Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 428285 | Date : Oct, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Ingredients Market Size

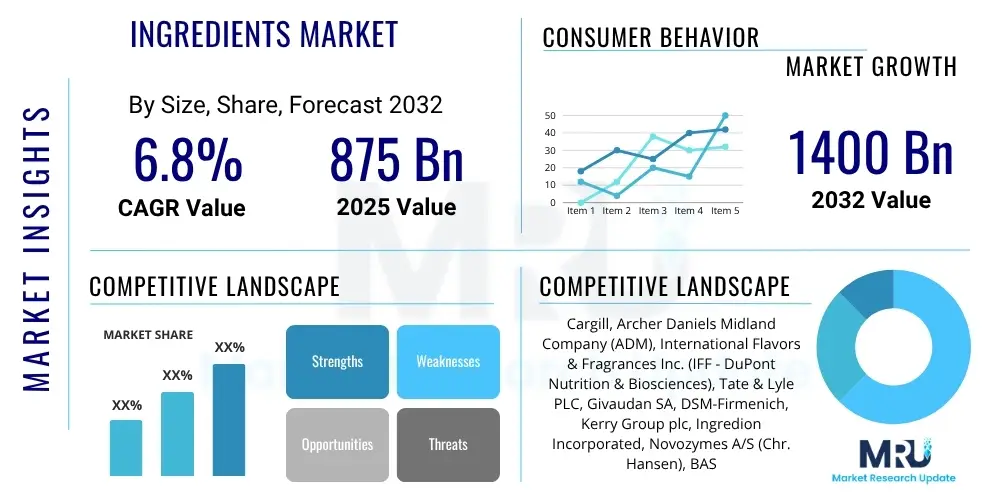

The Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2025 and 2032. The market is estimated at USD 875 Billion in 2025 and is projected to reach USD 1400 Billion by the end of the forecast period in 2032.

Ingredients Market introduction

The global ingredients market encompasses a vast array of substances derived from natural or synthetic sources, meticulously processed and formulated to be incorporated into a multitude of end products. These ingredients serve critical functions, ranging from providing essential nutritional value and enhancing sensory attributes like taste, texture, and aroma, to extending shelf life and improving the overall stability and functionality of consumer goods. This expansive market is fundamental to the manufacturing processes across diverse industries, acting as the foundational building blocks for everything from daily consumables to specialized industrial applications. The demand for these components is intrinsically linked to global consumption patterns, technological advancements, and evolving consumer preferences.

Products within this market are incredibly diverse, including but not limited to, sweeteners, flavors, colors, preservatives, emulsifiers, texturizers, nutritional supplements (vitamins, minerals, proteins, fibers), and functional ingredients (probiotics, prebiotics, botanicals). Each category plays a distinct role in product development and consumer acceptance. Major applications span across the food and beverage industry, pharmaceuticals, personal care and cosmetics, animal feed, and various other industrial sectors. In food and beverages, ingredients are vital for product innovation, health fortification, and sensory appeal in categories such as bakery, confectionery, dairy, meat, beverages, and processed foods. In pharmaceuticals, they act as excipients or active pharmaceutical ingredients, critical for drug efficacy and delivery. The cosmetic industry relies on them for efficacy, stability, and sensory experience in skincare, haircare, and makeup products.

The benefits derived from the ingredients market are multifaceted. For manufacturers, it enables product differentiation, cost optimization, and adherence to regulatory standards. For consumers, it translates into a wider selection of products with improved nutritional profiles, enhanced taste, extended freshness, and greater convenience. Key driving factors for market growth include a rapidly expanding global population, increasing disposable incomes in emerging economies, a heightened consumer focus on health and wellness leading to demand for functional and natural ingredients, and significant advancements in food science and biotechnology. Furthermore, urbanization and changing dietary habits, including the rise of plant-based diets, are fueling innovation and demand for specialized ingredients, pushing the market toward sustainable and ethically sourced solutions.

Ingredients Market Executive Summary

The ingredients market is experiencing robust growth, primarily driven by shifting consumer preferences towards healthier, natural, and sustainable products, coupled with significant innovation in food science and biotechnology. Business trends indicate a strong move towards clean label ingredients, plant-based alternatives, and personalized nutrition solutions, compelling ingredient manufacturers to invest heavily in research and development to meet these evolving demands. Strategic partnerships and mergers and acquisitions are commonplace as companies seek to expand their product portfolios, enhance technological capabilities, and strengthen their global distribution networks. Sustainability and ethical sourcing have become paramount considerations, influencing supply chain decisions and branding efforts across the industry.

Regional trends reveal Asia Pacific as a dominant and rapidly expanding market, fueled by its vast population, increasing urbanization, rising disposable incomes, and the growing processed food and beverage sector. North America and Europe, while mature, continue to drive innovation, particularly in functional and natural ingredients, and are characterized by stringent regulatory landscapes that shape product development. Latin America, the Middle East, and Africa are emerging as significant growth frontiers, exhibiting a burgeoning demand for convenience foods, fortified products, and imported culinary ingredients, driven by economic development and changing lifestyles. Each region presents unique market dynamics influenced by local culinary traditions, regulatory frameworks, and consumer purchasing power.

Segmentation trends highlight particular areas of accelerated growth. The nutritional and functional ingredients segment, encompassing proteins, vitamins, minerals, probiotics, and prebiotics, is witnessing exponential demand due to increasing health consciousness and the aging global population. The plant-based ingredients category, including plant proteins and dairy alternatives, is expanding rapidly in response to sustainability concerns and dietary shifts. Furthermore, advancements in flavor and color technologies are enabling more natural and authentic sensory experiences, driving innovation in these traditionally mature segments. The food and beverage application sector remains the largest consumer of ingredients, though pharmaceuticals, personal care, and animal feed are also significant and growing end-use segments, each presenting distinct opportunities for specialized ingredient suppliers.

AI Impact Analysis on Ingredients Market

User inquiries regarding AI's impact on the ingredients market predominantly revolve around its potential to revolutionize ingredient discovery, optimize production processes, and enhance supply chain efficiency. There is significant interest in how AI can accelerate the identification of novel ingredients with specific functional properties, predict consumer preferences more accurately, and enable personalized nutrition solutions. Concerns often include the initial investment costs, the need for specialized skills, data privacy implications, and the potential displacement of traditional labor. Expectations are high for AI to drive unprecedented levels of innovation, improve sustainability, and create more resilient and responsive ingredient supply chains, ultimately leading to higher quality and more tailored products for end-users.

AI's analytical capabilities are poised to transform the entire lifecycle of ingredients, from initial research to final product delivery. By leveraging machine learning algorithms, researchers can analyze vast datasets of chemical compounds, biological interactions, and sensory profiles to pinpoint new ingredients or optimize existing ones for enhanced functionality, taste, or nutritional value. This predictive power significantly reduces the time and cost associated with traditional R&D, allowing for faster market entry of innovative solutions. Furthermore, AI can assist in deciphering complex biological mechanisms, accelerating the development of ingredients with targeted health benefits, such as novel probiotics or bioactive compounds. This computational approach moves ingredient development from empirical trial-and-error to data-driven precision.

Beyond discovery, AI is instrumental in optimizing ingredient production and supply chain management. In manufacturing, AI-powered systems can monitor and control fermentation processes, optimize blending ratios, and predict equipment maintenance needs, leading to increased yield, reduced waste, and improved product consistency. For supply chains, AI algorithms can forecast demand fluctuations, identify potential disruptions, and optimize logistics and inventory management, ensuring a steady and efficient flow of raw materials and finished ingredients. This level of optimization minimizes costs, enhances reliability, and supports sustainable practices by reducing waste and energy consumption. The integration of AI also facilitates better traceability and transparency within the supply chain, crucial for regulatory compliance and consumer trust.

- Accelerated ingredient discovery and optimization through data analysis.

- Enhanced precision in predicting consumer preferences and market trends.

- Optimized production processes, leading to improved yield and reduced waste.

- More efficient and resilient supply chain management and logistics.

- Personalized nutrition development and functional ingredient formulation.

- Improved quality control and traceability throughout the ingredient lifecycle.

- Reduced R&D costs and faster time-to-market for new ingredients.

- Facilitation of sustainable sourcing and manufacturing practices.

DRO & Impact Forces Of Ingredients Market

The ingredients market is shaped by a dynamic interplay of driving forces, inherent restraints, and emerging opportunities, all subjected to various impact forces. A primary driver is the burgeoning global population and rising disposable incomes, particularly in developing economies, which fuel demand for processed foods, beverages, and other consumer goods that rely heavily on functional ingredients. Concurrently, a heightened global awareness of health and wellness is creating a surge in demand for natural, organic, plant-based, and fortified ingredients, as consumers seek products offering specific health benefits or catering to dietary restrictions. Technological advancements in ingredient processing, extraction, and synthesis also act as significant drivers, enabling the creation of novel ingredients with improved functionality, stability, and sensory attributes, while also opening doors for sustainable sourcing methods.

Despite these powerful drivers, several restraints temper market growth. Fluctuations in raw material prices, often influenced by geopolitical events, climate change, and agricultural yields, can significantly impact manufacturing costs and profit margins for ingredient suppliers. Stringent and evolving regulatory frameworks across different regions pose a considerable challenge, requiring substantial investment in research, testing, and compliance to ensure product safety and labeling accuracy. Additionally, the complex and often fragmented nature of global supply chains can lead to issues with traceability, quality control, and logistical inefficiencies, particularly when dealing with specialty or ethically sourced ingredients. The high capital expenditure required for R&D and scaling up production for innovative ingredients can also be a barrier to entry for smaller players and limits the pace of adoption for new technologies.

Opportunities within the ingredients market are abundant and diverse. The growing trend towards personalized nutrition and clean label products offers significant avenues for innovation in functional and natural ingredient development. The increasing demand for sustainable and ethically sourced ingredients presents a chance for companies to differentiate themselves and build stronger brand loyalty through transparent supply chains and eco-friendly practices. Furthermore, the untapped potential in emerging markets, coupled with rising urbanization and changing dietary patterns, creates new consumer segments and application areas for a wide range of ingredients. Strategic collaborations between ingredient manufacturers, food producers, and technology providers can unlock synergistic benefits, accelerate innovation, and help navigate regulatory complexities, ultimately paving the way for market expansion and the development of next-generation ingredients that cater to future consumer needs.

Segmentation Analysis

The ingredients market is highly fragmented and diverse, with segmentations typically based on ingredient type, application, and source. This granular breakdown allows for a comprehensive understanding of market dynamics, identifying specific growth drivers, competitive landscapes, and consumer preferences within each niche. Analyzing these segments is crucial for strategic planning, product development, and market entry strategies, as different ingredients cater to distinct industrial needs and consumer demands. The market's complexity necessitates a detailed examination of both broad categories and specialized sub-segments to capture the full scope of opportunities and challenges.

- By Type:

- Sweeteners (High-intensity, Bulk, Natural)

- Flavors & Colors (Natural, Artificial, Blends)

- Preservatives (Antimicrobials, Antioxidants)

- Emulsifiers (Lecithin, Mono & Diglycerides)

- Texturizers (Hydrocolloids, Starches)

- Nutritional Ingredients (Vitamins, Minerals, Proteins, Amino Acids, Fibers)

- Functional Ingredients (Probiotics, Prebiotics, Omega-3s, Botanicals, Bioactives)

- Enzymes (Amylases, Proteases, Lipases)

- Specialty Starches

- Hydrocolloids (Gums, Gelling Agents)

- Acidulants (Citric Acid, Lactic Acid)

- Fats & Oils (Specialty Fats, Vegetable Oils)

- Spices & Seasonings (Blends, Extracts)

- Dairy Ingredients (Whey Protein, Casein)

- Grain & Cereal Ingredients

- Fruit & Vegetable Ingredients

- Meat & Poultry Ingredients

- By Application:

- Food & Beverages (Bakery & Confectionery, Dairy & Frozen Desserts, Meat & Poultry Products, Beverages, Snacks & Savory, Prepared Foods, Infant Formula, Sauces & Dressings)

- Pharmaceuticals (Excipients, Active Pharmaceutical Ingredients, Nutraceuticals)

- Personal Care & Cosmetics (Skincare, Haircare, Makeup, Oral Care)

- Animal Feed (Pet Food, Livestock Feed)

- Other Industrial Applications (Chemicals, Textiles, Agriculture)

- By Source:

- Natural (Plant-based, Animal-based, Microbial)

- Synthetic

- By Form:

- Liquid

- Powder

- Granular

- Paste

- By Functionality:

- Enhancers (Flavor, Color)

- Preservatives

- Stabilizers

- Thickeners

- Sweeteners

- Nutritional Fortifiers

- Texturants

Value Chain Analysis For Ingredients Market

The value chain for the ingredients market is a complex ecosystem stretching from raw material sourcing to final product consumption, involving multiple stages and diverse stakeholders. Upstream analysis begins with the cultivation, harvesting, and initial processing of raw materials, which can range from agricultural produce like corn, soybeans, and fruits to animal by-products, minerals, and microbial cultures. This stage heavily involves farmers, agricultural cooperatives, and basic processors who extract fundamental compounds. Key considerations here include agricultural practices, sustainability, yield optimization, and adherence to environmental standards. The quality and availability of these primary resources directly impact the cost and characteristics of the derived ingredients.

Moving further along the value chain, midstream activities involve the specialized processing and manufacturing of these raw materials into functional ingredients. This stage is dominated by ingredient manufacturers who employ advanced technologies such as extraction, fermentation, synthesis, encapsulation, and purification to transform basic compounds into high-value ingredients like specialty starches, proteins, enzymes, flavors, colors, and functional additives. This involves significant R&D investment to innovate new ingredients, improve existing ones, and ensure compliance with stringent quality and safety regulations. The ability to customize ingredients for specific applications and deliver consistent quality is paramount for success in this segment.

Downstream analysis focuses on the distribution channels and the integration of ingredients into final consumer products. Ingredient manufacturers typically sell their products to food and beverage companies, pharmaceutical firms, personal care product manufacturers, and animal feed producers. Distribution can occur through direct sales channels, where large ingredient suppliers work closely with major clients, or indirectly through a network of distributors and agents who serve smaller clients and provide local market expertise. The choice of distribution channel often depends on the type of ingredient, client size, geographical reach, and the level of technical support required. Effective logistics, supply chain management, and technical customer support are critical in ensuring that ingredients reach end-users efficiently and are integrated successfully into their formulations, leading to the creation of diverse and appealing consumer products.

Ingredients Market Potential Customers

The potential customers for the ingredients market are incredibly diverse, spanning across numerous industries that rely on specialized components to formulate their end products. At the forefront are companies within the food and beverage sector, which represent the largest segment of demand. This includes major food manufacturers producing baked goods, confectionery, dairy products, processed meats, snacks, and ready-to-eat meals, as well as beverage companies focusing on soft drinks, juices, alcoholic beverages, and functional drinks. These customers seek ingredients that can enhance taste, texture, appearance, shelf life, and nutritional value, while also meeting clean label or natural product requirements. The evolving dietary trends, such as plant-based diets and health-conscious consumption, continuously drive innovation and demand from this critical customer base.

Beyond food and beverage, the pharmaceutical industry constitutes another significant customer segment. Pharmaceutical companies purchase ingredients for two primary purposes: as active pharmaceutical ingredients (APIs) that provide therapeutic effects, and as excipients, which are inactive substances used as carriers, binders, fillers, or stabilizers to facilitate drug delivery and efficacy. This sector demands exceptionally high purity, consistency, and regulatory compliance, often requiring ingredients manufactured under strict Good Manufacturing Practices (GMP). Similarly, the nutraceutical segment, which bridges the gap between food and pharma, is a growing customer base, seeking functional ingredients like vitamins, minerals, probiotics, and botanical extracts for dietary supplements and health-promoting foods.

Other crucial end-users include the personal care and cosmetics industry, where ingredients like emulsifiers, thickeners, colors, fragrances, and active botanicals are essential for formulating skincare, haircare, makeup, and oral hygiene products. Animal feed manufacturers also represent a substantial customer segment, utilizing ingredients such as proteins, vitamins, minerals, and feed additives to enhance animal nutrition, health, and growth. Furthermore, various other industrial applications, from textiles and chemicals to agriculture, intermittently require specialized ingredients for their manufacturing processes. The common thread among all these potential customers is the need for high-quality, safe, and functionally specific ingredients that enable them to create innovative and competitive products that meet consumer expectations and regulatory standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | USD 875 Billion |

| Market Forecast in 2032 | USD 1400 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Archer Daniels Midland Company (ADM), International Flavors & Fragrances Inc. (IFF - DuPont Nutrition & Biosciences), Tate & Lyle PLC, Givaudan SA, DSM-Firmenich, Kerry Group plc, Ingredion Incorporated, Novozymes A/S (Chr. Hansen), BASF SE, Beneo GmbH, Arla Foods Ingredients Group P/S, Barry Callebaut AG, Sensient Technologies Corporation, Ajinomoto Co., Inc., Lonza Group Ltd, Roquette Frères, Symrise AG, Döhler Group, FrieslandCampina Ingredients |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ingredients Market Key Technology Landscape

The ingredients market is continuously shaped by a dynamic and evolving technology landscape, with innovations driving advancements in ingredient discovery, processing, and application. Key technologies include advanced extraction and purification techniques, which are crucial for isolating specific compounds from natural sources with high purity and yield, such as supercritical fluid extraction for botanical extracts or membrane filtration for dairy proteins. Fermentation technologies, both traditional and precision, are gaining immense traction for producing a wide range of ingredients, including enzymes, probiotics, alternative proteins, and flavor compounds, often offering more sustainable and scalable production methods compared to chemical synthesis. These biotechnological approaches are pivotal in developing novel, natural, and highly functional ingredients to meet diverse consumer demands.

Another significant area is encapsulation technology, which involves encasing active ingredients within a protective matrix. This technology is vital for improving ingredient stability, masking undesirable tastes, controlling release profiles, and enhancing bioavailability, particularly for sensitive compounds like vitamins, probiotics, or flavor oils. Various methods, including spray drying, coacervation, and liposomal encapsulation, are employed to create micro- or nano-sized capsules, ensuring optimal performance in diverse product matrices and extending shelf life. Furthermore, advanced analytical techniques, such as mass spectrometry, nuclear magnetic resonance (NMR), and high-performance liquid chromatography (HPLC), are indispensable for quality control, ingredient authentication, and the identification of novel compounds, ensuring safety and compliance with regulatory standards.

The digital transformation is also profoundly impacting the ingredients market. Artificial intelligence (AI) and machine learning (ML) are increasingly being utilized in bioinformatics for ingredient discovery, predicting molecular interactions, and optimizing formulation designs, significantly accelerating R&D cycles. Automation and robotics in manufacturing processes enhance efficiency, reduce human error, and ensure consistent product quality at scale. Furthermore, blockchain technology is emerging as a critical tool for enhancing supply chain transparency and traceability, allowing for detailed tracking of ingredients from source to consumer, which is particularly important for organic, fair-trade, and specialty ingredients. These technological advancements collectively empower ingredient manufacturers to develop more innovative, sustainable, and high-performance solutions for a global market.

Regional Highlights

- North America: Characterized by a highly developed and mature market, North America exhibits strong demand for functional, clean label, and plant-based ingredients. The U.S. and Canada lead in product innovation, driven by health-conscious consumers, a robust food processing industry, and significant R&D investments. Stringent regulations often shape product development, pushing for transparency and quality.

- Europe: A diverse region with varying consumer preferences and regulatory landscapes. Western Europe is a key market for natural, organic, and sustainable ingredients, with a strong focus on health, wellness, and ethical sourcing. Eastern Europe is experiencing growth due to increasing disposable incomes and the adoption of Western dietary trends. Regulations, particularly from the European Food Safety Authority (EFSA), are among the strictest globally.

- Asia Pacific (APAC): The fastest-growing region, fueled by a large and expanding population, rapid urbanization, rising middle-class incomes, and a booming processed food and beverage industry. Countries like China, India, Japan, and Southeast Asian nations are significant markets. There is a growing demand for functional ingredients, convenience foods, and traditional Asian flavors.

- Latin America: An emerging market with significant growth potential, driven by economic development, changing lifestyles, and increasing consumption of convenience and fortified foods. Brazil and Mexico are leading markets, with a growing interest in natural, healthy, and locally sourced ingredients.

- Middle East and Africa (MEA): A developing market showing increasing demand for a variety of ingredients, particularly due to population growth, urbanization, and a rise in food processing capabilities. While still relatively small compared to other regions, it offers substantial untapped opportunities, especially for Halal-certified and specialty ingredients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ingredients Market.- Cargill

- Archer Daniels Midland Company (ADM)

- International Flavors & Fragrances Inc. (IFF - DuPont Nutrition & Biosciences)

- Tate & Lyle PLC

- Givaudan SA

- DSM-Firmenich

- Kerry Group plc

- Ingredion Incorporated

- Novozymes A/S (Chr. Hansen)

- BASF SE

- Beneo GmbH

- Arla Foods Ingredients Group P/S

- Barry Callebaut AG

- Sensient Technologies Corporation

- Ajinomoto Co., Inc.

- Lonza Group Ltd

- Roquette Frères

- Symrise AG

- Döhler Group

- FrieslandCampina Ingredients

Frequently Asked Questions

What are the major trends driving the Ingredients Market?

The Ingredients Market is primarily driven by increasing consumer demand for health and wellness products, a strong shift towards natural and clean label ingredients, the rising popularity of plant-based foods, and continuous innovation in functional food and beverage formulations. Sustainability and ethical sourcing are also growing influential factors.

How do regulations impact the Ingredients Market?

Regulations significantly impact the Ingredients Market by dictating safety standards, labeling requirements, and approved uses for various ingredients. Strict regulatory bodies like FDA, EFSA, and local authorities ensure product safety and transparency, influencing R&D, production processes, and market access for ingredient manufacturers globally.

What role do natural and clean label ingredients play?

Natural and clean label ingredients are playing a pivotal role in the market, driven by consumer desire for transparency, simple ingredient lists, and avoidance of artificial additives. This trend pushes manufacturers to reformulate products using naturally derived colors, flavors, sweeteners, and preservatives, fostering innovation in botanical extracts and minimally processed components.

How is sustainability addressed in ingredient sourcing?

Sustainability in ingredient sourcing is addressed through various initiatives, including certified sustainable agriculture practices, responsible supply chain management, reduced carbon footprint in processing, and ethical labor practices. Companies are increasingly focusing on traceability, reducing waste, and promoting biodiversity to meet both consumer expectations and corporate social responsibility goals.

What are the key challenges for ingredient manufacturers?

Key challenges for ingredient manufacturers include fluctuating raw material prices, navigating complex and varied regulatory landscapes across different regions, the high costs associated with R&D for novel ingredients, ensuring consistent quality and supply chain resilience, and adapting to rapidly changing consumer preferences and dietary trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Eye Health Ingredients Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Enzyme Modified Dairy and Cheese Ingredients Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Specialty Cosmetics Ingredients Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cosmetic Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Infant Nutrition Hydrolysate Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager