Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434951 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Trailer Market Size

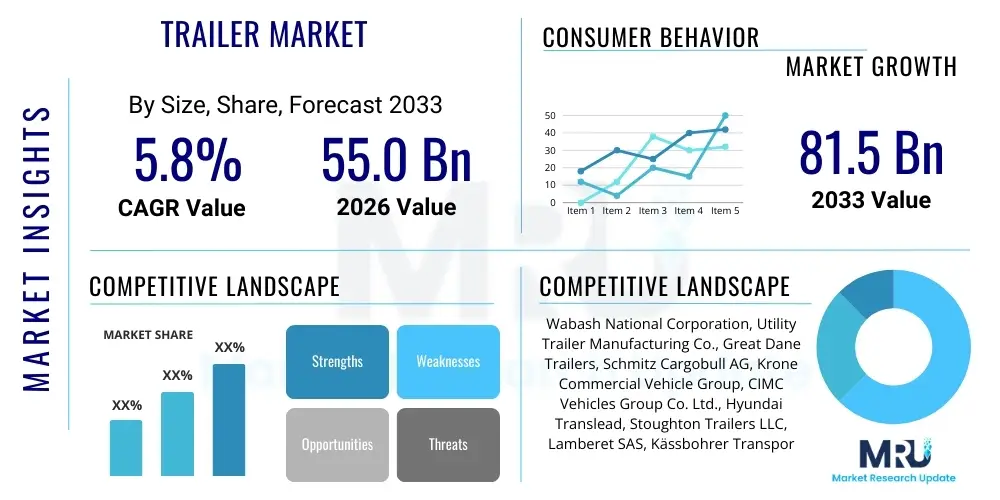

The Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 55.0 Billion in 2026 and is projected to reach USD 81.5 Billion by the end of the forecast period in 2033.

Trailer Market introduction

The Trailer Market encompasses the design, manufacturing, distribution, and utilization of non-motorized vehicles towed by a motorized vehicle to transport goods, equipment, or passengers. This robust industry is fundamentally driven by global logistics requirements, infrastructure development, and the expansion of the construction, agriculture, and recreational sectors. Trailers serve as critical components in the supply chain, providing flexible and cost-effective transport solutions across various industries, ranging from heavy-duty commercial freight transportation to specialized utility and recreational hauling for consumers. The product descriptions vary widely, including flatbed trailers, dry van trailers, refrigerated trailers (reefers), tankers, specialty equipment carriers, and recreational vehicles (RVs) like travel trailers, each tailored to specific payload characteristics and operational requirements. The market’s resilience is rooted in its indispensable role in facilitating economic activities that require movement of large or bulky items over long distances, adapting constantly to regulatory changes regarding weight, size, and safety standards.

Major applications of trailers span numerous economic verticals. In commercial logistics, dry van trailers and reefers are vital for transporting consumer goods, food, and pharmaceuticals, ensuring efficient shelf replenishment and temperature-sensitive integrity. The construction and infrastructure sectors rely heavily on flatbeds, lowboy trailers, and dump trailers for moving heavy machinery, raw materials, and debris. Furthermore, the burgeoning popularity of outdoor recreation significantly boosts demand for travel trailers and specialized sport utility trailers. The inherent benefits of utilizing trailers include enhanced payload capacity, optimized fuel efficiency when used in combination with tractors, reduced operational costs compared to dedicated motorized trucks for specific loads, and versatility in intermodal transport operations. As global trade volumes continue to increase, the demand for sophisticated, high-capacity, and durable trailers remains paramount to sustaining economic growth and meeting consumer needs efficiently.

Driving factors underpinning the consistent expansion of the Trailer Market are intrinsically linked to macroeconomic trends. Significant growth in e-commerce and last-mile delivery services necessitates an expanded fleet of commercial trailers, particularly specialized smaller units for urban logistics. Government investments in infrastructure projects, particularly in emerging economies, spur demand for construction and heavy-haul trailers. Technological advancements, such as the integration of telematics, anti-lock braking systems (ABS), and advanced materials like lightweight aluminum and composites, are improving trailer safety, durability, and operational efficiency, thereby accelerating fleet renewal cycles. Moreover, strict environmental regulations compelling better fuel economy and reduced emissions are driving innovation towards aerodynamic trailer designs and tire technology, ensuring continuous market evolution and sustained demand from commercial fleet operators prioritizing total cost of ownership (TCO) optimization and regulatory compliance adherence.

Trailer Market Executive Summary

The Trailer Market is currently characterized by significant business transformation driven by sustainability mandates, technological integration, and supply chain restructuring. Business trends indicate a strong shift towards lightweight materials, notably aluminum and advanced composites, to reduce overall vehicle weight, thereby improving fuel efficiency and increasing permissible payload capacity, which directly addresses rising operational costs for logistics providers. Furthermore, digitalization is pervasive, with fleet managers increasingly adopting telematics, GPS tracking, and sensor technologies to monitor trailer health, location, and cargo integrity in real-time. Consolidation among major manufacturers is a defining characteristic, seeking economies of scale and broader geographical reach, while smaller, specialized manufacturers focus on niche applications like highly customized refrigeration or specialized heavy equipment hauling. The demand fluctuation observed in recent years, influenced by pandemic-related supply chain disruptions and subsequent inventory rebuilding cycles, highlights the market's sensitivity to global economic stability and industrial production rates, yet the long-term outlook remains positive due to sustained demand from freight logistics.

Regional trends reveal distinct market dynamics influenced by regulatory environments and economic maturity. North America continues to dominate the market share, primarily due to large-scale freight movement across the continent and high consumer disposable income supporting the recreational vehicle (RV) segment. Europe shows a robust trajectory, significantly shaped by stringent environmental regulations, which accelerate the adoption of advanced, aerodynamic, and electric-trailer concepts (where auxiliary power is required). The Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid industrialization, infrastructure investment, and burgeoning e-commerce penetration in countries like China and India, leading to high demand for both standard commercial trailers and intermodal containers. Conversely, market growth in Latin America and the Middle East & Africa (MEA) is more fragmented, heavily reliant on fluctuations in commodity prices, particularly oil and mining, which dictate demand for specialized heavy-duty and tanker trailers, requiring localized product customization.

Segmentation trends highlight the increasing importance of specialized trailer types over generic hauling equipment. Dry van trailers remain the volume leader, but refrigerated trailers (reefers) are experiencing accelerated growth due to the expansion of the cold chain logistics necessary for pharmaceuticals and perishable goods distribution globally. In terms of axle type, tandem axle configurations dominate commercial segments, offering a balance between load capacity and maneuverability, though tri-axle and multi-axle configurations are crucial for heavy-haul applications mandated by specific regional load regulations. The shift in manufacturing preference towards advanced welding techniques and modular construction methods allows manufacturers to rapidly adapt production lines to meet dynamic customer specifications, emphasizing custom build-outs for specific fleet requirements. Moreover, the increasing adoption of rental and leasing services over outright purchase, particularly among smaller fleet operators, is influencing distribution patterns and inventory management strategies across the segment landscape, offering operational flexibility.

AI Impact Analysis on Trailer Market

Analysis of common user questions regarding AI’s impact on the Trailer Market frequently centers on how AI can enhance operational efficiency, predictive maintenance capabilities, and supply chain security. Users are keen to understand the practical integration of Artificial Intelligence into passive assets like trailers, asking about AI-powered telematics that predict mechanical failures (tires, brakes, suspension) before they occur, thus minimizing costly downtime. Concerns also revolve around the capital investment required for these intelligent trailer systems and the data security implications of transmitting vast amounts of operational data. Furthermore, users often inquire about the potential for AI in optimizing routing when trailers are integrated with autonomous driving systems or used in platooning operations, aiming for maximized fuel savings and reduced driver cognitive load, signifying a high expectation for transformative operational improvements through AI adoption.

- AI-powered Predictive Maintenance: Utilization of machine learning algorithms applied to sensor data (temperature, vibration, pressure) to anticipate component failures in brakes, tires, and refrigeration units, optimizing maintenance schedules and dramatically reducing unexpected breakdowns.

- Enhanced Fleet Management Optimization: AI algorithms analyzing real-time traffic, weather, and logistical data to recommend optimal staging locations, pick-up times, and drop-off sequences, improving trailer utilization rates and reducing empty mileage.

- Cargo Integrity Monitoring: Implementing AI through computer vision and specialized sensors within refrigerated and dry van trailers to detect unauthorized access, internal damage, or temperature deviations, automatically alerting operators and mitigating potential loss.

- Autonomous Platooning Integration: AI systems facilitating seamless, automated connection and synchronized braking/acceleration between the lead truck and multiple trailing units, significantly improving aerodynamic efficiency and achieving fuel savings of up to 10-15%.

- Demand Forecasting and Inventory Optimization: Leveraging AI to analyze historical shipping patterns, seasonal fluctuations, and economic indicators to predict future trailer demand, helping manufacturers optimize production schedules and fleet operators manage trailer inventory effectively.

- Supply Chain Visibility and Security: Utilizing AI to process complex, multi-modal tracking data, providing granular, real-time visibility of the trailer's location and status, enhancing security protocols against theft and ensuring compliance with specific transit regulations.

DRO & Impact Forces Of Trailer Market

The dynamics of the Trailer Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces dictating market trajectory. Key drivers include the exponential growth in global e-commerce, demanding robust logistics infrastructure capable of high-volume, time-sensitive freight movement, coupled with significant governmental infrastructure spending worldwide, particularly in developing economies, necessitating heavy-duty construction and specialized trailers. These drivers are further amplified by the continuous push toward intermodal transport solutions, where trailers are designed for seamless transition between road, rail, and sea, maximizing operational flexibility and global reach. However, the market faces significant restraints, primarily stemming from fluctuating raw material costs, especially steel and aluminum, which directly impact manufacturing margins and final product pricing. Additionally, regulatory complexities regarding vehicle size and weight limitations, which vary drastically across countries and regions, often constrain design innovation and necessitate highly localized production strategies, posing a persistent challenge to global standardization and optimization.

Opportunities within the Trailer Market predominantly revolve around technology integration and sustainability initiatives. The shift towards electrification in trucking presents a major opportunity for trailer manufacturers to innovate ancillary power systems for refrigerated or liftgate applications, leading to the development of 'smart trailers' equipped with self-sustaining power sources. Furthermore, the increasing focus on fleet optimization and safety fuels the opportunity for advanced telematics and sensor integration, enabling trailer health monitoring and predictive maintenance services that generate new revenue streams for manufacturers beyond initial sales. The growing consumer demand for recreational vehicles (RVs) and specialized hobby trailers also represents a recession-resistant niche opportunity, particularly in North America and Europe, capitalizing on trends toward personalized travel and outdoor leisure activities, requiring continuous development of lightweight, amenity-rich travel trailers. These opportunities incentivize research and development investment aimed at product differentiation and improved lifecycle value.

The collective impact forces suggest a market moving towards higher complexity and technological dependence. The powerful driver of e-commerce mandates faster innovation cycles and higher quality standards for dry van and specialty logistics trailers. Simultaneously, the restraint imposed by material price volatility necessitates strategic long-term sourcing contracts and greater adoption of alternative, cost-stable materials. The most significant impact force remains environmental regulation, which acts as both a driver (pushing for aerodynamic and lightweight designs) and a constraint (increasing compliance costs). The market equilibrium is increasingly maintained by technological advancements that effectively mitigate the restraints; for instance, telematics systems (opportunity) help justify higher upfront costs imposed by expensive lightweight materials (restraint) by offering demonstrable long-term operational savings (driver). This continuous pressure ensures sustained innovation focused on safety, efficiency, and sustainability across all trailer segments.

Segmentation Analysis

The Trailer Market is meticulously segmented based on product type, axle type, capacity, and end-user application, reflecting the diverse and specialized requirements of the global logistics and industrial sectors. This segmentation allows manufacturers to target specific market niches with precision-engineered products, optimizing resource allocation and maximizing profitability. Product type segmentation, which separates the market into Dry Vans, Reefers, Flatbeds, Tankers, and Specialized Trailers, is essential as each category demands unique construction methodologies, materials, and technological integration, particularly concerning insulation, load securing, or pressurized storage. Axle type differentiation—single, tandem, and multi-axle—directly correlates with load capacity and the regulatory landscape of the operating region, guiding fleet operators in selecting appropriate equipment for heavy or standard loads, while capacity segmentation further refines selection based on volumetric size or maximum payload weight requirements, crucial for optimizing transport logistics and adhering to legal road limits.

End-user segmentation is critical for understanding demand patterns, distinguishing between applications in construction, logistics and transport, oil and gas, agriculture, and mining. The logistics and transport sector represents the largest consumer segment, driving demand for standard dry vans and reefers, while construction and mining sectors exhibit high demand for robust, heavy-duty trailers capable of operating in harsh environments, such as dump trailers and lowboy equipment carriers. Geographic segmentation remains fundamentally important, as trailer specifications related to length, height, and width are often highly localized due to national road laws and infrastructure limitations. The continuous trend toward specialization means that bespoke trailers, categorized under the 'Specialized' segment (e.g., car carriers, wind turbine blade carriers), are gaining market share, reflecting the complexity of modern industrial logistics and the need for tailor-made transport solutions that general-purpose trailers cannot adequately address.

- By Product Type:

- Dry Vans

- Refrigerated Trailers (Reefers)

- Flatbed Trailers

- Tanker Trailers

- Dump Trailers

- Specialized Trailers (Car Carriers, Logging Trailers, Lowboys)

- Utility and Recreational Trailers (Travel Trailers, Boat Trailers)

- By Axle Type:

- Single Axle

- Tandem Axle

- Multi Axle (Tri-Axle and above)

- By Capacity (Payload Weight):

- Low Capacity (Up to 10 Metric Tons)

- Medium Capacity (10-25 Metric Tons)

- High Capacity (Above 25 Metric Tons)

- By End-Use Application:

- Logistics and Transport

- Construction and Infrastructure

- Agriculture

- Oil and Gas

- Mining

- Consumer/Recreational

Value Chain Analysis For Trailer Market

The Value Chain for the Trailer Market begins upstream with the procurement of critical raw materials, primarily steel, aluminum, composites, and specialized components like axles, tires, brake systems, and refrigeration units. Key upstream activities involve commodity sourcing, price negotiation, and managing complex global supply networks to ensure a stable flow of materials while mitigating volatility risks inherent in metal markets. The quality and cost of these input materials significantly determine the final product quality and the manufacturer's profit margins. Strong relationships with high-quality component suppliers, particularly those providing advanced technological systems (e.g., telematics, ABS), are crucial for manufacturers aiming to differentiate their products through safety and efficiency enhancements. This phase is characterized by intense focus on optimizing inventory management and achieving economies of scale in bulk purchasing to maintain competitive pricing in the downstream market.

The manufacturing and assembly phase constitutes the core value addition activity, transforming raw materials and components into finished trailers. This phase includes design engineering, chassis fabrication, body assembly, painting/finishing, and the final integration of specialized systems (e.g., cooling units in reefers or hydraulic systems in dump trailers). Modular design and advanced manufacturing techniques, such as robotic welding and automated assembly lines, are increasingly adopted to improve precision, speed up production cycles, and enable customization. Downstream activities involve distribution channels, which are segmented into direct sales to large fleet operators, sales through authorized dealers and distributors, and, increasingly, rental and leasing companies. Direct sales channels allow for tailored product customization and strong customer relationships, while dealer networks are vital for reaching smaller operators and providing localized service support, including maintenance and spare parts supply, enhancing the trailer's operational lifecycle.

The final stages of the value chain focus on aftermarket services and end-of-life management, which contribute significantly to long-term profitability and customer retention. Aftermarket services include routine maintenance, major repairs, body refurbishment, and the supply of high-margin spare parts. The efficiency of the distribution channel is directly proportional to customer satisfaction; robust service networks ensure minimal downtime for fleet operators. Furthermore, the growing focus on sustainability integrates end-of-life considerations, promoting the recycling of steel and aluminum components, minimizing environmental impact, and supporting a circular economy model within the industry. The effectiveness of the overall value chain relies heavily on seamless information flow, particularly in using data generated by smart trailers to inform maintenance scheduling and future design improvements, cementing a continuous feedback loop between the downstream user experience and upstream engineering processes.

Trailer Market Potential Customers

Potential customers for the Trailer Market span a wide array of commercial, industrial, and consumer entities, driven by the fundamental need to move goods or equipment efficiently. The primary customer segment comprises large-scale Logistics and Third-Party Logistics (3PL) providers who operate vast fleets of tractors and require thousands of standardized trailers (dry vans and reefers) to support national and international supply chains. These customers prioritize total cost of ownership (TCO), fuel efficiency, payload capacity, and the reliability of advanced tracking and safety systems, often engaging in multi-year procurement contracts with major manufacturers to ensure fleet standardization and preferential servicing. Retail giants and major e-commerce platforms, increasingly managing their own dedicated distribution networks, also represent significant direct buyers, focusing on rapid deployment and high-utilization rates to meet stringent delivery timelines, often requiring specialized urban trailers for metropolitan distribution.

The second major segment includes specialized industrial customers such as Construction and Mining companies, and entities within the Oil and Gas sector. These customers require heavy-duty, often highly customized, trailers like lowboys, dump trailers, and tanker trailers designed to haul oversized or specific hazardous materials under rigorous conditions. Their purchasing decisions are primarily influenced by durability, safety compliance, and the ability of the trailer to withstand harsh operational environments, making specialized engineering and certification crucial purchasing criteria. Agricultural enterprises also constitute a vital market, demanding specialized livestock carriers, grain haulers, and machinery transport trailers, where seasonal demand cycles heavily influence procurement timing and requirements for robustness and sanitation features specific to food and animal transport regulations.

Finally, the consumer and smaller business segments represent a consistently growing portion of the market, primarily purchasing utility trailers, car carriers, and Recreational Vehicles (RVs) such as travel trailers and fifth-wheel units. This segment includes individuals and small to medium-sized enterprises (SMEs) that utilize trailers for recreational activities, specialized mobile businesses, or localized delivery services. For these buyers, ease of use, aesthetic appeal, brand reputation, and affordability are key considerations. The proliferation of small construction contractors and landscape businesses, needing reliable utility trailers for equipment transport, further solidifies the diverse customer base, requiring manufacturers and dealers to maintain a varied inventory of standard and customizable units to satisfy both large enterprise and individual consumer demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.0 Billion |

| Market Forecast in 2033 | USD 81.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wabash National Corporation, Utility Trailer Manufacturing Co., Great Dane Trailers, Schmitz Cargobull AG, Krone Commercial Vehicle Group, CIMC Vehicles Group Co. Ltd., Hyundai Translead, Stoughton Trailers LLC, Lamberet SAS, Kässbohrer Transport Technik GmbH, Heil Trailer International, Dennison Trailers, Mac Trailer Manufacturing, Fontaine Trailer Company, SDC Trailers, Talbert Manufacturing, Dorsey Intermodal, Vanhool NV, Kögel Trailer GmbH & Co. KG, China International Marine Containers (CIMC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trailer Market Key Technology Landscape

The technological landscape of the Trailer Market is rapidly evolving, driven by the need for increased efficiency, safety, and integration within the broader digital logistics ecosystem. A primary technological focus is the implementation of advanced telematics and Internet of Things (IoT) sensors, transforming traditional trailers into 'smart trailers.' These integrated systems collect real-time data on location, tire pressure, brake performance, cargo temperature, and door security status. This data is critical for predictive maintenance scheduling, proactive safety alerts, and comprehensive asset utilization analysis, allowing fleet managers to minimize downtime and optimize operational flow. Furthermore, the adoption of proprietary software platforms that interface directly with the trailer’s sensors enables robust data analytics, providing insights into driver behavior, route compliance, and cargo health, which were previously unavailable for passive assets, thus significantly enhancing overall supply chain visibility and management capabilities.

Material science innovation represents another foundational element of the current technology landscape. The persistent industry goal of reducing tare weight to maximize payload capacity has accelerated the adoption of high-strength, low-alloy (HSLA) steel and advanced aluminum alloys for chassis and structural components. Furthermore, the increasing use of composite materials, particularly in specialized applications like refrigerated trailer panels (reefers), offers superior thermal efficiency and durability compared to traditional materials, directly impacting operating costs by reducing the energy needed for cooling. Beyond materials, advancements in aerodynamic design kits, including side skirts, boat tails, and gap fairings, are becoming standard features, significantly reducing aerodynamic drag and contributing to substantial fuel savings, thereby addressing both economic and environmental mandates faced by commercial carriers. These designs, often developed using computational fluid dynamics (CFD) analysis, are critical for optimizing highway efficiency.

Safety and ancillary technology are continuously being upgraded to meet rigorous global standards. Key safety technologies include advanced Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and Tire Pressure Monitoring Systems (TPMS), which are becoming mandatory in many jurisdictions, significantly reducing the risk of rollover accidents and blowouts. Integration with the tractor unit through sophisticated communication protocols (e.g., CAN bus) allows for synchronized braking and control in modern heavy-duty trucks. Moreover, the impending shift towards electric mobility in the trucking sector is fostering research into self-powered trailer systems, particularly for reefers and trailers with powered liftgates. These innovations often involve regenerative braking or solar panels to charge onboard battery banks, reducing reliance on the tractor engine for auxiliary power, representing a critical step towards decarbonizing logistics operations and setting the stage for fully integrated, electrified transport chains.

Regional Highlights

- North America (NA): Dominates the global Trailer Market due to extensive cross-border logistics between the U.S., Canada, and Mexico, facilitated by robust highway infrastructure and high consumer demand for transported goods. The region is a leader in adopting specialized trailers, especially recreational vehicles (RVs) and high-technology dry vans equipped with advanced telematics, driven by aggressive fleet modernization cycles and favorable economic conditions supporting capital investment.

- Europe: Characterized by stringent environmental and safety regulations, driving high demand for aerodynamic designs, lightweight materials, and advanced braking systems (ABS/EBS). The market is highly influenced by intermodal transport needs, emphasizing standardized container chassis and robust curtain-side trailers tailored for varying national road rules and shorter haul distances compared to NA. Germany, France, and the UK are the major revenue contributors, with a strong focus on high-quality, long-lasting trailers.

- Asia Pacific (APAC): Expected to exhibit the fastest growth rate globally, propelled by explosive infrastructure development, rapid industrialization, and massive penetration of e-commerce, particularly in China and India. The demand is skewed towards utility and standard dry freight trailers initially, but specialized transport needs related to energy and mining are also growing rapidly. Investment in domestic manufacturing capabilities is rising, challenging established Western dominance.

- Latin America (LATAM): Market growth is volatile, closely tied to commodity exports and infrastructure spending. Demand is concentrated on durable, heavy-duty trailers capable of handling challenging road conditions, particularly for mining and agricultural applications. Brazil and Mexico are the primary markets, focusing on locally manufactured, rugged designs that prioritize resilience and high load capacity over advanced technological features.

- Middle East and Africa (MEA): Growth is primarily driven by energy sector investments (oil and gas), necessitating substantial demand for tanker trailers and specialized heavy-haul carriers. The market benefits from ongoing development in major Gulf Cooperation Council (GCC) states, fueling construction and logistics sectors. Climate considerations are crucial, spurring demand for highly insulated reefers and reliable air braking systems designed for extreme heat operation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trailer Market.- Wabash National Corporation

- Utility Trailer Manufacturing Co.

- Great Dane Trailers

- Schmitz Cargobull AG

- Krone Commercial Vehicle Group

- CIMC Vehicles Group Co. Ltd.

- Hyundai Translead

- Stoughton Trailers LLC

- Lamberet SAS

- Kässbohrer Transport Technik GmbH

- Heil Trailer International

- Dennison Trailers

- Mac Trailer Manufacturing

- Fontaine Trailer Company

- SDC Trailers

- Talbert Manufacturing

- Dorsey Intermodal

- Vanhool NV

- Kögel Trailer GmbH & Co. KG

- China International Marine Containers (CIMC)

- Manac Inc.

- Tremcar Inc.

- Faymonville Group

- Transcraft Corporation

- Polar Tank Trailer, LLC

Frequently Asked Questions

Analyze common user questions about the Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major factors are driving the current growth of the Trailer Market?

The primary drivers are the massive expansion of global e-commerce and subsequent increase in high-volume freight logistics demand, alongside significant governmental investment in global infrastructure projects. Furthermore, technological integration, especially telematics for predictive maintenance and enhanced supply chain visibility, is incentivizing fleet modernization and replacement cycles, sustaining demand for smart, efficient trailer assets.

How is the adoption of lightweight materials impacting trailer manufacturing and operational costs?

The adoption of lightweight materials, such as advanced aluminum alloys and composites, is crucial for reducing the trailer's tare weight, which directly increases the legal payload capacity. Operationally, a lighter trailer contributes significantly to fuel efficiency, minimizing ongoing transportation costs and allowing fleet operators to maximize revenue per trip, positioning lightweight construction as a key competitive advantage.

Which trailer segment is expected to experience the highest growth rate during the forecast period?

The Refrigerated Trailer (Reefer) segment is projected to show the highest growth rate. This accelerated expansion is driven by the global requirement for robust cold chain logistics, necessitated by the increasing distribution of temperature-sensitive pharmaceuticals (vaccines) and perishable foods across vast distances, particularly in rapidly urbanizing economies within the Asia Pacific region.

What role does Artificial Intelligence (AI) play in the future development of the Trailer Market?

AI's role is transformative, primarily through the optimization of asset performance and safety. AI algorithms analyze sensor data from smart trailers to provide sophisticated predictive maintenance alerts, optimize routing logistics, and manage cargo integrity in real time. This leads to minimized unexpected breakdowns and maximized asset utilization for commercial fleet operators.

Why is North America the leading region in terms of market share for trailers?

North America holds the largest market share due to its established, large-scale long-haul logistics industry, high volume of cross-border trade, and high consumer adoption of recreational vehicles (RVs) and utility trailers. The region benefits from standardized regulations across key national markets (US, Canada) and high investment capability for new, technologically equipped fleet acquisitions.

What are the main risks associated with the production side of the trailer market?

The main production risks involve the extreme volatility and cyclical nature of raw material pricing, particularly steel and aluminum, which severely impact manufacturing margins. Furthermore, labor shortages in skilled welding and assembly trades, coupled with complex, varied regional regulatory standards for trailer specifications, introduce significant operational constraints and high localization costs for global manufacturers.

How do fleet operators typically acquire new trailers, and what financing options dominate the market?

Fleet operators primarily acquire new trailers through outright purchase or, increasingly, through leasing and rental agreements. Leasing offers operational flexibility and reduced upfront capital expenditure, making it highly attractive to smaller and mid-sized fleet operators. Major manufacturers and financial institutions often provide captive financing options to streamline procurement and offer integrated service contracts.

What is a 'smart trailer,' and what are its core technological components?

A 'smart trailer' is equipped with advanced telematics and IoT sensor systems designed to gather and transmit comprehensive operational data. Core components include GPS tracking for location, dedicated sensors for monitoring tire pressure and brake function, integrated temperature control monitors (for reefers), and automated anti-theft security systems, all linked via a cellular network to a centralized fleet management platform.

In the context of the trailer market, what is intermodal transport, and why is it important?

Intermodal transport refers to the movement of cargo in specialized units, such as intermodal chassis or containers, using multiple modes of transport (e.g., road, rail, sea) without handling the cargo itself when changing modes. This is vital as it enhances supply chain efficiency, reduces handling costs, and maximizes global reach, driving demand for robust and standardized container chassis designs that meet international specifications.

What impact are safety regulations having on trailer design and innovation?

Safety regulations are driving mandatory adoption of advanced braking and stability technologies, such as ABS and Electronic Stability Control (ESC), necessitating continuous innovation in axle and suspension design. Additionally, regulations concerning conspicuity tape, lighting standards, and structural integrity for crash protection are increasing the engineering complexity and cost, but ultimately improving road safety performance across all trailer types globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dump Trailer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Trailer Leasing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Asphalt Distributor Trailer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Conventional Travel Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aluminum Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager