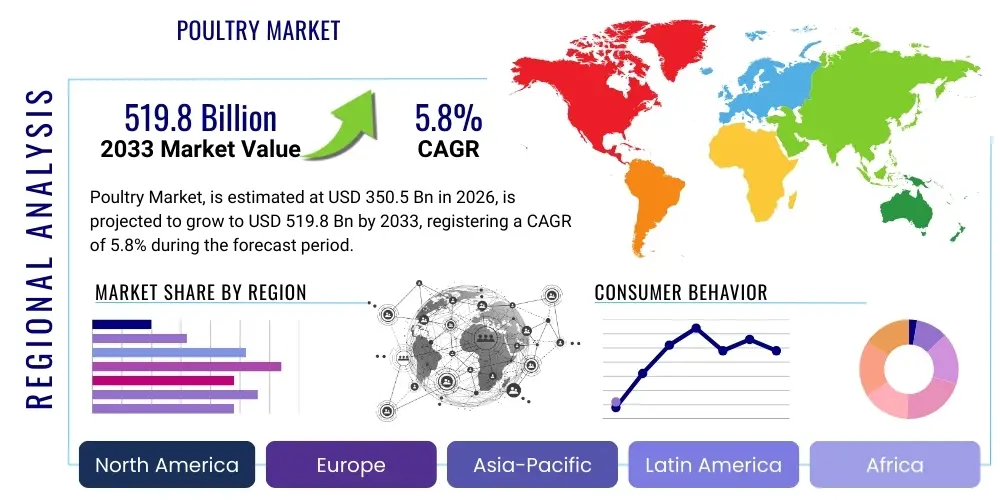

Poultry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438247 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Poultry Market Size

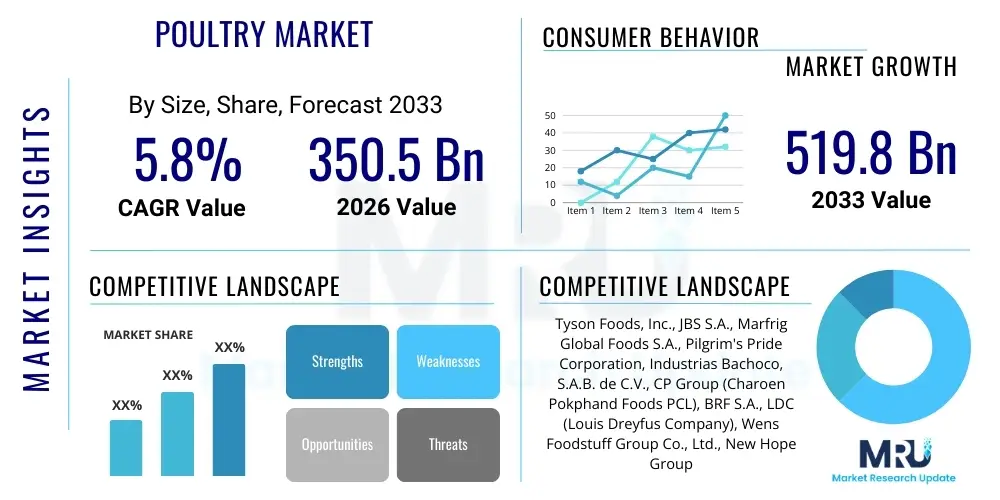

The Poultry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 519.8 Billion by the end of the forecast period in 2033.

Poultry Market introduction

The global Poultry Market encompasses the breeding, rearing, processing, and distribution of domesticated birds, primarily chickens, turkeys, ducks, and geese, for meat and egg production. This industry is a cornerstone of the global food system, driven by poultry's superior nutritional profile, including high protein and low-fat content, coupled with its relative affordability compared to other meat sources like beef or pork. The product category involves diverse formats, ranging from whole carcasses and fresh cuts to highly processed, ready-to-eat products, catering to varying consumer lifestyles and culinary traditions worldwide. Key applications span across retail consumption, encompassing supermarkets and direct consumer sales, as well as the robust foodservice sector, which relies heavily on poultry for fast food, casual dining, and institutional catering.

A primary benefit of the poultry market is its highly efficient feed conversion ratio, making it an environmentally and economically sustainable protein source compared to ruminants. Furthermore, advancements in poultry genetics and precision farming techniques have significantly enhanced productivity, ensuring a consistent and high-quality supply chain globally. Major driving factors propelling market expansion include rapid population growth, particularly in emerging economies of Asia Pacific and Latin America, increasing urbanization leading to higher demand for convenience foods, and shifting dietary trends favoring white meat due to perceived health advantages. The versatility of poultry in terms of flavor absorption and suitability for diverse global cuisines further solidifies its market position, making it a staple protein choice for billions of consumers across different income strata.

Despite facing scrutiny related to animal welfare standards and the persistent threat of Avian Influenza outbreaks, the market continues to innovate through vertical integration and technological adoption. The industry is heavily investing in automation within processing facilities, advanced climate control systems in farms, and sophisticated disease management protocols to mitigate risks and maintain consumer confidence. The long-term growth trajectory remains robust, underpinned by continuous product development, such as antibiotic-free and organic poultry options, which cater to the growing segment of health-conscious and ethically-minded consumers, ensuring sustained market relevance through the forecast period.

Poultry Market Executive Summary

The Poultry Market is characterized by dynamic business trends, marked by significant consolidation among large producers aiming for economies of scale and enhanced supply chain control, alongside increasing scrutiny regarding sustainable sourcing and animal welfare practices. Key business trends include the vertical integration of operations, spanning feed production, breeding, farming, processing, and distribution, which optimizes efficiency and quality control. Furthermore, the push towards premiumization, driven by consumer demand for specialty attributes like organic certification, free-range status, and specific nutritional claims (e.g., omega-3 enriched eggs), is creating profitable niche segments. Geographically, the market exhibits uneven growth; while mature markets like North America and Europe focus on value-added products and ethical production, growth in Asia Pacific and Latin America is volumetrically driven by rising middle-class consumption and rapid infrastructure development supporting cold chain logistics.

Regional trends highlight Asia Pacific as the dominant market, driven by population density, increasing disposable income in countries like China and India, and the cultural acceptance of poultry consumption. North America and Europe, conversely, are leading innovation in terms of processing technology, automation, and alternative proteins, which act as substitutes. Segment-wise, the chicken segment remains overwhelmingly dominant due to its global prevalence and production efficiency. However, the processed poultry segment is witnessing the highest growth rates, fueled by the demand for convenience foods such as ready-to-eat meals, nuggets, and deli meats, especially among urban dwellers and dual-income households. The convergence of digital technologies, particularly in tracking and traceability, is becoming essential, responding to both regulatory requirements and consumer transparency demands.

In summary, the market outlook is cautiously optimistic, balancing robust fundamental demand—driven by population and protein necessity—against operational challenges, including feed price volatility, labor shortages, and biosecurity risks. Strategic focus is shifting toward maximizing operational resilience and satisfying sophisticated consumer requirements related to health and ethics. Companies prioritizing investments in genetic improvement, sustainable feed alternatives (e.g., insect protein), and advanced digital farming tools are poised to capture market share and navigate the competitive landscape effectively, reinforcing the industry's commitment to delivering affordable and safe protein globally.

AI Impact Analysis on Poultry Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Poultry Market primarily revolve around operational efficiency, disease prediction, feed optimization, and the ethical implications of automated farming. Common user questions seek to understand how AI-powered computer vision systems can monitor flock health and behavior in real-time to preempt outbreaks, thereby minimizing economic losses and antibiotic use. Furthermore, there is significant interest in AI's role in optimizing the complex logistics of feed formulation, considering fluctuating ingredient costs and specific nutritional requirements for different growth stages, asking how algorithms can minimize costs while maximizing yield. A major concern frequently raised is the accessibility of these technologies, particularly for small-to-medium enterprises (SMEs), and the return on investment (ROI) associated with implementing advanced AI platforms in traditional farming environments, highlighting a need for scalable and cost-effective solutions that democratize precision poultry farming.

The integration of AI extends significantly into the processing and quality control segments, where users question the efficacy of machine learning in defect detection and carcass grading. Consumers, regulators, and industry stakeholders are also intensely interested in AI-driven traceability systems, asking how blockchain combined with AI analytics can provide irrefutable provenance data, enhancing food safety and consumer trust. The future expectation, reflected in user queries, is that AI will move beyond simple data aggregation to truly predictive and prescriptive analytics, enabling farmers to make minute-by-minute decisions based on environmental factors, bird biometric data, and market demand forecasts. Addressing these questions requires clear demonstrations of AI's capability to deliver measurable improvements in the crucial metrics of feed conversion ratio (FCR), mortality rates, and overall operational throughput.

Ultimately, the consensus among user inquiries indicates that AI is not just a productivity tool but a necessary evolution for the industry to meet stringent sustainability goals and manage increasing complexity. The shift toward automated management of micro-climates, environmental stressors, and early disease detection—utilizing thermal cameras, acoustics sensors, and sophisticated algorithms—is perceived as critical for mitigating large-scale losses associated with systemic issues like Avian Influenza. User expectation is high for AI to standardize practices globally, ensuring consistent welfare outcomes and quality across diverse farm settings, pushing the industry toward a higher degree of digitalization and operational transparency.

- Enhanced Flock Monitoring: AI-powered computer vision and sensor networks detect subtle behavioral changes indicative of stress or disease, enabling early intervention and reducing mortality rates.

- Precision Feed Formulation: Machine learning algorithms dynamically optimize feed composition based on real-time growth data, ingredient costs, and environmental conditions, maximizing Feed Conversion Ratio (FCR).

- Automated Processing and Grading: AI systems inspect carcasses for defects, ensuring superior quality control and standardized grading in high-speed processing plants, minimizing human error.

- Predictive Maintenance: AI analyzes data from farm equipment (ventilators, heating systems) to predict potential failures, reducing downtime and ensuring optimal climate conditions.

- Supply Chain Optimization: Predictive analytics forecasts demand fluctuations and optimizes logistics, reducing waste and improving inventory management from farm to fork.

- Biosecurity and Risk Management: AI models predict disease outbreak probabilities based on environmental factors, historical data, and regional movement, enhancing proactive biosecurity measures.

DRO & Impact Forces Of Poultry Market

The strategic dynamics of the global Poultry Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate investment decisions and market performance. Key Drivers include the undeniable demographic shifts, specifically the expansion of the global population and the rising middle class in developing nations, leading to structural growth in protein demand. Furthermore, the inherent efficiency of poultry production—characterized by a low feed-to-meat ratio and shorter growth cycles compared to beef or pork—makes it an economically attractive and scalable protein source, sustaining demand even amidst economic downturns. Consumer perception of poultry as a healthier, leaner alternative to red meat continues to propel its acceptance across diverse global dietary patterns.

Conversely, significant Restraints challenge sustained growth and profitability. The primary concern is the inherent biological risk posed by infectious diseases such as Avian Influenza (AI) and Newcastle disease, which can devastate flocks, halt international trade, and significantly disrupt supply chains, necessitating costly biosecurity investments. Another major restraint is the volatility in input costs, particularly corn and soybean, which constitute the majority of poultry feed, directly impacting producer margins. The growing societal pressure regarding animal welfare standards and sustainable farming practices mandates costly operational upgrades and compliance efforts, sometimes limiting scalability, especially for producers operating in regions with less stringent regulations attempting to export to high-standard markets like the EU.

Opportunities for market players are concentrated in technological innovation and market diversification. The adoption of advanced digitalization, including IoT, Big Data analytics, and robotics, presents vast opportunities for optimizing farm management, resource utilization, and processing efficiency. Furthermore, the increasing consumer willingness to pay a premium for certified, traceable, and ethically raised products (e.g., organic, non-GMO, antibiotic-free poultry) allows companies to capture higher margins and differentiate their offerings. Global expansion into underserved or rapidly developing markets, coupled with investment in aquaculture-like vertical farming concepts, offers pathways for long-term profitable growth, mitigating risks associated with localized disease outbreaks and geopolitical trade disputes, ultimately pushing the industry toward a future defined by transparency and technological sophistication.

Segmentation Analysis

The Poultry Market is extensively segmented across multiple dimensions, including Type, Processing Type, Distribution Channel, and End-Use, reflecting the diversity of consumer demand and production methods worldwide. Analyzing these segments is crucial for understanding specific market dynamics, identifying high-growth niches, and tailoring product development strategies. The dominance of the Chicken segment is structural, driven by its versatility and cost-efficiency, but segments like Turkey and Duck exhibit specialized growth, particularly in seasonal and gourmet food markets. Processing segmentation reveals a decisive shift toward highly processed, convenient formats as urbanization accelerates and cooking time decreases, contrasting with the slower, yet stable, demand for fresh whole cuts, which remain popular in traditional cooking regions.

Segmentation by Distribution Channel highlights the ongoing power struggle between traditional retail (supermarkets and hypermarkets) and the burgeoning e-commerce platforms, which offer direct-to-consumer models and sophisticated cold chain logistics solutions, especially relevant post-pandemic. The end-use segment clearly separates the massive volume demands of the Foodservice sector—including QSRs (Quick Service Restaurants) and institutional catering—from the varied consumer requirements of the Retail sector. Strategic emphasis is increasingly placed on differentiating products within these segments, for instance, developing specific poultry cuts optimized for industrial foodservice preparation versus premium, pre-marinated products aimed at the retail consumer seeking gourmet home preparation.

- By Type:

- Chicken (Broilers, Layers, Cull Hens)

- Turkey

- Duck

- Goose

- Others (Quail, Guinea Fowl)

- By Product/Processing Type:

- Fresh/Chilled Poultry

- Frozen Poultry

- Processed Poultry Products (Sausages, Nuggets, Deli Meats, Canned Meat)

- Eggs and Egg Products (Shell Eggs, Liquid Eggs, Egg Powder)

- By Distribution Channel:

- Retail (Supermarkets, Hypermarkets, Convenience Stores)

- Foodservice (Restaurants, Hotels, Institutional Catering)

- E-commerce/Online Sales

- Direct Sales (Farm Gates, Farmers Markets)

- By End-Use:

- Household Consumption

- Commercial/Industrial Use (Meat Ingredients)

- By Nature/Production System:

- Conventional

- Organic

- Antibiotic-Free (ABF)

- Free-Range/Pasture-Raised

Value Chain Analysis For Poultry Market

The Poultry Market value chain is highly complex and often characterized by extensive vertical integration, aiming for maximum efficiency and control over quality and biosecurity. The upstream phase primarily involves input suppliers, including genetic companies that provide high-yielding breeding stock (grandparents and parents), and feed manufacturers responsible for formulating nutritionally complete and cost-effective feeds. Genetic research is foundational, determining the growth rate, disease resistance, and yield of the final product. Feed production, heavily reliant on global commodity markets for corn, soy, and supplements, represents the largest variable cost and is a critical leverage point in the chain. Optimized upstream operations are essential for maintaining competitive pricing and ensuring the consistent quality of live birds entering the midstream segment.

The midstream phase encompasses farming (rearing and growing out the birds) and primary processing (slaughtering, cutting, and chilling). Farming is increasingly moving toward climate-controlled, automated housing systems that maximize bird welfare and minimize environmental impact. Processing involves highly sophisticated, high-throughput plants, where technology like automated cutting and packaging is crucial for hygiene and yield optimization. Downstream activities focus on secondary processing (creating value-added products like marinated cuts, prepared meals, and deli products) and the complex distribution network. The distribution channel is bifurcated into direct sales to large institutional buyers (foodservice) and indirect distribution through organized retail chains, involving intricate cold chain management to preserve product integrity and safety from the plant to the final consumer purchase point.

The distribution network itself utilizes a combination of direct contractual relationships with major retailers and foodservice companies, alongside partnerships with third-party logistics (3PL) providers specializing in chilled and frozen transport. The proliferation of e-commerce has introduced a new, direct-to-consumer channel that bypasses traditional retail entirely, requiring specialized last-mile cold chain solutions. Effective management of this value chain necessitates seamless information flow—from genetic tracking to final sale traceability—to satisfy stringent regulatory requirements and growing consumer demand for transparency and sustainability claims, with successful market participants continuously focusing on enhancing biosecurity and minimizing post-harvest losses throughout the entire lifecycle.

Poultry Market Potential Customers

Potential customers for the Poultry Market span across diverse commercial and household sectors, primarily categorized based on volume and required processing level. The largest volume consumers are institutional Foodservice Operators, which include major Quick Service Restaurant (QSR) chains, full-service dining establishments, and industrial caterers serving schools, hospitals, and military bases. These customers demand large, consistent supplies of standardized cuts (e.g., specific-sized breast fillets, wings, or ground meat) that adhere to rigid specifications for preparation and consistency across multiple outlets. Their purchasing decisions are highly influenced by price stability, supply reliability, and safety certifications, making them direct buyers often involved in long-term procurement contracts with integrated poultry producers.

The second major customer group is the Retail Sector, encompassing supermarkets, hypermarkets, convenience stores, and specialized butcher shops. These customers cater directly to the end consumer and require a diverse product mix, including fresh whole poultry, various packaged cuts, and an increasing array of value-added and premium products (such as organic, marinated, or pre-cooked items). Retail buyers are driven by shelf life, attractive packaging, brand recognition, and consumer trends, necessitating close collaboration with producers on branding and promotional strategies. Furthermore, the burgeoning e-commerce platforms and meal kit delivery services represent a rapidly growing, technologically savvy customer base, demanding flexible order sizes and impeccable cold chain logistics directly to the household.

Finally, the Industrial Sector represents another significant end-user, comprising food processing companies that utilize poultry meat as a key ingredient in soups, frozen meals, pet food, and prepared packaged foods. These customers require bulk, standardized raw materials (mechanically separated meat, trim, specific poultry fats) and are highly cost-sensitive, often procuring poultry derivatives based on long-term fixed pricing agreements to manage their own production costs. The common thread across all potential customer segments is the non-negotiable requirement for high standards of food safety, traceability, and adherence to production claims like 'antibiotic-free' or 'humanely raised,' necessitating rigorous certification processes from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 519.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tyson Foods, Inc., JBS S.A., Marfrig Global Foods S.A., Pilgrim's Pride Corporation, Industrias Bachoco, S.A.B. de C.V., CP Group (Charoen Pokphand Foods PCL), BRF S.A., LDC (Louis Dreyfus Company), Wens Foodstuff Group Co., Ltd., New Hope Group, Hormel Foods Corporation, Koch Foods, Inc., Sanderson Farms, Inc., Perdue Farms, Inc., Mountaire Farms, Foster Farms, Cargill, Incorporated, Wayne Farms LLC, PFG (Performance Food Group), OSI Group LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Poultry Market Key Technology Landscape

The Poultry Market is undergoing a significant technological transformation, moving from traditional farming methods to highly digitized and data-driven systems, collectively termed "Precision Poultry Farming." A fundamental technology is the integration of Internet of Things (IoT) sensors within poultry houses. These sensors continuously monitor critical environmental parameters such as temperature, humidity, ammonia levels, and ventilation rates. This real-time data collection allows for immediate, automated adjustments to climate control systems, ensuring optimal bird health and minimizing energy consumption. Furthermore, advanced thermal imaging and acoustic sensors are being deployed to detect distress signals or early signs of illness within the flock, providing unprecedented levels of biosecurity and allowing for targeted veterinary intervention, significantly reducing systemic antibiotic usage and operational risks.

Beyond farm-level management, technological advancements are revolutionizing genetics and feed formulation. Genetic mapping and selective breeding techniques are utilizing genomic technologies to develop birds with superior feed conversion ratios (FCRs), enhanced resistance to common diseases, and improved meat yield characteristics. Simultaneously, sophisticated software and AI are central to feed mills, employing linear programming and machine learning to optimize feed recipes based on daily fluctuating commodity prices, nutrient requirements specific to the hybrid strain, and the real-time consumption patterns monitored by smart feeders. This highly technical optimization directly influences the economic viability and environmental footprint of poultry production globally.

In the processing segment, robotics and advanced automation are becoming industry standards to address labor shortages and enhance hygiene. High-speed processing lines utilize complex robotic arms for slaughter, evisceration, and cutting, ensuring precision and reducing contamination risks. Computer vision systems equipped with machine learning algorithms are indispensable for quality assurance, automatically scanning every carcass for defects, ensuring consistency in grading, and providing data feedback loops to farming operations for continuous improvement. These integrated technologies collectively create a closed-loop data ecosystem, driving efficiency gains across the entire value chain and reinforcing the industry's commitment to high quality and safety standards demanded by global regulatory bodies and sophisticated consumers.

Regional Highlights

- Asia Pacific (APAC): Dominates the global poultry consumption landscape, primarily driven by large populations in China, India, and Indonesia, and rapidly rising disposable incomes. The region is characterized by fragmented local markets alongside growing international investments in large-scale integrated farms. Demand focuses heavily on both fresh poultry and affordable processed items, with significant investments in cold chain infrastructure required to support urbanization and distribution.

- North America: A technologically mature market defined by extensive vertical integration, advanced automation, and a strong focus on high-value, differentiated products such as antibiotic-free (ABF) and organic poultry. The U.S. remains a key global exporter. Innovation centers around precision farming, genetic optimization, and sustainable waste management.

- Europe: Highly regulated market with stringent animal welfare and food safety standards (e.g., EU regulations on cage sizes, antibiotics, and labeling). Growth is slower but premiumization is strong. Consumers demand high traceability, leading to increased adoption of blockchain and certified sustainable farming practices across key producing nations like Poland, Germany, and France.

- Latin America (LATAM): A major global producer and exporter, led by Brazil, which is the world's largest poultry meat exporter. The market benefits from low production costs and strong export competitiveness, particularly to Asian and Middle Eastern markets. Growth is driven by both export volume and increasing domestic consumption fuelled by improving economic conditions.

- Middle East and Africa (MEA): Characterized by high import dependency in the Middle East due to water scarcity and local production challenges, leading to major opportunities for international exporters. Africa presents long-term growth potential due to rapid population expansion and urbanization, though constrained currently by weak cold chain infrastructure and market fragmentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Poultry Market.- Tyson Foods, Inc.

- JBS S.A.

- Marfrig Global Foods S.A.

- Pilgrim's Pride Corporation

- CP Group (Charoen Pokphand Foods PCL)

- BRF S.A.

- Industrias Bachoco, S.A.B. de C.V.

- LDC (Louis Dreyfus Company)

- Wens Foodstuff Group Co., Ltd.

- New Hope Group

- Hormel Foods Corporation

- Koch Foods, Inc.

- Sanderson Farms, Inc. (now part of Cargill/Continental Grain)

- Perdue Farms, Inc.

- Mountaire Farms

- Foster Farms

- Cargill, Incorporated

- Wayne Farms LLC

- PFG (Performance Food Group)

- OSI Group LLC

Frequently Asked Questions

Analyze common user questions about the Poultry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Poultry Market globally?

The primary growth drivers are the increasing global population, rising disposable incomes in emerging economies, and poultry's superior efficiency in converting feed into protein (low Feed Conversion Ratio). Additionally, the perception of poultry as a healthier, leaner alternative to red meat continues to accelerate its adoption across diverse diets worldwide, fueling sustained demand in both retail and foodservice sectors.

How is technological advancement, such as AI, transforming poultry farming?

Technological advancement is leading to "Precision Poultry Farming," using AI and IoT sensors for real-time monitoring of flock health, behavior, and environmental conditions. This allows for automated optimization of feed delivery, ventilation, and early detection of diseases, drastically improving operational efficiency, reducing mortality rates, and minimizing the necessary reliance on antibiotics.

What are the most significant restraints affecting the profitability of the poultry industry?

The most significant restraints include the high volatility and upward trend in the cost of feed ingredients (corn and soy), which heavily impacts operating margins. Furthermore, persistent biosecurity threats, particularly the outbreaks of Avian Influenza, cause substantial economic losses, trade barriers, and necessitate continuous, costly investments in enhanced disease management protocols and operational resilience.

Which regional segment currently dominates the Poultry Market, and what drives its position?

Asia Pacific (APAC) currently dominates the Poultry Market in terms of volume consumption. This dominance is driven by the sheer size of the population in countries like China and India, rapid urbanization leading to increased demand for convenient processed products, and a growing middle class capable of increasing per capita protein consumption. APAC also sees high domestic production coupled with substantial import demand.

What is the current trend regarding consumer demand for processed versus fresh poultry products?

While fresh/chilled poultry remains a staple, the processed poultry segment is exhibiting the fastest growth rate. This trend is directly linked to modern urban lifestyles, where time constraints necessitate convenient, ready-to-eat or easy-to-prepare products like nuggets, deli meats, and pre-marinated cuts. Producers are focusing investment on value-added processing capabilities to meet this escalating demand for convenience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Poultry Opening Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Meat and Poultry Processing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Meat Poultry and Seafood Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Poultry Vaccines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Poultry Feed Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager