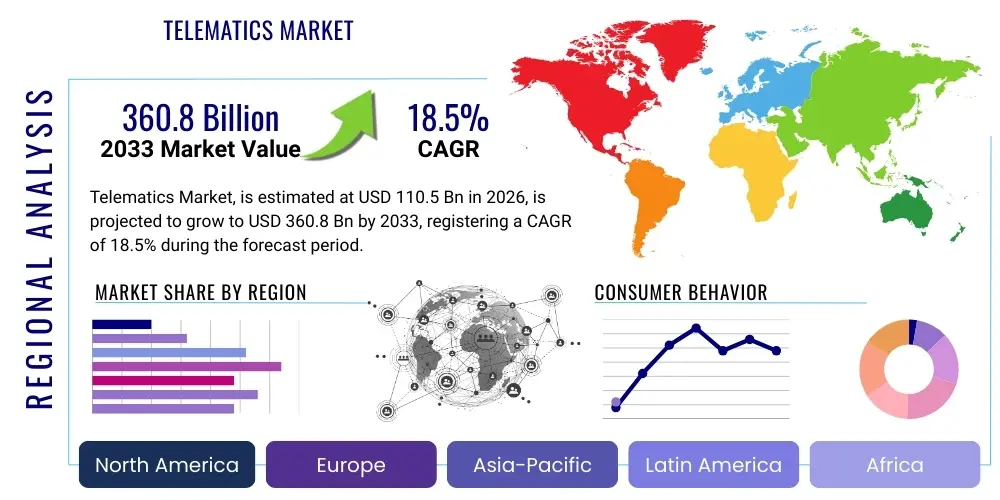

Telematics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438170 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Telematics Market Size

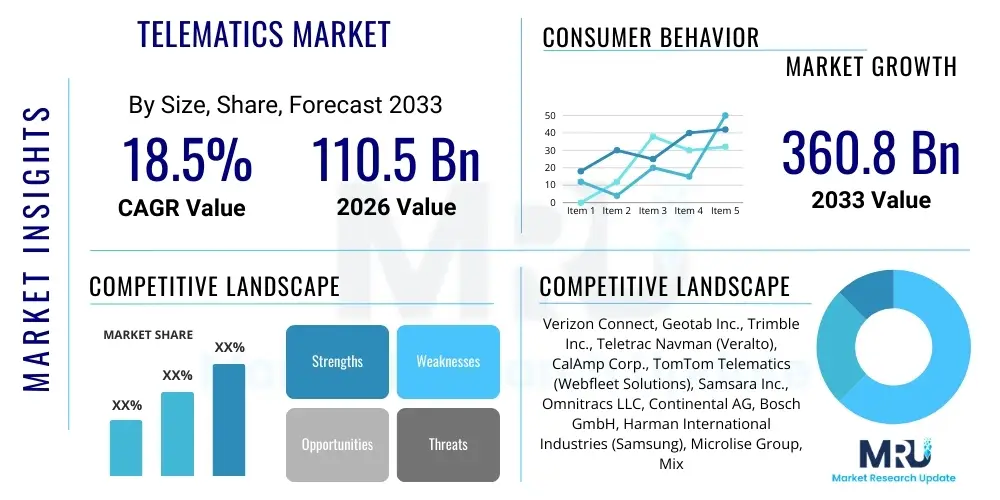

The Telematics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 110.5 Billion in 2026 and is projected to reach USD 360.8 Billion by the end of the forecast period in 2033.

Telematics Market introduction

Telematics represents the convergence of telecommunications and informatics, encompassing the integration of global positioning system (GPS) technology, mobile communications, and vehicular sensors to transmit data and control mechanisms remotely. This technology suite is primarily defined by the ability to monitor the location, movement, status, and behavior of vehicles or assets in real-time, providing actionable intelligence crucial for optimizing operations, enhancing safety, and ensuring regulatory compliance across various industries. The core product offering ranges from simple black box devices and embedded systems to complex, cloud-based software platforms (SaaS) that facilitate sophisticated data analytics and reporting capabilities, fundamentally transforming fleet management, insurance risk assessment, and vehicle diagnostics. The robust growth trajectory of this market is intrinsically linked to the accelerating digitization of the logistics sector and the increasing proliferation of connected vehicle initiatives globally, demanding higher bandwidth and robust security features.

Major applications of telematics systems span critical sectors, including commercial fleet management for optimizing routes and managing driver behavior, insurance telematics (usage-based insurance or UBI) which customizes premiums based on driving habits, and automotive original equipment manufacturers (OEMs) who integrate these services for remote diagnostics, navigation, and infotainment. Furthermore, applications extend significantly into critical asset tracking, supply chain monitoring, and specialized public services like emergency response and smart city infrastructure management. The tangible benefits derived from adopting telematics include substantial reductions in operational costs due to optimized fuel consumption and preventative maintenance schedules, significant improvements in worker safety through detailed driving behavior analysis, and enhanced compliance with increasingly stringent governmental regulations concerning hours of service (HOS) and vehicle tracking, such as the Electronic Logging Device (ELD) mandates in North America.

The market is predominantly driven by powerful macro-economic trends and specific technological advancements. Key driving factors include the global expansion of e-commerce and the subsequent pressure on logistics providers to enhance efficiency; the mandated adoption of vehicle safety standards and tracking technologies by regulatory bodies; the rapid decline in sensor and connectivity hardware costs, making telematics solutions more economically viable for small and medium enterprises (SMEs); and the pervasive deployment of high-speed wireless networks, particularly 5G, which enables massive data transfer rates necessary for complex, real-time analytics and over-the-air updates (OTA). These synergistic factors are creating a fertile environment for innovation, prompting vendors to continually upgrade platforms with advanced features like predictive analytics, machine learning integration, and robust cybersecurity protocols, ensuring the market remains dynamic and highly competitive.

Telematics Market Executive Summary

The global Telematics Market is witnessing an accelerated paradigm shift driven primarily by the transition from hardware-centric solutions to sophisticated, data-driven software and platform services, reflecting a broader trend towards subscription-based revenue models (SaaS). Commercial fleets, particularly within logistics, construction, and utilities sectors, represent the primary consumption base, exhibiting strong demand for advanced features such as video telematics, integrated dashcams, and Artificial Intelligence (AI) powered driver coaching systems aimed at mitigating collision risks and insurance liability. Business trends indicate significant consolidation through mergers and acquisitions (M&A) as large technology conglomerates and specialized telematics providers seek to acquire niche capabilities, such as advanced analytics firms or specific regional expertise, thereby creating integrated end-to-end solutions that cover asset management, supply chain visibility, and compliance reporting in a unified dashboard. Furthermore, partnerships between automotive OEMs and established telematics service providers (TSPs) are intensifying, aiming to offer factory-installed connectivity solutions directly to consumers and enterprise buyers, circumventing the need for aftermarket installation.

Regional trends highlight that North America and Europe currently dominate the market in terms of value, primarily due to stringent regulatory frameworks—such as ELD in the US and specific digital tachograph requirements in the EU—coupled with high adoption rates in mature commercial sectors and well-established technological infrastructure supporting widespread deployment of 4G and nascent 5G networks. However, the Asia Pacific (APAC) region, spearheaded by rapid economic development in China, India, and Southeast Asian nations, is poised to demonstrate the highest growth rate during the forecast period. This rapid expansion in APAC is fueled by massive infrastructure projects, burgeoning e-commerce markets necessitating optimized last-mile delivery, and increasing governmental investments in smart transportation systems, although challenges related to diverse regulatory landscapes and fragmented local connectivity remain pertinent factors influencing market penetration speed and strategy for global players. Latin America and the Middle East & Africa (MEA) are also emerging as high-potential markets, particularly for asset tracking and logistics management solutions supporting commodity transport and resource exploration activities.

Segment trends underscore the rising prominence of solution-based offerings, specifically Fleet Management Systems, which hold the largest market share and are evolving rapidly to incorporate predictive maintenance algorithms and sophisticated route optimization based on real-time traffic and weather data. Within the application landscape, Insurance Telematics (UBI) is experiencing exponential uptake, driven by insurers seeking granular risk assessment capabilities and consumers desiring personalized premium structures that reward safe driving. Concurrently, the proliferation of connected car technology is making embedded telematics the standard in new vehicles, slowly eroding the aftermarket segment's dominance for basic tracking functionality, although aftermarket solutions will remain critical for retrofitting older fleets. The evolution towards real-time data processing and edge computing within telematics hardware is a crucial segmentation trend, enabling faster decision-making and reducing dependency on constant cloud connectivity, thereby broadening the applicability of telematics in geographically remote areas with inconsistent network access.

AI Impact Analysis on Telematics Market

User queries regarding AI's influence on the Telematics Market typically revolve around three key areas: the capability of AI to enhance safety and reduce accidents, the impact of AI on data security and privacy concerns related to constant monitoring, and the practical implementation barriers for integrating sophisticated AI models into existing fleet infrastructure. Users are particularly interested in how AI, specifically machine learning (ML) algorithms, can move beyond simple data logging to provide genuine predictive intelligence, such as accurately forecasting equipment failure or driver fatigue before an incident occurs. There is also significant curiosity regarding AI’s role in optimizing complex, multi-modal logistics networks and in verifying the veracity of insurance claims through automated video analysis, seeking assurance that these technologies are reliable, cost-effective, and provide a measurable return on investment (ROI). The underlying concern often centers on the ethical implications of using AI for constant surveillance and ensuring that algorithmic bias does not unfairly penalize drivers or fleets.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the Telematics Market from a reactive monitoring system into a proactive, predictive management platform. AI algorithms are now deployed extensively to process the massive volumes of heterogeneous data generated by telematics devices—including GPS coordinates, accelerometer readings, engine diagnostics, and video footage—at speeds and accuracies impossible for human analysts. This shift enables systems to identify subtle patterns indicative of dangerous driving behavior (e.g., sudden braking or aggressive cornering) or impending mechanical failures (e.g., thermal fluctuations or vibration anomalies). Consequently, AI significantly enhances operational efficiency by optimizing dynamic routing based on real-time factors, predicting maintenance needs, and automating compliance reporting, thereby reducing human error and overall operational downtime across large fleets.

Furthermore, AI is pivotal in advancing specialized telematics verticals, notably in usage-based insurance (UBI) where sophisticated ML models refine risk scoring by analyzing contextual driving data, moving beyond simple speed metrics to evaluate complex maneuvers in varied environments. Within video telematics, AI-powered computer vision is crucial for automated event detection, instantly flagging distracted driving, seatbelt violations, or harsh road conditions, drastically reducing the time needed for human review of footage and ensuring timely intervention and driver coaching. As the market matures, AI integration is expected to become a baseline expectation for all high-value telematics platforms, driving a competitive advantage for vendors who can successfully leverage edge computing capabilities to run complex AI models directly on vehicular hardware, ensuring low latency and reduced data transmission costs.

- AI enables predictive maintenance by analyzing engine diagnostics data patterns, forecasting component failure, and minimizing unplanned vehicle downtime.

- Machine Learning algorithms significantly enhance driver behavior scoring for Usage-Based Insurance (UBI), leading to more accurate risk assessment and personalized pricing.

- Computer Vision powered by AI is utilized in video telematics for real-time detection of risky driving behaviors, such as fatigue, distraction, and adherence to traffic rules.

- AI optimizes complex logistics and route planning dynamically, accounting for real-time traffic, weather, and delivery window constraints.

- Natural Language Processing (NLP) is increasingly used in fleet management software for simplified data input and automated report generation from unstructured text data.

- AI enhances cybersecurity by identifying abnormal data transmission patterns characteristic of hacking attempts or unauthorized system access in connected vehicles.

DRO & Impact Forces Of Telematics Market

The Telematics Market is governed by a potent combination of robust drivers, inherent restraining factors, and significant opportunities, collectively shaped by powerful external impact forces such as regulatory mandates and technological obsolescence cycles. The primary drivers revolve around the regulatory push for enhanced safety and monitoring in commercial transport, exemplified by global mandates for tracking technologies like ELD and digital tachographs, coupled with the clear economic incentive for businesses to reduce operational expenditures (OpEx) through better fleet visibility and optimized asset utilization. However, restraints present substantial challenges, most notably the high initial cost of implementation, particularly for smaller enterprises (SMEs), and pervasive concerns surrounding data privacy and stringent regulations like GDPR, which complicate the collection and cross-border transfer of sensitive vehicle and driver behavior data. Opportunities, conversely, are abundant, rooted in the rapid expansion of 5G infrastructure enabling real-time complex data transfer, the burgeoning adoption of usage-based insurance models, and the massive untapped potential in emerging markets, especially in APAC, offering pathways for market penetration through scalable, low-cost solutions.

Key impact forces shaping the competitive landscape include significant pressure from regulatory bodies demanding transparency and accountability in commercial transportation, which acts as a non-optional driver for adoption across entire sectors. Technological impact forces are centered around the rapid evolution of connected vehicle architectures and the necessity for telematics solutions to seamlessly integrate with sophisticated OEM hardware and vehicle-specific data buses (like CAN bus), often requiring vendors to constantly innovate to avoid obsolescence. Economic forces play a crucial role, as fluctuating fuel prices intensify the business need for fuel efficiency optimization tools provided by telematics, simultaneously making capital expenditure sensitive for fleet operators when considering large-scale technology upgrades. The combination of these forces—regulatory requirements ensuring market baseline adoption, technological advancement pushing the performance ceiling, and economic incentives driving ROI focus—creates a highly dynamic and demanding environment for market stakeholders, emphasizing the need for flexible, cloud-native, and interoperable telematics platforms that can quickly adapt to changing standards and operator needs.

The strategic deployment of resources and innovation capabilities across the market value chain directly correlates with the ability to navigate these forces. Companies that successfully address the inherent restraints—such as developing robust cybersecurity protocols to alleviate privacy concerns and offering tiered, subscription-based pricing models accessible to SMEs—are best positioned for growth. Furthermore, leveraging the significant opportunities, particularly in integrating advanced AI for predictive diagnostics and expanding service offerings to non-traditional assets like construction equipment or intermodal containers, allows vendors to differentiate themselves in a crowded marketplace. The interaction between these DRO factors dictates investment priorities: substantial capital is being channeled into developing solutions compliant with increasingly complex global data residency laws and into creating sophisticated analytics dashboards that translate raw telematics data into clear, operational business intelligence for fleet managers, solidifying telematics as a mission-critical rather than optional business tool.

Segmentation Analysis

The Telematics Market is intricately segmented based on technology, component, deployment, solution type, vehicle type, and end-user application, reflecting the diverse and evolving needs across various industries utilizing real-time connectivity and data analytics. This segmentation is crucial for vendors to tailor their offerings, addressing specific pain points ranging from heavy-duty commercial compliance to consumer insurance optimization. The core technological distinction often lies between embedded systems, which are factory-installed and utilize the vehicle’s native infrastructure, and tethered/integrated solutions, which often rely on peripheral devices connected to the vehicle's diagnostics port (OBD-II). The trend is definitively moving towards greater integration and reliance on software-as-a-service (SaaS) models within the solution segment, offering scalable and flexible access to sophisticated features like route planning, driver risk management, and regulatory reporting without demanding heavy upfront capital investment in proprietary server infrastructure.

From a solution perspective, Fleet Management Systems remain the largest and most complex segment, continually expanding its functionalities to include advanced capabilities such as field service management, supply chain integration, and mobile workforce optimization, significantly beyond basic GPS tracking. Conversely, the segmentation by vehicle type highlights the differing priorities between Passenger Vehicles, where telematics focuses predominantly on safety (eCall), navigation, and infotainment, and Commercial Vehicles (trucks and buses), where the emphasis is strictly on regulatory compliance, operational efficiency, and lowering the total cost of ownership (TCO). Furthermore, the Heavy Commercial Vehicle (HCV) sub-segment exhibits specific needs related to cargo integrity monitoring and specialized maintenance schedules, distinguishing it from Light Commercial Vehicle (LCV) requirements, which are often centered on delivery efficiency in urban environments.

Geographic segmentation is vital for understanding market maturity and regulatory impact, where established markets like North America and Europe demand feature-rich, integrated solutions and exhibit high price sensitivity, while high-growth regions like APAC prioritize cost-effectiveness, scalability, and robust performance in environments with fragmented connectivity. This layered segmentation approach allows for precise market sizing and strategic targeting, enabling manufacturers of hardware components (modems, sensors, GPS chips) and providers of software platforms (analytics, APIs, cloud services) to align their development roadmaps with the most financially rewarding and strategically critical market niches. The increasing integration of telematics with third-party logistics software and enterprise resource planning (ERP) systems further blurs traditional segmentation lines, indicating a future where telematics data is simply a fundamental layer of broader business intelligence platforms.

- By Technology:

- Embedded Telematics

- Tethered Telematics (Integrated)

- Smartphone-based Telematics

- By Component:

- Hardware (e.g., GPS modules, Accelerometers, Gyroscopes, Communication Modules)

- Software (e.g., Analytical Platforms, APIs, Cloud Infrastructure)

- Services (e.g., Integration Services, Managed Services, Consulting, Maintenance)

- By Solution Type:

- Fleet Management (FMS)

- Asset Tracking

- Navigation and Location-Based Services

- Infotainment and Safety

- Usage-Based Insurance (UBI)

- Diagnostics and Maintenance

- Security and Surveillance (Video Telematics)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Off-Highway Vehicles

- By End-Use Industry:

- Transportation and Logistics

- Insurance

- Healthcare (Emergency Services)

- Construction and Mining

- Government and Public Safety

- Manufacturing

Value Chain Analysis For Telematics Market

The Telematics Market value chain is highly complex and multi-layered, beginning with upstream activities focused on the manufacturing and supply of critical hardware components and foundational connectivity solutions. Upstream analysis involves suppliers of semiconductor chips, GPS modules, cellular modems (4G/5G), and specialized sensor technologies (e.g., accelerometers, CAN bus readers). The competitive advantage at this stage rests heavily on miniaturization, power efficiency, cost of materials, and securing long-term supply agreements with major OEMs and Tier 1 automotive suppliers. Innovation in this segment is driven by the necessity for robust, automotive-grade components capable of operating reliably under harsh environmental conditions and integrating seamlessly with diverse vehicle electronic architectures. Pricing pressures are intense, forcing component manufacturers to continuously refine fabrication processes and leverage economies of scale, particularly as telematics penetration increases globally.

Midstream activities constitute the crucial aggregation and integration stage, where Telematics Service Providers (TSPs) and System Integrators assemble the hardware and develop proprietary software platforms and analytical tools. This stage involves the development of core software functionalities such as data acquisition protocols, cloud-based data storage infrastructure, advanced analytics dashboards, and user interfaces (UIs). The TSPs act as the primary value generators here, converting raw vehicle data into actionable business intelligence (e.g., fuel reports, driver risk scores, predictive maintenance alerts). Distribution channels are bifurcated into direct sales models, where large TSPs contract directly with major fleet operators or automotive OEMs for embedded solutions, and indirect channels, which rely on a network of authorized dealers, installers, and Value-Added Resellers (VARs) to target SMEs and provide localized installation and maintenance support, particularly critical in geographically expansive regions.

Downstream analysis focuses on the end-user deployment, service delivery, and ongoing support, which defines the final value proposition and customer retention. This includes professional installation services (for aftermarket devices), integration with the client's existing enterprise resource planning (ERP) or logistics management systems, data security management, and comprehensive customer support. For direct sales (OEMs and large TSPs), the focus is on maximizing fleet uptime and providing highly customized reporting tailored to specific organizational KPIs. In contrast, indirect channels often emphasize rapid deployment and scalable, standardized software packages. Success in the downstream segment is highly dependent on service reliability, data accuracy, adherence to Service Level Agreements (SLAs), and the ability to demonstrate a clear and rapid return on investment (ROI) to the end-user, often secured through subscription-based revenue models ensuring long-term customer lock-in and predictable recurring revenue streams for the service provider.

Telematics Market Potential Customers

Potential customers for telematics solutions encompass a vast array of organizations and individual consumers whose operations involve the management of mobile assets, optimization of transportation logistics, or assessment of driving risk, reflecting the technology's broad applicability across the modern economy. The most significant segment of end-users are Commercial Fleet Operators, ranging from global third-party logistics (3PL) providers managing thousands of trucks and trailers to local delivery services operating small fleets of vans. These buyers utilize telematics primarily for mission-critical functions such as route optimization, mandated regulatory compliance (HOS tracking), fuel management, driver safety coaching, and reducing insurance costs by proactively managing operational risks. Their purchasing decisions are heavily influenced by the demonstrable ROI, platform integration capabilities, and the vendor's ability to provide reliable, scalable hardware and robust analytical support tailored to their specific industry vertical, such as cold chain monitoring or heavy equipment tracking.

Another rapidly expanding segment of potential buyers includes Insurance Companies and Financial Institutions, which leverage telematics data to revolutionize risk assessment and policy underwriting through Usage-Based Insurance (UBI) models. For these buyers, telematics serves as an indispensable tool for granular data collection on driver behavior, vehicle usage patterns, and accident reconstruction, allowing them to move away from demographic risk pools toward individualized, behavior-based pricing. Their requirement centers on secure, standardized data streams, minimal customer friction during data collection (often via smartphone apps or OBD-II devices), and robust analytical APIs that seamlessly integrate telematics data into their complex actuarial models and claims processing systems, thereby driving profitability through accurate risk calculation and fraud mitigation.

Furthermore, Automotive Original Equipment Manufacturers (OEMs) represent a crucial set of institutional buyers, integrating telematics systems directly into new passenger and commercial vehicles, positioning themselves as service providers rather than just vehicle manufacturers. These customers prioritize embedded solutions that enable advanced services like remote diagnostics, Over-The-Air (OTA) updates, concierge services, emergency calling (eCall), and vehicle health monitoring, all contributing to enhanced customer experience and enabling new post-sale revenue streams. Government agencies, including public transit authorities, emergency services (police, fire, ambulance), and military/defense departments, also constitute major potential customers, focusing on maximizing resource deployment efficiency, ensuring public safety response times, and maintaining high levels of operational readiness for specialized, often high-value, government assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 110.5 Billion |

| Market Forecast in 2033 | USD 360.8 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon Connect, Geotab Inc., Trimble Inc., Teletrac Navman (Veralto), CalAmp Corp., TomTom Telematics (Webfleet Solutions), Samsara Inc., Omnitracs LLC, Continental AG, Bosch GmbH, Harman International Industries (Samsung), Microlise Group, Mix Telematics, Masternaut (Clario), Zonar Systems, Spireon, AT&T Inc., Octo Telematics, WirelessCar (Volvo Group), Vodafone Automotive. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telematics Market Key Technology Landscape

The Telematics Market's technological foundation is rapidly shifting, driven by advancements in connectivity and processing power, transitioning from simple 2G/3G connectivity to sophisticated 4G LTE and emerging 5G networks, which are crucial for handling the massive increase in real-time data from vehicle sensors and video feeds. The shift towards 5G is transformative, offering ultra-low latency and extremely high bandwidth, enabling advanced vehicle-to-everything (V2X) communications that facilitate autonomous driving features and enhanced cooperative safety systems, moving telematics beyond mere tracking into active vehicle control and safety augmentation. Key hardware components include high-precision GNSS (Global Navigation Satellite Systems) receivers, multi-sensor integration platforms (incorporating accelerometers, gyroscopes, and magnetometers), and advanced microprocessor units capable of edge computing, which allows for preliminary data processing and filtering directly on the device, minimizing network load and accelerating response times for critical events like collisions or driver warnings.

Software and platform technologies form the intellectual core of the telematics ecosystem, centered around cloud-native architectures that ensure scalability, resilience, and global accessibility for fleet operators managing geographically dispersed assets. A critical technology is the development of robust Application Programming Interfaces (APIs) that allow seamless integration of telematics data with third-party Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and supply chain management (SCM) systems, transforming raw telemetry into integrated business insight. Furthermore, data analytics platforms employing Machine Learning (ML) and Artificial Intelligence (AI) are essential for executing predictive maintenance, optimizing complex logistics algorithms, and automating sophisticated driver risk scoring. Cybersecurity technology is paramount, utilizing encryption, secure boot protocols, and intrusion detection systems to protect sensitive vehicle data and prevent unauthorized access or manipulation of vehicular systems, a growing concern as vehicles become more interconnected and exposed to external threats.

The rise of video telematics and the requirement for real-time video streaming has catalyzed the adoption of higher performance cameras and integrated processing units that handle on-device video compression and AI-powered image analysis (computer vision) for tasks such as road sign recognition, pedestrian detection, and in-cab driver behavior monitoring. Furthermore, advancements in specialized low-power wide-area network (LPWAN) technologies, such as LoRaWAN and NB-IoT, are expanding the feasibility of telematics for static asset tracking and monitoring in remote or constrained environments where traditional cellular coverage is impractical or too power-intensive. The constant evolution requires vendors to adopt agile development methodologies, focusing on over-the-air (OTA) update capabilities to remotely patch software, deploy new features, and ensure the longevity and security of deployed telematics units throughout the vehicle's operational lifecycle.

Regional Highlights

The global Telematics Market exhibits distinct regional dynamics driven by varying levels of technological maturity, regulatory environments, and commercial fleet adoption rates. North America stands as a foundational and leading market, largely propelled by mandatory federal regulations, most notably the Electronic Logging Device (ELD) mandate, which necessitates the use of telematics for Hours-of-Service (HOS) tracking in commercial trucking. This high regulatory compliance rate, combined with a large, technologically sophisticated fleet base and robust 4G LTE infrastructure, has fostered rapid growth and saturation in advanced solution segments like video telematics and sophisticated predictive maintenance platforms. The region benefits from strong presence of global telematics leaders and intense competition, favoring innovation in AI-powered analytics and cybersecurity protocols, making it a critical market for the deployment of cutting-edge solutions.

Europe represents another mature and substantial market, distinguished by strict European Union regulations, including the mandatory implementation of eCall systems in new vehicles for automatic emergency assistance and the use of digital tachographs for driver work time recording. The focus in Europe is heavily skewed towards reducing carbon emissions and improving road safety, driving demand for telematics solutions that optimize fuel consumption and enforce eco-friendly driving behaviors. Western Europe maintains high adoption rates, while Eastern European countries offer significant growth potential as logistics infrastructures modernize. Furthermore, the stringent General Data Protection Regulation (GDPR) forces providers operating in this region to adhere to the highest standards of data privacy and residency, influencing platform architectures and data handling practices significantly, thereby raising the barrier to entry for external players.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, characterized by vast, developing logistics networks, explosive e-commerce growth (especially in India and Southeast Asia), and massive state-backed investments in smart city infrastructure and modern public transportation. While connectivity infrastructure can be fragmented across the region, particularly in rural areas, the sheer volume of commercial vehicles and the nascent stage of telematics adoption provide immense opportunities. China and India are key growth engines, driven by domestic manufacturing strength and increasing realization of the efficiency gains provided by fleet management. Growth strategies here prioritize cost-effective, scalable, and localized solutions capable of operating reliably within diverse regulatory landscapes and often relying on simpler, affordable hardware configurations to achieve mass market penetration.

- North America: Dominant market share fueled by ELD mandates, mature logistics sector, and high adoption of advanced video telematics and predictive maintenance systems.

- Europe: Strong growth driven by eCall requirements, digital tachograph usage, and stringent environmental policies promoting fuel efficiency and reducing emissions; high focus on GDPR compliance.

- Asia Pacific (APAC): Highest CAGR anticipated due to rapid commercial vehicle production, booming e-commerce logistics, and increasing governmental investment in smart transportation in key economies like China and India.

- Latin America: Emerging market characterized by strong demand for asset tracking solutions to combat theft and improve supply chain visibility, particularly in agriculture and commodity transport.

- Middle East and Africa (MEA): Growth concentrated in GCC countries due to oil & gas logistics and smart city initiatives, emphasizing asset security and tracking in geographically challenging environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telematics Market.- Verizon Connect

- Geotab Inc.

- Trimble Inc.

- Teletrac Navman (Veralto)

- CalAmp Corp.

- TomTom Telematics (Webfleet Solutions)

- Samsara Inc.

- Omnitracs LLC

- Continental AG

- Robert Bosch GmbH

- Harman International Industries (Samsung)

- Microlise Group

- Mix Telematics

- Masternaut (Clario)

- Zonar Systems

- Spireon

- AT&T Inc.

- Octo Telematics

- WirelessCar (Volvo Group)

- Vodafone Automotive

Frequently Asked Questions

Analyze common user questions about the Telematics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Telematics Market?

The foremost driver is the increasing implementation of governmental regulations globally, such as the ELD mandate in North America and mandatory eCall systems in Europe, which compel commercial and passenger vehicle owners to adopt telematics solutions for safety compliance and operational monitoring. This is strongly supported by the economic necessity for fleets to utilize advanced analytics for fuel efficiency and reduced operational costs.

How is Artificial Intelligence (AI) specifically transforming traditional fleet management telematics?

AI is transforming telematics by enabling predictive capabilities. Instead of merely recording data, AI algorithms analyze patterns in real-time sensor and video inputs to predict mechanical failures (predictive maintenance) and proactively identify high-risk driving behaviors, facilitating automated driver coaching and enhancing overall fleet safety and uptime.

What are the main security and privacy concerns associated with telematics data collection?

The primary concerns revolve around the sensitive nature of continuous location and driver behavior data. Users are concerned about unauthorized data access, potential misuse of personal driving information by employers or insurers, and compliance with data protection laws like GDPR, necessitating robust encryption, access control, and adherence to data residency requirements by service providers.

Which telematics segment currently holds the largest market share and why?

The Fleet Management Systems (FMS) segment holds the largest market share. This dominance is due to its wide range of applications in the massive commercial sector (trucking, logistics, construction), where telematics is essential for regulatory compliance, improving supply chain visibility, and generating substantial, measurable returns on investment (ROI) through efficiency gains.

What role does 5G technology play in the future expansion of the Telematics Market?

5G technology is critical as it provides the ultra-low latency and massive bandwidth capacity required to support complex applications like real-time video telematics, highly accurate V2X (vehicle-to-everything) communication for autonomous driving, and massive scale data transmission necessary for real-time traffic management and over-the-air (OTA) software updates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Telematics Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Telematics Control Unit (TCU) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Construction Equipment Telematics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Automotive OEM Telematics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- 4G/5G Automotive Telematics Control Units (TCUs) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager