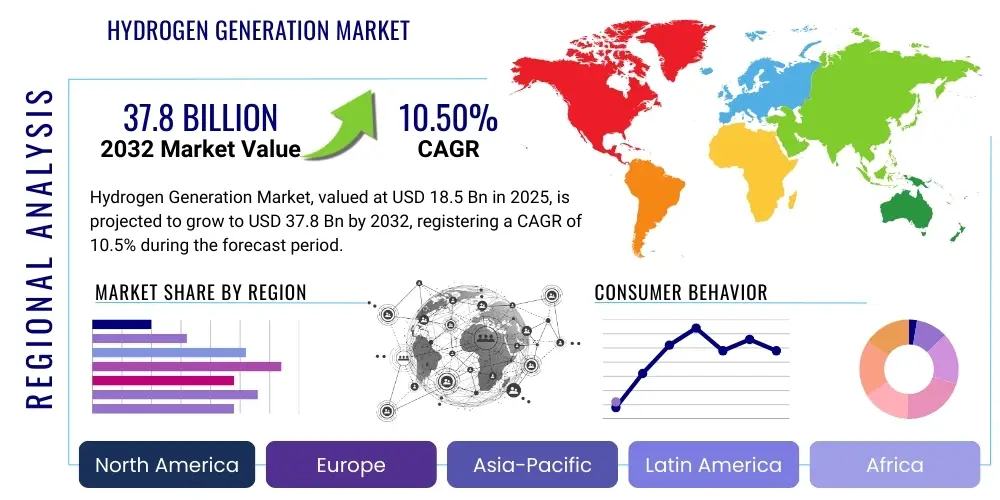

Hydrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 427363 | Date : Oct, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hydrogen Generation Market Size

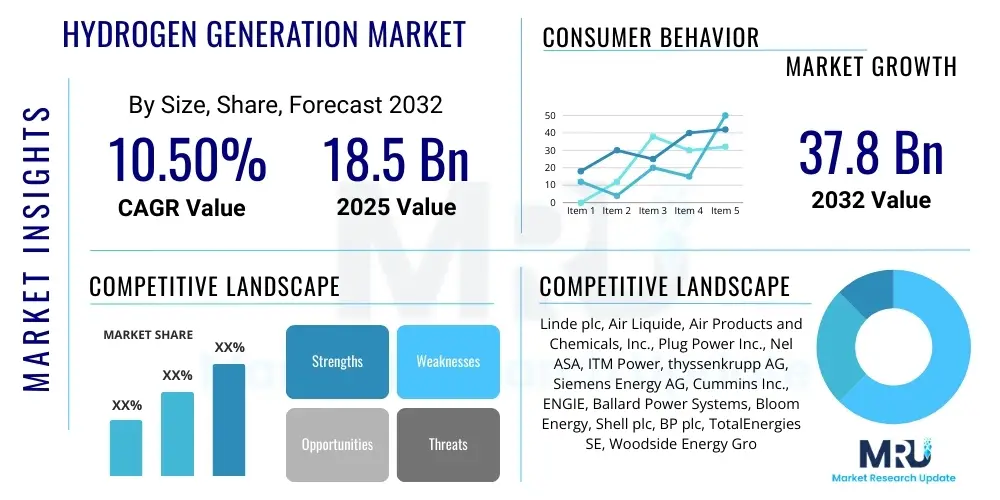

The Hydrogen Generation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2025 and 2032. The market is estimated at USD 18.5 Billion in 2025 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2032.

Hydrogen Generation Market introduction

The Hydrogen Generation Market encompasses the production of hydrogen gas through various methods, serving as a critical energy carrier and industrial feedstock. Hydrogen, recognized for its zero-emission potential when produced from renewable sources, is central to global decarbonization strategies, driving significant investments in both established and emerging production technologies. The primary product is pure hydrogen gas, used across a multitude of applications. This includes its traditional roles in chemical manufacturing and petroleum refining, alongside rapidly expanding uses in power generation, transportation, and metallurgy.

Major applications for hydrogen extend to the production of ammonia for fertilizers, methanol, and the desulfurization of fuels in refineries, ensuring cleaner petroleum products. Its growing utility as a clean fuel source for fuel cell electric vehicles (FCEVs), particularly in heavy-duty transport, and for long-duration energy storage in grid applications, underscores its versatility. The benefits of hydrogen generation, especially green hydrogen, are profound, offering a pathway to significantly reduce greenhouse gas emissions, enhance energy security by diversifying energy sources, and provide a flexible solution for integrating intermittent renewable energy into the grid. It presents a critical opportunity to decarbonize hard-to-abate sectors where electrification is challenging.

Driving factors for market expansion include ambitious global climate goals and net-zero commitments, which are stimulating unprecedented government support through policies, subsidies, and incentives for clean hydrogen production and infrastructure development. Additionally, the declining costs of renewable electricity, essential for green hydrogen, combined with advancements in electrolysis technologies and growing corporate sustainability mandates, are further accelerating market growth and innovation. The increasing demand for cleaner industrial processes and the emergence of hydrogen-powered mobility solutions are also pivotal in shaping the markets trajectory.

Hydrogen Generation Market Executive Summary

The Hydrogen Generation Market is experiencing transformative business trends, marked by a decisive global pivot towards sustainable production methods, particularly green hydrogen derived from renewable energy sources. This shift is fueled by aggressive decarbonization targets and substantial public and private sector investments aimed at scaling up electrolysis capacity and establishing comprehensive hydrogen ecosystems. Key business strategies involve forging strategic partnerships across the value chain, from renewable energy developers to industrial end-users, alongside a strong emphasis on technological innovation to reduce production costs and enhance efficiency. Companies are also focusing on developing integrated solutions that encompass hydrogen production, storage, and distribution, addressing infrastructure gaps to accelerate market adoption.

Regionally, Europe, North America, and Asia-Pacific are at the forefront of the hydrogen generation revolution. Europe, with its ambitious EU Hydrogen Strategy, leads in developing green hydrogen projects and establishing cross-border hydrogen pipelines, positioning itself as a key producer and consumer. North America, driven by significant government funding and an abundance of natural gas for blue hydrogen, alongside burgeoning renewable capacity for green hydrogen, is rapidly expanding its production capabilities. Asia-Pacific, particularly countries like Japan, South Korea, and China, is focused on securing future energy supplies and decarbonizing heavy industries, investing heavily in both domestic production and international supply chains for hydrogen. The Middle East and Latin America are also emerging as significant players, leveraging vast renewable energy potential for green hydrogen exports.

Segmentation trends reveal a clear growth trajectory for electrolysis technologies, with Proton Exchange Membrane (PEM) and Solid Oxide Electrolyzers (SOECs) gaining traction due to their efficiency and scalability, though Steam Methane Reforming (SMR) remains dominant for grey hydrogen production. In terms of application, the market is diversifying beyond traditional industrial uses, with significant growth projected in power generation, transportation (heavy-duty vehicles, maritime), and heat for industrial processes. The demand for green and blue hydrogen is soaring as industries seek to reduce their carbon footprint, shifting away from grey hydrogen. This dynamic interplay of technological advancements, supportive policies, and increasing end-use diversification is shaping a vibrant and rapidly expanding global hydrogen generation landscape.

AI Impact Analysis on Hydrogen Generation Market

Common user questions regarding AIs impact on the Hydrogen Generation Market frequently revolve around how artificial intelligence can enhance efficiency, reduce costs, improve safety, and accelerate the overall transition to a hydrogen economy. Users are particularly interested in AIs capabilities for optimizing production processes, predicting maintenance needs for complex equipment like electrolyzers, and seamlessly integrating hydrogen into existing energy infrastructures and smart grids. There is also significant curiosity about AIs role in scaling up production, managing complex supply chains, and driving innovation in materials science and catalyst development for next-generation hydrogen technologies.

The key themes emerging from these inquiries highlight a strong expectation that AI will act as a critical enabler for overcoming current market hurdles, such as the capital intensity of projects and operational complexities. Users envision AI as a tool to unlock greater operational reliability, minimize downtime, and ensure the consistent and safe delivery of hydrogen across diverse applications. Furthermore, the potential for AI to optimize resource utilization, particularly renewable electricity for green hydrogen production, and to accurately forecast demand and supply, is seen as crucial for market stability and growth.

Overall, the predominant concerns and expectations center on leveraging AI to make hydrogen generation more economically viable, environmentally sustainable, and operationally robust, thereby accelerating its role as a cornerstone of the future energy landscape. The consensus suggests that AI is not merely an incremental improvement but a transformative technology for the hydrogen sector, capable of driving efficiencies across the entire value chain.

- Process Optimization: AI algorithms can analyze vast datasets from hydrogen production facilities to optimize operational parameters, leading to higher efficiency, reduced energy consumption, and increased output for both SMR and electrolysis processes.

- Predictive Maintenance: AI-powered predictive analytics can monitor the health and performance of electrolyzers, compressors, and other critical equipment, forecasting potential failures and enabling proactive maintenance to minimize downtime and extend asset lifespans.

- Demand Forecasting and Supply Chain Management: AI can analyze market trends, energy prices, and weather patterns to accurately forecast hydrogen demand and optimize supply chain logistics, ensuring efficient distribution and reducing waste.

- Energy Management and Grid Integration: AI plays a crucial role in managing renewable energy inputs for green hydrogen production, optimizing energy consumption, and facilitating the seamless integration of hydrogen production and storage into smart grids and broader energy systems.

- Safety Monitoring and Risk Management: AI-driven sensors and analytical tools can enhance safety protocols by detecting potential leaks, system anomalies, or hazardous conditions in real-time, allowing for immediate intervention and mitigating risks.

- Research and Development Acceleration: AI and machine learning are being used to accelerate the discovery of new catalysts, materials, and electrolysis designs, significantly speeding up the innovation cycle for more efficient and cost-effective hydrogen generation technologies.

DRO & Impact Forces Of Hydrogen Generation Market

The Hydrogen Generation Market is propelled by significant drivers, primarily the urgent global imperative for decarbonization and the widespread adoption of net-zero emission targets by nations and corporations. This environmental push is strongly supported by robust government policies, financial incentives, and regulatory frameworks designed to promote clean hydrogen production and its integration into the energy mix. Furthermore, the decreasing cost of renewable energy, particularly solar and wind power, directly lowers the operational expenses for green hydrogen production via electrolysis, enhancing its economic viability and making it a more attractive option compared to fossil-fuel-based methods. The growing demand for clean fuels in hard-to-abate sectors like heavy industry, maritime shipping, and aviation also serves as a potent driver.

Despite these tailwinds, several restraints hinder the rapid expansion of the market. High capital expenditure remains a significant barrier for establishing new green hydrogen production facilities and developing the necessary infrastructure for storage, transportation, and distribution. The energy-intensive nature of electrolysis, even when powered by renewables, contributes to production costs and technical complexity. Furthermore, the nascent stage of hydrogen infrastructure globally presents logistical challenges, making large-scale deployment difficult and costly. Public perception and safety concerns associated with hydrogen handling and storage, though largely manageable with current technologies, also pose a restraint requiring consistent education and stringent safety protocols to address effectively.

Opportunities within the Hydrogen Generation Market are substantial and diverse. The most prominent opportunity lies in the scaling up of green hydrogen production, leveraging abundant renewable resources worldwide to create a truly sustainable energy carrier. The expansion of fuel cell technology into new applications, including heavy-duty transportation, maritime, and even residential power, opens up vast new markets. Additionally, the potential for hydrogen to serve as a long-duration energy storage solution, balancing intermittent renewable energy generation, represents a critical opportunity for grid stability and energy security. Innovation in advanced electrolysis technologies, hydrogen storage materials, and carbon capture utilization and storage (CCUS) for blue hydrogen also presents lucrative avenues for growth. Impact forces such as geopolitical developments affecting energy supply, technological breakthroughs in production efficiency, and evolving environmental regulations will profoundly shape the markets future trajectory.

Segmentation Analysis

The Hydrogen Generation Market is intricately segmented across multiple dimensions, providing a comprehensive understanding of its diverse landscape and growth drivers. These segmentations are crucial for stakeholders to identify specific market niches, tailor technological developments, and strategize investment decisions effectively. The market is categorized by the method of production, the source of feedstock, the various applications, and the end-use industries it serves, reflecting the wide array of technologies and demands shaping the hydrogen economy. Understanding these segments allows for a targeted approach to market development, ensuring that production capabilities align with industrial needs and evolving clean energy mandates.

This granular analysis is vital for monitoring market trends, assessing competitive dynamics, and forecasting future growth across different hydrogen value chains. As the industry matures, the distinctions between segments will become even more pronounced, driven by technological advancements, regulatory pressures, and cost efficiencies. The shift towards cleaner production methods, for instance, significantly impacts the "By Production Method" segment, while the expansion of hydrogen into new mobility and energy storage applications reshapes the "By Application" and "By End-Use Industry" segments. Ultimately, a detailed segmentation analysis underpins strategic planning and resource allocation for sustained growth in the global hydrogen market.

- By Technology:

- Steam Methane Reforming (SMR)

- Electrolysis (Alkaline, Proton Exchange Membrane (PEM), Solid Oxide Electrolyzer Cell (SOEC))

- Coal Gasification

- Others (Biomass Gasification, Methane Pyrolysis, Photoelectrochemical)

- By Application:

- Chemicals (Ammonia, Methanol)

- Refining

- Power Generation

- Transport (Fuel Cell Electric Vehicles, Maritime, Aviation)

- Metal Production

- Other Industrial Uses

- By End-Use Industry:

- Industrial

- Energy

- Mobility

- Residential & Commercial

- By Source:

- Natural Gas

- Coal

- Water

- Biomass

- Renewable Electricity

- By Production Method (Color Classification):

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

- Turquoise Hydrogen

Hydrogen Generation Market Value Chain Analysis

The hydrogen generation markets value chain commences with upstream activities centered on feedstock procurement and the initial production of hydrogen. This stage involves sourcing raw materials such as natural gas for Steam Methane Reforming (SMR), coal for gasification, or increasingly, water and renewable electricity for electrolysis. Significant investment is required here for the construction and operation of production facilities, including SMR plants, coal gasifiers, or large-scale electrolyzer installations coupled with renewable energy farms. Research and development into more efficient catalysts, electrolysis membranes, and carbon capture technologies are also integral upstream components, aiming to improve cost-effectiveness and reduce environmental impact.

Moving downstream, the value chain encompasses the subsequent processes of hydrogen purification, compression, storage, and transportation. Once generated, hydrogen often needs to be purified to meet specific industrial or fuel cell grade requirements. Compression is necessary for efficient storage and transport, which can occur via pipelines for large volumes and short distances, or in specialized high-pressure tanks for trucks and ships for longer distances and varied applications. The development of robust and safe storage solutions, including underground caverns, liquid hydrogen tanks, and solid-state hydrogen storage, is a crucial aspect of this downstream segment. The efficiency and safety of these midstream operations directly impact the final cost and availability of hydrogen to end-users.

The final stage involves the distribution channels and the ultimate consumption of hydrogen across various end-use applications. Direct distribution typically involves delivering hydrogen to large industrial consumers such as chemical plants or oil refineries through dedicated pipelines or bulk deliveries. Indirect channels involve a network of distributors and refueling stations that supply hydrogen to smaller industrial users, fuel cell vehicle fleets, or power generation facilities. The effectiveness of these distribution networks is paramount for market penetration and widespread adoption. The integration of hydrogen into existing energy systems, including blending with natural gas grids or utilization in fuel cell power plants, further defines the downstream segment, connecting production to a diverse and expanding base of customers.

Hydrogen Generation Market Potential Customers

The Hydrogen Generation Market caters to a broad spectrum of potential customers and end-users, reflecting hydrogens versatile role as both an industrial feedstock and a clean energy carrier. Traditionally, the chemical industry has been a primary off-taker, utilizing hydrogen extensively for the production of ammonia, a key component in fertilizers, and methanol, a crucial intermediate for various chemicals and fuels. Oil refineries represent another foundational customer segment, where hydrogen is indispensable for hydrotreating and hydrocracking processes, reducing the sulfur content and upgrading petroleum products to meet environmental standards. These industries continue to be significant, but their demand profile is increasingly shifting towards cleaner hydrogen sources to align with sustainability goals.

Beyond these established segments, the energy sector is rapidly emerging as a substantial potential customer for hydrogen. This includes power generation companies exploring hydrogen as a fuel for gas turbines to generate electricity with reduced emissions, and as a long-duration energy storage solution to balance the intermittency of renewable energy sources. Hydrogen offers a flexible way to store excess renewable electricity and convert it back into power when needed, enhancing grid stability and energy security. The residential and commercial sectors are also beginning to explore hydrogen for combined heat and power (CHP) systems and heating, aiming for zero-emission energy solutions.

Furthermore, the mobility sector is poised for significant growth in hydrogen consumption. This encompasses the increasing adoption of fuel cell electric vehicles (FCEVs) for passenger cars, buses, and heavy-duty trucks, offering zero-emission transportation with quick refueling times and longer ranges compared to battery electric vehicles. The maritime and aviation industries are also exploring hydrogen and hydrogen-derived fuels (e.g., ammonia, synthetic fuels) as a pathway to decarbonize their operations. Lastly, heavy industries such as steel and cement production are considering hydrogen as a crucial element to replace fossil fuels in high-temperature processes, making them significant future customers in the pursuit of industrial decarbonization.

Hydrogen Generation Market Key Technology Landscape

The Hydrogen Generation Market is characterized by a dynamic and evolving technological landscape, driven by the imperative to produce hydrogen more sustainably, efficiently, and cost-effectively. The most mature and widely adopted technology remains Steam Methane Reforming (SMR), which produces "grey" hydrogen from natural gas. SMR involves reacting natural gas with steam at high temperatures to produce hydrogen and carbon dioxide. While currently the most economical, its significant carbon emissions are driving the shift towards cleaner alternatives. "Blue" hydrogen also uses SMR but incorporates Carbon Capture, Utilization, and Storage (CCUS) technologies to mitigate CO2 emissions, offering a transition pathway.

Electrolysis, which uses electricity to split water into hydrogen and oxygen, is at the forefront of the clean hydrogen revolution, enabling "green" hydrogen production when powered by renewable energy. Within electrolysis, several technologies are prominent. Alkaline Electrolyzers (AEL) are mature and robust, operating with liquid electrolytes. Proton Exchange Membrane (PEM) Electrolyzers are known for their compact design, rapid response to fluctuating renewable electricity, and high purity hydrogen output, making them ideal for integration with intermittent renewable sources. Solid Oxide Electrolyzers (SOEC) operate at high temperatures, offering higher electrical efficiency and the potential to utilize waste heat, making them attractive for industrial applications or nuclear power integration.

Beyond these established and rapidly scaling technologies, the market is also seeing significant research and development in emerging production pathways. These include Biomass Gasification, which converts organic matter into syngas from which hydrogen can be extracted, and Methane Pyrolysis, a process that splits methane into hydrogen and solid carbon, avoiding CO2 emissions. Photoelectrochemical (PEC) water splitting, utilizing sunlight directly to produce hydrogen, and advanced thermochemical cycles are also under investigation. The continuous innovation across these diverse technologies is crucial for achieving cost parity with conventional fuels and ensuring a scalable, sustainable future for hydrogen generation.

Regional Highlights

- Europe: Europe is a global leader in the hydrogen generation market, driven by its ambitious decarbonization targets, comprehensive EU Hydrogen Strategy, and substantial investments in green hydrogen projects. Countries like Germany, France, and the Netherlands are at the forefront, establishing extensive hydrogen valleys, investing in large-scale electrolyzer deployments, and developing cross-border hydrogen pipeline infrastructure. The region benefits from strong policy support, significant R&D funding, and a commitment to fostering a circular hydrogen economy, aiming for widespread adoption in industry, transport, and energy storage.

- North America: North America is experiencing robust growth in hydrogen generation, propelled by significant government incentives such as the U.S. Infrastructure Investment and Jobs Act and the establishment of regional hydrogen hubs. The region leverages its vast natural gas reserves for blue hydrogen production, incorporating carbon capture technologies, while also rapidly expanding green hydrogen initiatives fueled by abundant wind and solar resources. Canada is also a key player, focusing on both domestic clean hydrogen production and developing export capabilities, particularly to Europe and Asia, solidifying the continents role in the global hydrogen supply chain.

- Asia-Pacific: The Asia-Pacific region is a critical and rapidly expanding market for hydrogen generation, characterized by its diverse energy demands and strong industrial base. Countries such as Japan, South Korea, and China are making substantial investments in hydrogen technologies and infrastructure to secure future energy supplies, reduce reliance on fossil fuels, and address severe air quality concerns. Japan and South Korea are particularly focused on developing international green hydrogen supply chains and integrating hydrogen into their energy mix, while China is rapidly scaling up both grey and green hydrogen production to support its industrial and mobility sectors. Australia is emerging as a major potential exporter of green hydrogen due to its vast renewable energy resources.

- Middle East & Africa: The Middle East and Africa region is positioned to become a global hub for low-cost green hydrogen production, leveraging its world-class solar and wind resources. Countries like Saudi Arabia, the UAE, and Oman are investing heavily in large-scale green hydrogen and ammonia projects, primarily targeting export markets in Europe and Asia. These nations aim to diversify their economies away from fossil fuels and capitalize on their competitive advantage in renewable energy. Africa, particularly North and Southern Africa, also holds immense potential for green hydrogen production, attracting international partnerships for development and export.

- Latin America: Latin America possesses significant, untapped potential for green hydrogen generation, driven by its abundant renewable energy resources, particularly hydropower, solar, and wind. Countries like Chile and Brazil are leading the charge, developing ambitious national hydrogen strategies and attracting international investment for large-scale production projects. Chile, with its exceptional Patagonia wind resources, is focused on green hydrogen and green ammonia for export and decarbonizing its mining industry. Brazils vast hydropower and solar potential make it a promising region for future clean hydrogen production, contributing to both domestic energy needs and global supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogen Generation Market.- Linde plc

- Air Liquide

- Air Products and Chemicals, Inc.

- Plug Power Inc.

- Nel ASA

- ITM Power

- thyssenkrupp AG

- Siemens Energy AG

- Cummins Inc.

- ENGIE

- Ballard Power Systems

- Bloom Energy

- Shell plc

- BP plc

- TotalEnergies SE

- Woodside Energy Group Ltd

- Uniper SE

- Fortescue Future Industries

- ExxonMobil Corporation

- Kawasaki Heavy Industries, Ltd.

Frequently Asked Questions

What are the primary types of hydrogen produced in the market?

Hydrogen is primarily categorized by its production method: "Grey" hydrogen, produced from fossil fuels like natural gas without carbon capture; "Blue" hydrogen, also from fossil fuels but with carbon capture and storage (CCS) to reduce emissions; and "Green" hydrogen, generated from water electrolysis powered by renewable electricity, resulting in zero greenhouse gas emissions during production.

What are the main applications of hydrogen generation in various industries?

Hydrogen generation serves diverse applications across industries, including its traditional use as a feedstock for producing ammonia in fertilizers and methanol in chemicals, and for desulfurization in petroleum refining. Emerging applications include its use as a clean fuel for fuel cell electric vehicles (FCEVs), for long-duration energy storage in power grids, and for decarbonizing heavy industries like steel and cement production.

What are the key drivers propelling the growth of the Hydrogen Generation Market?

The primary drivers include ambitious global decarbonization targets and net-zero commitments, significant government support through policies and incentives for clean hydrogen, the declining cost of renewable electricity, and the increasing demand for cleaner industrial processes and sustainable mobility solutions. Technological advancements in electrolysis and carbon capture also play a crucial role.

What challenges does the Hydrogen Generation Market face?

Key challenges include the high upfront capital expenditure required for green hydrogen production facilities and extensive infrastructure development (storage, transportation), the energy-intensive nature of electrolysis processes, and the current cost competitiveness against fossil fuels. Furthermore, establishing robust and scalable supply chains and addressing safety perceptions are significant hurdles.

How does artificial intelligence impact the Hydrogen Generation Market?

Artificial intelligence significantly impacts the Hydrogen Generation Market by optimizing production processes for higher efficiency and lower energy consumption, enabling predictive maintenance for critical equipment, and enhancing demand forecasting and supply chain management. AI also plays a crucial role in integrating hydrogen into smart energy grids and accelerating research and development for new materials and technologies, ultimately contributing to cost reduction and operational reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Steam Methane Reforming Hydrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Chemical Merchant Hydrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Captive Chemical Hydrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Steam Reformer Merchant Hydrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Chemical Hydrogen Generation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager