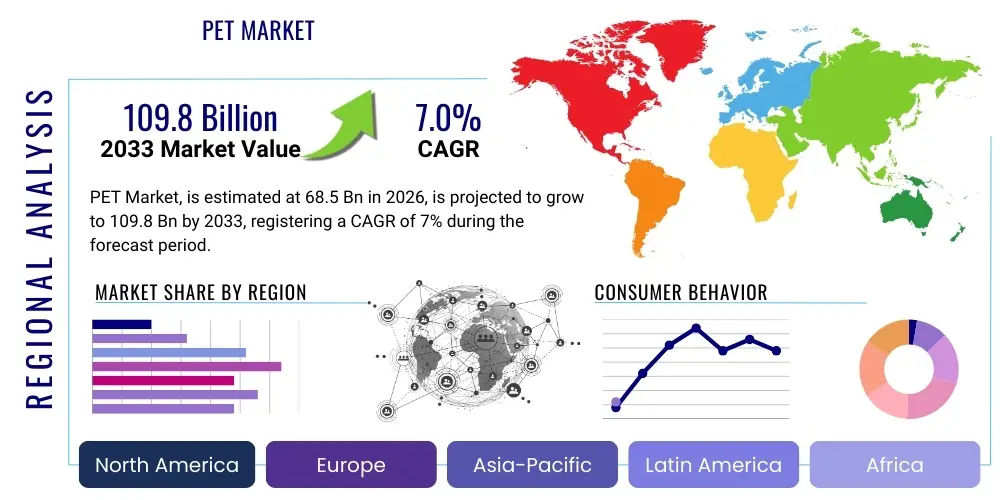

PET Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439366 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

PET Market Size

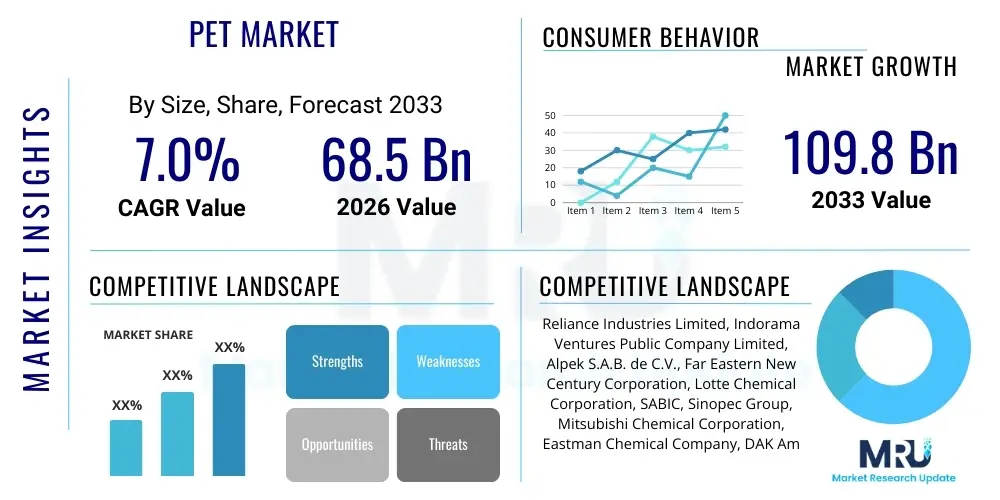

The PET Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.0% between 2026 and 2033. The market is estimated at USD 68.5 Billion in 2026 and is projected to reach USD 109.8 Billion by the end of the forecast period in 2033.

PET Market introduction

Polyethylene Terephthalate (PET) is a thermoplastic polymer resin of the polyester family, widely utilized across various industries due to its exceptional properties. As a product, PET is characterized by its excellent strength-to-weight ratio, superior barrier properties against gases and moisture, and remarkable transparency. These attributes make it an ideal material for packaging applications, especially for beverages, food, and other consumer goods where product integrity and visual appeal are paramount. The market for PET is thus fundamentally driven by consumer demand for convenient, safe, and attractively packaged products, underpinning its status as a cornerstone material in modern packaging solutions.

Major applications of PET span several critical sectors. In the food and beverage industry, it is predominantly used for manufacturing bottles for water, carbonated soft drinks, edible oils, and condiments. Beyond liquid packaging, PET is also widely employed in producing films and sheets for blister packaging, trays, and ovenable applications, providing robust protection and extending shelf life. Furthermore, PET finds significant use in the textile industry as polyester fibers for clothing, carpets, and industrial fabrics, capitalizing on its durability and wrinkle resistance. Its versatility extends to non-packaging applications such as automotive components, electronic housings, and medical devices, showcasing its adaptability across diverse industrial needs.

The benefits of PET are extensive, contributing significantly to its market dominance. Its lightweight nature reduces transportation costs and carbon footprint, aligning with global sustainability goals. PET is also highly recyclable, making it a preferred choice for companies committed to circular economy principles. The material's chemical inertness ensures product safety, preventing any interaction with packaged contents, while its toughness and shatter-resistance enhance consumer safety. These combined advantages, coupled with its cost-effectiveness in production and processing, cement PET's position as an indispensable material, with its market growth primarily fueled by increasing demand for sustainable packaging solutions, advancements in recycling technologies, and the burgeoning e-commerce sector requiring robust and lightweight packaging.

PET Market Executive Summary

The PET market's executive summary reveals a landscape shaped by persistent demand for packaged goods, coupled with an increasing emphasis on sustainability and circular economy principles. Business trends indicate a robust investment in expanding production capacities, particularly for recycled PET (rPET), driven by corporate commitments to use more recycled content and evolving regulatory frameworks. Brand owners are actively seeking innovative PET solutions that reduce material usage, enhance recyclability, and offer improved barrier properties, leading to a surge in research and development activities focused on lightweighting, bio-based PET, and advanced chemical recycling technologies. The competitive environment is characterized by strategic partnerships and mergers aimed at consolidating market share and achieving economies of scale in raw material procurement and distribution, reflecting a proactive approach to managing supply chain complexities and cost fluctuations.

Regionally, the PET market exhibits diverse growth dynamics. Asia Pacific remains the largest and fastest-growing region, fueled by rapid urbanization, expanding middle-class populations, and the proliferation of food and beverage manufacturing. Countries like China and India are pivotal, acting as both major producers and consumers of PET resins and finished products. Europe, while a mature market, is at the forefront of driving PET recycling innovations and establishing ambitious targets for recycled content integration, significantly influencing global sustainability standards. North America also demonstrates steady growth, propelled by strong consumer spending, innovations in packaging design, and a growing consumer preference for convenience foods, albeit with increasing regulatory scrutiny on single-use plastics.

Segment-wise, the PET bottle segment continues to dominate, driven by its extensive use in bottled water and carbonated soft drinks. However, the market is witnessing significant growth in PET films and sheets, particularly for flexible packaging, thermoformed trays, and industrial applications, reflecting diversification in end-use industries. The fiber segment, while mature, sees consistent demand from the textile and carpet industries. A notable trend across all segments is the accelerating adoption of rPET, responding to consumer environmental concerns and regulatory mandates. This shift towards circularity is not only influencing raw material sourcing but also driving innovation in packaging design to facilitate easier collection, sorting, and reprocessing, thereby transforming the entire PET value chain towards more sustainable practices.

AI Impact Analysis on PET Market

The integration of Artificial Intelligence (AI) across the PET market value chain is poised to revolutionize its operational efficiency, product innovation, and sustainability efforts. Common user inquiries often revolve around how AI can optimize production processes, enhance material quality, improve recycling rates, and foster new product developments. There's significant interest in AI's role in predictive maintenance for manufacturing equipment, its capacity to streamline complex supply chain logistics, and its potential for more accurate demand forecasting, which can drastically reduce waste and operational costs. Concerns frequently touch upon the initial investment required for AI infrastructure, the need for specialized skills to manage these systems, and the potential impact on workforce dynamics, alongside questions regarding data privacy and cybersecurity in an increasingly automated environment.

Users are keen to understand how AI algorithms can be leveraged to analyze vast datasets from production lines, identifying inefficiencies and predicting equipment failures before they occur, thereby maximizing uptime and output. Furthermore, there is a strong expectation that AI will play a critical role in material science, aiding in the discovery and development of novel PET formulations with enhanced properties, such as improved barrier performance or increased biodegradability potential. The market anticipates AI's contribution to achieving higher levels of circularity by optimizing sorting processes in recycling facilities, where AI-powered vision systems can accurately identify and separate different plastic types, including various forms of PET, significantly improving the quality and yield of recycled content.

Ultimately, the overarching theme from user questions indicates a strong belief that AI will be a transformative force, enabling the PET industry to meet stringent sustainability targets while maintaining economic competitiveness. Expectations are high for AI to facilitate smarter, more agile manufacturing processes, personalize product offerings based on consumer data, and create a more transparent and efficient supply chain. The industry views AI as a strategic tool to address complex challenges, ranging from raw material price volatility to environmental compliance, ultimately paving the way for a more resilient, innovative, and sustainable PET market future.

- Optimized production efficiency and reduced energy consumption through predictive analytics.

- Enhanced quality control and defect detection using AI-powered vision systems.

- Improved supply chain management and logistics, leading to reduced waste and delivery times.

- Advanced material development, accelerating the creation of novel PET formulations and additives.

- Revolutionized recycling processes through AI-driven sorting and identification technologies, increasing rPET yield and purity.

- Personalized packaging design and marketing strategies based on consumer behavior analysis.

- Predictive maintenance for machinery, minimizing downtime and extending equipment lifespan.

- More accurate demand forecasting, reducing overproduction and inventory costs.

- Robotics and automation integration in manufacturing and recycling for increased operational speed and safety.

- Data-driven decision-making across all business functions, from procurement to sales.

DRO & Impact Forces Of PET Market

The PET market's dynamics are significantly shaped by a confluence of drivers, restraints, and opportunities, all influenced by various impact forces. Key drivers include the escalating global demand for packaged food and beverages, propelled by urbanization, changing lifestyles, and the expansion of the e-commerce sector, which necessitates durable and lightweight packaging solutions. The inherent properties of PET, such as its transparency, strength, and barrier capabilities, make it an ideal choice for ensuring product integrity and shelf life. Additionally, growing consumer awareness and regulatory pressures towards sustainable packaging are accelerating the adoption of recycled PET (rPET) and promoting innovations in eco-friendly PET solutions, acting as a powerful market stimulant.

Despite robust growth drivers, the PET market faces several significant restraints. Volatility in the prices of raw materials, primarily crude oil and its derivatives (like Purified Terephthalic Acid and Monoethylene Glycol), directly impacts production costs and profit margins for PET manufacturers. The intense competition from alternative packaging materials such as glass, aluminum, and other plastics (e.g., HDPE, PP) also poses a challenge, requiring continuous innovation to maintain market share. Furthermore, increasing regulatory scrutiny and public outcry against single-use plastics in various regions are leading to bans or restrictions, compelling the industry to pivot towards more sustainable and circular models, which often involve substantial investments and shifts in existing infrastructure.

Opportunities for growth in the PET market primarily lie in the rapid advancements in recycling technologies, including chemical recycling, which can process difficult-to-recycle PET waste into virgin-quality material, thus closing the loop on plastic usage. The expansion into bio-based PET, derived from renewable resources, presents another avenue for reducing reliance on fossil fuels and improving environmental footprints. Moreover, the continuous development of lightweight PET solutions and advanced barrier technologies creates new application possibilities and further enhances the material's competitiveness. Strategic collaborations across the value chain, from resin producers to brand owners and recyclers, are crucial for capitalizing on these opportunities and navigating the complex interplay of market forces, ultimately fostering a more resilient and sustainable PET industry.

Segmentation Analysis

The PET market is comprehensively segmented to provide a detailed understanding of its diverse applications and material types, catering to a wide array of industrial needs and consumer preferences. This segmentation allows for a nuanced analysis of market trends, identifying key growth areas and competitive landscapes within specific categories. The primary segments include those based on the type of PET resin, its application across various product forms, and the end-use industries it serves. This granular approach helps in assessing market penetration, potential for innovation, and the impact of regulatory changes on different sub-markets, enabling stakeholders to make informed strategic decisions regarding product development, market entry, and investment.

Segmentation by type distinguishes between virgin PET and recycled PET (rPET). Virgin PET, produced directly from petrochemical feedstocks, remains the backbone of the market, prized for its consistent quality and broad applicability. However, the rapidly expanding rPET segment is gaining significant traction due to environmental concerns, corporate sustainability commitments, and stringent recycling mandates. The demand for rPET is driving innovation in collection, sorting, and reprocessing technologies, reshaping the supply chain towards a more circular economy model, and offering opportunities for brands to meet their recycled content targets.

Further segmentation by application categorizes PET into bottles, films & sheets, and fibers. The bottle segment, encompassing water, soft drinks, and food packaging, dominates in terms of volume. Films and sheets find extensive use in flexible packaging, thermoforming, and industrial laminates, offering versatility and protective properties. The fiber segment is crucial for textiles, carpets, and non-woven applications, leveraging PET's strength and durability. End-use industry segmentation includes food & beverage, automotive, consumer goods, healthcare, and others, each presenting unique demands and growth trajectories for PET products. This multi-dimensional segmentation highlights PET's adaptability and indispensable role across a vast spectrum of economic activities.

- By Type:

- Virgin PET

- Recycled PET (rPET)

- By Application:

- Bottles

- Films & Sheets

- Fibers

- Others (Strapping, Engineering Plastics, etc.)

- By End-Use Industry:

- Food & Beverage

- Automotive

- Consumer Goods

- Healthcare

- Textiles

- Others (Construction, Electrical & Electronics)

Value Chain Analysis For PET Market

The PET market's value chain is a complex ecosystem beginning with upstream activities focused on raw material sourcing and extending through various stages of production, conversion, and distribution to reach the end-users. The upstream segment is dominated by petrochemical companies that produce the primary feedstocks: Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG). These companies are crucial as their pricing strategies and supply stability directly impact the cost structure of PET resin manufacturers. The integration of these raw material suppliers can significantly influence the overall competitiveness and resilience of the PET market, highlighting the importance of long-term contracts and strategic partnerships to mitigate supply chain risks and ensure consistent material availability for downstream operations.

Moving downstream, these raw materials are then processed by PET resin manufacturers through polymerization to produce virgin PET pellets. These pellets are subsequently supplied to converters and processors, who transform the resin into various forms such as preforms, bottles, films, sheets, or fibers using technologies like injection molding, blow molding, extrusion, and spinning. This conversion stage adds significant value by tailoring the material to specific application requirements, including design, functionality, and aesthetic properties. Following conversion, brand owners and product manufacturers integrate these PET components into their final products, which are then distributed through a combination of direct and indirect channels to reach consumers. The efficiency and cost-effectiveness of these conversion and manufacturing processes are critical determinants of market success, driving innovation in equipment and processing techniques.

Distribution channels in the PET market are multi-faceted. Direct channels involve PET resin producers selling directly to large converters or major brand owners, fostering strong relationships and enabling customized solutions. Indirect channels, on the other hand, utilize distributors, wholesalers, and brokers to reach smaller enterprises or diverse geographical markets, providing flexibility and market penetration. The rise of e-commerce has also influenced distribution, increasing the demand for lightweight and durable PET packaging suitable for online retail logistics. Post-consumer, the value chain extends to recycling infrastructure, where collection, sorting, and reprocessing facilities transform used PET into recycled PET (rPET), closing the loop and contributing to a circular economy. The effectiveness of this recycling infrastructure and the economic viability of rPET production are increasingly critical components of the overall PET value chain, driven by both regulatory pressures and growing consumer demand for sustainable products.

PET Market Potential Customers

The PET market serves a vast and diverse customer base, primarily comprising industries that rely heavily on robust, lightweight, and cost-effective packaging solutions for their products. At the forefront are companies within the food and beverage sector, which represent the largest segment of PET consumption. Manufacturers of bottled water, carbonated soft drinks, juices, edible oils, and various condiments are major buyers of PET bottles and preforms. These customers prioritize PET for its excellent barrier properties, ensuring product freshness and safety, as well as its transparency, which allows for product visibility and enhances consumer appeal. The demand from this sector is consistently driven by global population growth, urbanization, and evolving consumer preferences for convenience and single-serve packaging.

Beyond the food and beverage industry, pharmaceutical and healthcare companies constitute another significant segment of potential customers. They utilize PET for packaging liquid medicines, intravenous solutions, and various medical devices due to its chemical inertness, non-reactivity with contents, and sterilization compatibility. The material's shatter resistance also provides a safer alternative to glass in healthcare settings. Furthermore, the automotive industry increasingly employs PET in components such as interior fabrics, seat covers, and even some lightweight structural parts, capitalizing on its durability and strength. This shift is part of a broader trend towards weight reduction in vehicles to improve fuel efficiency and reduce emissions, making PET an attractive material choice.

The consumer goods sector, encompassing personal care products, household cleaners, and electronics, also represents a substantial customer segment. Companies producing shampoos, detergents, lotions, and small electronic device casings value PET for its moldability, aesthetic versatility, and protective qualities. Additionally, the textile industry is a long-standing consumer of PET in the form of polyester fibers for clothing, home furnishings, and industrial applications due to its wrinkle resistance, strength, and ease of care. The continuous innovation in PET formulations and processing technologies ensures that the material remains a preferred choice across these varied end-user industries, offering tailored solutions that meet specific product requirements and market demands while increasingly aligning with sustainability objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 68.5 Billion |

| Market Forecast in 2033 | USD 109.8 Billion |

| Growth Rate | 7.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reliance Industries Limited, Indorama Ventures Public Company Limited, Alpek S.A.B. de C.V., Far Eastern New Century Corporation, Lotte Chemical Corporation, SABIC, Sinopec Group, Mitsubishi Chemical Corporation, Eastman Chemical Company, DAK Americas LLC, LyondellBasell Industries N.V., Formosa Plastics Corporation, Petrobras, Toray Industries Inc., Jiangsu Sanfangxiang Group Co., Ltd., BP p.l.c., OCTAL, NEO GROUP, Thai PET Resin Co., Ltd., Zhejiang Wankai New Materials Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

PET Market Key Technology Landscape

The PET market's technological landscape is continuously evolving, driven by the dual imperatives of enhancing performance and improving sustainability. Key technological advancements are centered around polymerization processes, barrier technologies, and recycling innovations. In polymerization, focus remains on developing catalysts and processes that yield PET resins with superior molecular structures, offering improved mechanical strength, thermal stability, and clarity, while also reducing energy consumption during manufacturing. Techniques like continuous polymerization are being optimized to achieve higher production efficiencies and cost-effectiveness, ensuring a consistent supply of high-quality virgin PET resin for diverse applications, from beverage bottles to textile fibers.

Barrier technologies represent another critical area of innovation, particularly for extending the shelf life of oxygen-sensitive products like juices, beer, and dairy items. Multi-layer PET structures, often incorporating barrier materials like EVOH or nylon, are becoming increasingly sophisticated, offering enhanced protection against oxygen and CO2 ingress. Additionally, active barrier technologies, which scavenge oxygen within the package, are gaining traction. Lightweighting technologies are also paramount, enabling the production of thinner, yet equally robust, PET packaging, which not only reduces material usage and cost but also significantly lowers transportation emissions, aligning with environmental objectives. These innovations are crucial for maintaining PET's competitive edge against alternative packaging materials.

Perhaps the most transformative technological developments are occurring within the recycling sector, particularly with the growth of recycled PET (rPET). Mechanical recycling processes are being refined with advanced sorting equipment, including near-infrared (NIR) and AI-powered vision systems, to improve the purity of collected PET flakes. Chemical recycling technologies, such as depolymerization and glycolysis, are emerging as game-changers, capable of breaking down complex or contaminated PET waste into its monomer components, which can then be re-polymerized into virgin-quality PET. These advanced recycling methods are vital for achieving truly circular economy models, reducing reliance on virgin fossil fuels, and positioning PET as a leading material for sustainable packaging solutions in the long term, thereby mitigating environmental concerns and meeting stringent regulatory demands for recycled content.

Regional Highlights

- North America: Characterized by a mature market with high consumption rates for bottled beverages and packaged foods. The region is seeing significant investment in rPET production and advanced recycling infrastructure, driven by corporate sustainability pledges and growing consumer demand for eco-friendly products. Innovations in packaging design and lightweighting are prominent.

- Europe: A leader in circular economy initiatives and stringent regulations regarding plastic waste. Strong emphasis on high recycled content targets, fostering innovation in chemical recycling and collection systems. Germany, France, and the UK are key markets, pushing for bio-based PET and advanced barrier solutions.

- Asia Pacific (APAC): The largest and fastest-growing market due to rapid industrialization, urbanization, and increasing disposable incomes. China, India, and Southeast Asian countries are major production hubs and consumption centers. Expanding food & beverage sector and textile industries fuel demand, with a growing focus on developing recycling capabilities.

- Latin America: Emerging market with substantial growth potential, primarily driven by increasing consumption of bottled water and soft drinks. Brazil and Mexico are key players, experiencing rising demand for packaged goods and developing their nascent recycling infrastructure.

- Middle East and Africa (MEA): Exhibiting steady growth, particularly in the Gulf Cooperation Council (GCC) countries, due to infrastructure development, tourism, and expanding food processing industries. Investment in local PET production capacity is increasing, alongside efforts to establish effective waste management and recycling systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the PET Market.- Reliance Industries Limited

- Indorama Ventures Public Company Limited

- Alpek S.A.B. de C.V.

- Far Eastern New Century Corporation

- Lotte Chemical Corporation

- SABIC

- Sinopec Group

- Mitsubishi Chemical Corporation

- Eastman Chemical Company

- DAK Americas LLC

- LyondellBasell Industries N.V.

- Formosa Plastics Corporation

- Petrobras

- Toray Industries Inc.

- Jiangsu Sanfangxiang Group Co., Ltd.

- BP p.l.c.

- OCTAL

- NEO GROUP

- Thai PET Resin Co., Ltd.

- Zhejiang Wankai New Materials Co., Ltd.

Frequently Asked Questions

What is PET and what are its primary uses?

PET, or Polyethylene Terephthalate, is a highly versatile thermoplastic polymer widely used for packaging beverages, foods, and personal care products due to its strength, clarity, and barrier properties. It's also utilized in fibers for textiles and sheets for thermoforming applications.

What drives the growth of the PET market?

The PET market's growth is primarily driven by increasing global demand for packaged food and beverages, the expansion of e-commerce, growing consumer awareness regarding sustainable packaging, and continuous advancements in recycling technologies, including the rising adoption of rPET.

How does recycled PET (rPET) contribute to sustainability?

rPET significantly contributes to sustainability by reducing the reliance on virgin fossil fuel resources, lowering energy consumption in production compared to virgin PET, and diverting plastic waste from landfills and oceans. It closes the loop in the PET lifecycle, supporting circular economy principles.

What are the main challenges facing the PET market?

Key challenges include volatility in raw material prices (derived from crude oil), intense competition from alternative packaging materials like glass and aluminum, and increasing regulatory pressures and public scrutiny on single-use plastics, which necessitate significant investment in recycling infrastructure and sustainable innovations.

How is AI impacting the PET industry?

AI is transforming the PET industry by optimizing production processes, enhancing quality control through advanced defect detection, improving supply chain efficiency, and revolutionizing recycling through AI-powered sorting. It also aids in developing new material formulations and enabling data-driven decision-making for a more sustainable and efficient market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Pet daycare and lodging Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- HPP Pet Food Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- BOPET Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- PET Felt Acoustic Panels Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Mobile Pet Care Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager