Eel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436940 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Eel Market Size

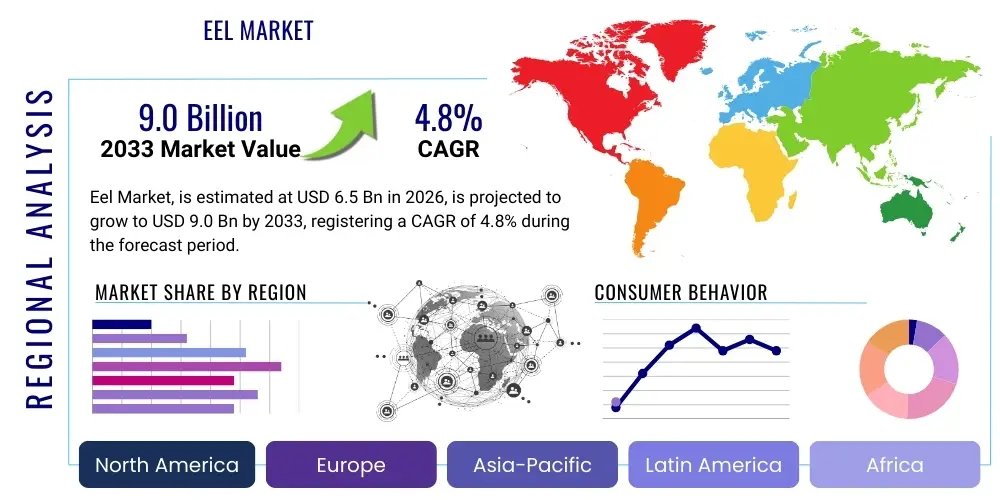

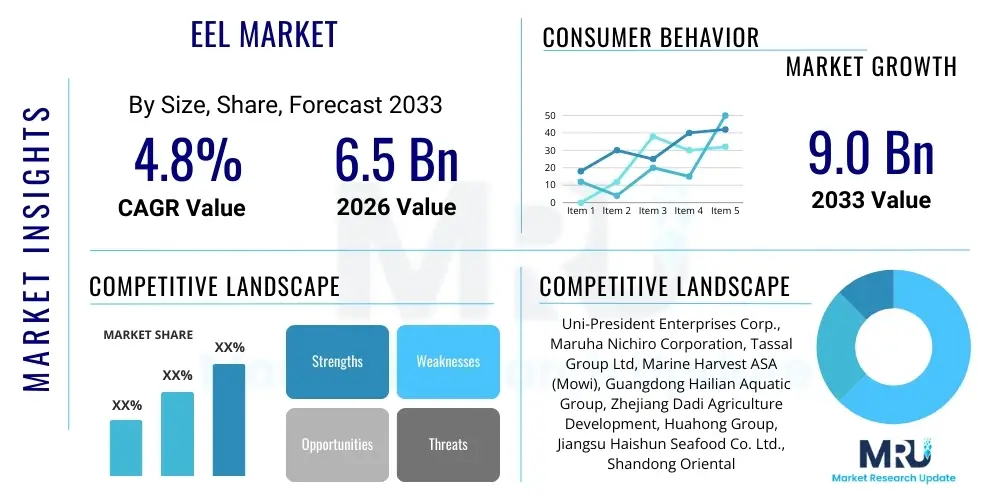

The Eel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Eel Market introduction

The global Eel Market encompasses the trade, processing, and consumption of various species of eels, primarily belonging to the genus Anguilla, such as the European Eel (Anguilla anguilla), Japanese Eel (Anguilla japonica), and American Eel (Anguilla rostrata). These fish are highly prized in East Asian cuisine, particularly in Japan, where they are consumed as Unagi (freshwater eel) and Anago (saltwater eel). The market spans wild-caught resources, which are increasingly constrained by environmental regulations and conservation efforts, and robust aquaculture operations, which drive the primary supply chain. The product is valued for its rich flavor profile, high nutritional content—including omega-3 fatty acids, protein, and vitamins—and its versatility in prepared food products, ranging from smoked eel and marinated fillets to high-end sushi and kabayaki dishes. Given the sensitivity of eel stocks to environmental changes, the industry places significant emphasis on sustainable farming practices and the efficiency of the juvenile eel (glass eel) capture and farming process, which remains a bottleneck for expansion. This focus on controlled environment aquaculture (CEA) mitigates supply volatility often associated with wild fisheries, ensuring consistent product quality and availability for global distribution networks.

Major applications of eels extend across the foodservice sector, retail distribution, and specialized ingredient manufacturing. In the foodservice industry, eels are a cornerstone ingredient, particularly in countries like Japan, China, and South Korea, driving demand for fresh and frozen products suitable for immediate preparation in restaurants. The retail segment involves the sale of packaged, ready-to-eat (RTE) eel products, such as frozen unagi kabayaki, catering to growing consumer convenience trends in developed economies. Furthermore, the pharmaceutical and nutraceutical sectors also represent niche applications, utilizing eel oil and certain tissues for their rich lipid and protein composition, although this remains a minor proportion of overall market value. The economic value chain is characterized by intensive international trade, where glass eels are often sourced globally, transported to specialized rearing facilities (primarily in Asia), processed into finished products, and then re-exported, creating complex logistical challenges and regulatory hurdles related to species protection and traceability.

Driving factors for the sustained market growth include the rising disposable income in Asia Pacific, leading to increased consumption of premium seafood, and the globalization of East Asian culinary traditions, which has introduced eel dishes to Western palates. However, the most critical factor remains the advancements in closed-loop aquaculture systems. These technological improvements are vital for overcoming the biological complexities associated with breeding eels in captivity, which historically relied heavily on wild-caught glass eels. Successful implementation of recirculating aquaculture systems (RAS) enhances feed conversion ratios, improves disease management, and reduces the environmental footprint compared to traditional pond farming. Additionally, growing consumer awareness regarding the health benefits of seafood consumption, coupled with the luxury perception of eel products, further strengthens market momentum, even amidst persistent concerns regarding the ecological status of wild eel populations and the stringent international regulations governing their cross-border movement, particularly CITES listings for certain species.

Eel Market Executive Summary

The Eel Market is positioned for moderate yet steady growth, primarily driven by robust demand from East Asia and significant technological shifts in aquaculture practices designed to ensure supply stability amid environmental constraints. Business trends indicate a strong move toward vertical integration among major market players, encompassing juvenile eel sourcing, advanced farming, processing, and global distribution. This integration is critical for maintaining quality control and traceability, which are increasingly demanded by both regulatory bodies and end consumers. Furthermore, market competition is intensifying, prompting companies to invest heavily in product innovation, focusing on value-added formats such as specialized sauces, pre-cooked meals, and certified sustainable products. The transition away from reliance on fluctuating wild stocks toward sustainable, high-density recirculating aquaculture systems (RAS) represents the most pivotal business trend, providing a pathway to decouple production cycles from volatile natural conditions and mitigating the risk associated with disease outbreaks in traditional farming environments, thus stabilizing long-term pricing structures.

Regional trends unequivocally highlight Asia Pacific, led by Japan and China, as the dominant consumption and processing hub. Japan remains the largest consumer, valuing eel as a cultural delicacy, while China is the largest global producer due to extensive farming capacity and processing infrastructure. Europe and North America represent niche but growing markets, characterized by increasing imports of processed eel and specialized local consumption (e.g., smoked eel in Northern Europe). However, regulatory divergence across regions poses significant challenges. The European Union's strict regulations on the export of European glass eels (Anguilla anguilla) and the heightened conservation status of American eels heavily influence global supply dynamics, pushing production toward Asian farmed species. This regulatory pressure necessitates sophisticated supply chain management and rigorous adherence to international trade protocols, impacting pricing and sourcing decisions globally.

Segment trends demonstrate continuous growth in the processed and frozen segment, driven by convenience and longer shelf life, making global logistics feasible. Unagi Kabayaki (marinated and grilled eel) dominates this segment due to its popularity and standardized preparation. Within distribution channels, Food Service remains the primary driver, particularly in high-volume consumption areas, although the E-commerce and organized retail channels are rapidly gaining traction, especially for premium, smaller-packaged consumer units designed for home preparation. The segmentation by species shows that the Japanese Eel (Anguilla japonica) and Chinese Eel farming systems are critical to global volume, while European and American species, constrained by conservation measures, command premium prices in specialized niche markets. Innovation in feed technology—developing non-fishmeal-based diets for sustainable eel growth—is a key trend within the segment, aimed at addressing sustainability concerns related to the overall aquaculture industry.

AI Impact Analysis on Eel Market

Analysis of common user questions regarding AI's impact on the Eel Market reveals strong interest centered around optimizing aquaculture efficiency, enhancing disease detection, and improving supply chain transparency, reflecting industry concerns over sustainability and resource management. Users frequently inquire about how AI can predict environmental variables crucial for eel growth, such as water temperature and dissolved oxygen levels in RAS facilities, aiming to minimize operational costs and maximize yield. Another significant area of concern focuses on applying machine learning to image recognition for the early detection of stress or pathogens in dense farming systems, mitigating mass mortality events that pose massive economic threats. Furthermore, consumers and regulatory bodies are keenly interested in how AI-driven blockchain solutions can ensure the ethical and legal sourcing of eels, particularly addressing concerns related to the illegal trade of protected species and ensuring that wild glass eel quotas are not exceeded. These queries highlight a market seeking technological solutions to biological volatility and regulatory complexity.

AI's primary influence will manifest in precision aquaculture, where sophisticated algorithms process vast amounts of sensor data collected from Recirculating Aquaculture Systems (RAS) and flow-through farms. By deploying predictive analytics, farmers can anticipate feed requirements, optimize pumping cycles, and preemptively adjust environmental parameters before they negatively impact the health of the eel stock. This capability dramatically reduces resource wastage, minimizes energy consumption associated with environmental control, and ensures optimal growth rates, accelerating the time to market for farmed eels. Moreover, AI-powered systems can analyze genetic markers and growth patterns of individual cohorts, facilitating selective breeding programs aimed at developing faster-growing, disease-resistant eel strains, which is crucial for fully closing the life cycle of commercially viable eels in captivity—a long-standing goal of aquaculture research.

Beyond the farm, AI will revolutionize the processing and global logistics segments. In processing plants, computer vision systems combined with machine learning can rapidly and accurately sort eels by size, quality, and species, automating labor-intensive tasks and ensuring consistency in packaged products, critical for high-value export markets like Japan and Europe. On the logistics front, AI optimization tools can model complex international shipping routes, considering customs regulations, temperature control requirements, and dynamic trade tariffs, ensuring timely delivery while minimizing spoilage. The ability of AI to integrate and analyze real-time data from disparate parts of the supply chain—from the hatchery phase to the consumer point of sale—will establish an unprecedented level of traceability, fulfilling the stringent transparency mandates increasingly imposed by global governance bodies and addressing consumer skepticism regarding the environmental impact of seafood consumption.

- AI-driven optimization of Recirculating Aquaculture Systems (RAS) parameters (temperature, pH, oxygen) for maximum growth efficiency and reduced energy use.

- Machine learning algorithms applied to video monitoring for early disease detection, stress level assessment, and behavioral analysis in dense farming environments.

- Predictive supply chain modeling using AI to forecast consumer demand, manage volatile global sourcing of glass eels, and optimize international shipping logistics.

- Implementation of AI and blockchain technology for enhanced traceability, verifying the origin and legal compliance of eel products against CITES regulations.

- Automated quality control and grading during processing using computer vision to ensure product uniformity for high-end retail and food service markets.

- Development of personalized feed schedules based on real-time biological data and growth metrics, improving Feed Conversion Ratio (FCR) and reducing input costs.

DRO & Impact Forces Of Eel Market

The Eel Market is governed by powerful and often conflicting dynamics characterized by persistent high demand and severely limited wild supply, creating significant market volatility. Drivers include the deeply embedded cultural value of eel consumption, particularly in East Asia, which sustains premium pricing even in times of shortage. Technological innovation in aquaculture, specifically the increasing viability of closed-loop systems (RAS), acts as a critical force, providing the necessary stability to mitigate supply shocks caused by environmental volatility and stricter fishing quotas. Furthermore, expanding global trade liberalization and improved cold chain logistics facilitate the movement of processed eel products to distant markets efficiently. However, these drivers are counteracted by formidable restraints, primarily the biological difficulty and high cost associated with fully closing the life cycle of the eel in captivity. This biological bottleneck forces continuous reliance on wild-caught glass eels (elvers), making the industry vulnerable to conservation regulations and illegal fishing, significantly inflating initial rearing costs and contributing to price instability and regulatory uncertainty.

Opportunities within the market largely revolve around sustainability and value-added product development. The most significant opportunity lies in achieving a breakthrough in commercial-scale captive breeding, which would entirely revolutionize the supply chain, rendering it fully independent of wild stocks and potentially unlocking massive investment in controlled environment agriculture globally. Until then, substantial opportunity exists in enhancing the efficiency and sustainability of current farming models through optimized feed formulations that reduce reliance on marine resources, appealing to environmentally conscious consumers and reducing operational costs. Furthermore, the development of processed, ready-to-eat eel products tailored for Western tastes, such as low-sodium or innovative flavor profiles, opens new revenue streams in relatively untapped geographical markets. Strategic partnerships between technology providers, research institutions, and large-scale aquaculture operators are essential to capitalize on these technological and market expansion opportunities, transforming perceived market restraints into drivers for long-term growth and stability in the overall ecosystem.

The interplay of these Drivers, Restraints, and Opportunities dictates the Impact Forces shaping the market structure. The primary impact force is the regulatory pressure exerted by international conservation bodies, such as CITES, which governs the international trade of protected species like the European Eel, creating significant geopolitical friction and influencing global pricing benchmarks. Demand-side factors remain strong, acting as a gravitational pull that continually justifies high investment despite operational difficulties. Environmental concerns and climate change are also major impact forces, affecting wild populations' migration patterns and the water quality in farming regions, necessitating substantial capital investment in risk mitigation technologies like advanced water filtration and climate-controlled facilities. The combined effect of high biological risk, stringent regulation, and unwavering consumer loyalty creates a highly specialized, capital-intensive market where technological supremacy and regulatory compliance are non-negotiable prerequisites for sustained competitive advantage, forcing smaller, less adaptable players out of the market and consolidating power among vertically integrated conglomerates.

Segmentation Analysis

The Eel Market is comprehensively segmented based on species type, product form, distribution channel, and application, reflecting the complex global value chain from wild capture to specialized consumer consumption. Segmentation by species is crucial, as availability and conservation status heavily influence pricing and market dynamics, differentiating the higher-volume farmed species (Japanese and Chinese Eel) from restricted, premium species (European Eel). Product form segmentation highlights the market's shift toward convenience and value addition, with frozen and processed products dominating international trade due to their inherent logistical advantages and standardization. Analyzing distribution channels illuminates the market's heavy reliance on the traditional food service sector (restaurants, hotels), which processes the bulk of fresh and semi-processed eel, juxtaposed against the rapidly evolving e-commerce sector catering directly to end consumers with ready-to-eat products. Understanding these segments is paramount for market players to tailor sourcing strategies, processing standards, and geographic targeting effectively.

- By Species:

- Japanese Eel (Anguilla japonica)

- European Eel (Anguilla anguilla)

- American Eel (Anguilla rostrata)

- Other Anguilla Species (e.g., A. bicolor, A. reinhardtii)

- By Product Form:

- Live/Fresh

- Frozen

- Processed/Canned (e.g., Unagi Kabayaki, Smoked Eel)

- Fillets/Cut Portions

- By Distribution Channel:

- Food Service (Restaurants, Hotels, Catering)

- Retail (Supermarkets, Hypermarkets)

- E-commerce/Online Retail

- Specialty Stores/Wet Markets

- By Application:

- Food Consumption (Primary Application)

- Nutraceuticals (Niche Application)

Value Chain Analysis For Eel Market

The Eel Market value chain begins with the critical upstream phase: the capture of juvenile eels, or glass eels (elvers). This phase is characterized by intense regulatory scrutiny and high seasonal volatility, as virtually all farmed eels still rely on wild-caught stock for their initial rearing phase. Key upstream activities include specialized fishing operations (often seasonal and highly localized), immediate transport of live elvers, and initial conditioning within quarantine facilities. Due to the scarcity and high demand, glass eels command extremely high prices, often exceeding tens of thousands of dollars per kilogram, making this the most capital-intensive and risk-laden step in the entire chain. Sourcing networks are global but often funnel through key transit hubs in Asia and Europe, requiring sophisticated logistical support to maintain the high viability of the live stock during transit, with compliance with CITES regulations being a non-negotiable requirement for legal trade.

The core midstream process involves the grow-out phase, predominantly executed in intensive aquaculture facilities, ranging from traditional earthen ponds to modern, high-tech Recirculating Aquaculture Systems (RAS). This stage involves meticulous feeding (often using specialized, high-protein feed pellets), continuous water quality management, and disease monitoring over a period of 1 to 3 years until the eels reach market size. Following the grow-out, the eels move to the processing stage, where they are cleaned, filleted, and often prepared into value-added products like Unagi Kabayaki (grilled and marinated), smoked eel, or frozen fillets. Major processing centers are concentrated in high-production regions like China and Taiwan, leveraging specialized equipment and labor to meet the stringent quality standards required for export markets, especially Japan.

The downstream distribution channel is bifurcated into direct and indirect routes. Direct distribution involves large farming operations selling directly to major food service chains or specialty export agents. Indirect distribution is dominated by international traders, wholesalers, and specialized seafood distributors who manage the complex cold chain logistics, customs clearance, and market entry into consumer regions such as Europe and North America. The distribution network must ensure strict temperature control and rapid transit, especially for high-value fresh and live eel products. Organized retail and e-commerce platforms are increasingly important for distributing processed, ready-to-eat products directly to consumers, bypassing traditional foodservice reliance. This vertical flow—from regulated wild sourcing to technological farming, high-level processing, and complex global distribution—underscores the need for robust traceability systems across all segments.

Eel Market Potential Customers

The primary customers for the Eel Market are segmented based on their purchasing volume, processing needs, and final consumption patterns, overwhelmingly led by the Food Service Industry, particularly in Asian markets. High-end Japanese restaurants and specialized Unagi restaurants constitute the largest and most valuable end-user group, demanding premium quality, consistency, and specific size ranges for their dishes. These customers purchase large quantities of fresh or frozen processed eel (Kabayaki) and prioritize long-term supply agreements with reliable processors and exporters. The demand from this segment is highly sensitive to quality metrics such as fat content, texture, and flavor profile, reflecting the cultural significance of eel preparation in these culinary traditions. Furthermore, general Chinese and Korean restaurants also contribute substantially, albeit often purchasing slightly smaller or lower-grade processed products for various regional specialties.

The second major group comprises global organized retail chains, including supermarkets and hypermarkets, which cater directly to household consumers seeking convenient, packaged seafood options. These customers focus on ready-to-eat formats, such as frozen, vacuum-sealed Unagi portions or smoked eel pieces, prioritizing ease of preparation and standardized packaging, often under private label brands. The retail segment's growth is strongly influenced by demographic shifts, including smaller household sizes and increased demand for gourmet convenience foods in developed Western and Asian economies. Retail procurement necessitates compliance with global food safety certifications (e.g., HACCP, ISO 22000) and increasingly, sustainability certifications, driving processors to adopt rigorous quality assurance protocols to meet these high standards required for shelf placement.

A third, specialized customer segment includes industrial food manufacturers and nutraceutical companies. Food manufacturers utilize eel fillets or trimmings as ingredients in specialized prepared foods, sauces, or Asian packaged meals, focusing on cost-effective, high-volume sourcing. Nutraceutical companies, although a much smaller volume purchaser, are interested in high-purity eel oil for omega-3 supplements and other derived products, valuing the high lipid and protein content of the species. This segment demands highly specific component parts and rigorous documentation regarding the raw material's nutritional composition and safety profile. Regardless of the segment, all potential customers share a fundamental need for certified legal sourcing, given the conservation status of many eel species, making traceability a crucial purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Uni-President Enterprises Corp., Maruha Nichiro Corporation, Tassal Group Ltd, Marine Harvest ASA (Mowi), Guangdong Hailian Aquatic Group, Zhejiang Dadi Agriculture Development, Huahong Group, Jiangsu Haishun Seafood Co. Ltd., Shandong Oriental Ocean Sci-Tech, Eel Aquaculture Co. Ltd., Shanghai Kaichuang Marine International, Hangzhou Qiandaohu Xunlong Aquaculture Co. Ltd., Anguillicola, Inc., Fuzhou Golden Eel Co., Ltd., China Fishery Group Limited, A & E Enterprise, Inc., American Eel Company, Seafresh Group, Ocean Harvest Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eel Market Key Technology Landscape

The technology landscape in the Eel Market is predominantly focused on overcoming biological hurdles and enhancing operational sustainability, primarily centered around sophisticated aquaculture engineering. Recirculating Aquaculture Systems (RAS) represent the foundational technology, allowing for intensive, year-round eel production regardless of geographical location or external climatic conditions. Modern RAS facilities incorporate advanced components such as biofilters (for nitrogen removal), mechanical filtration systems, UV sterilizers, and oxygen injection systems, crucial for maintaining optimal water quality necessary for the delicate growth phases of the eel. The integration of high-precision monitoring systems, including real-time sensors for dissolved oxygen, pH, temperature, and ammonia levels, is mandatory for mitigating the risk of disease outbreaks and ensuring high stocking densities are managed effectively. This shift towards high-tech containment systems minimizes environmental discharge and maximizes the efficiency of limited feed resources, driving down the environmental footprint per kilogram of harvested eel, addressing key consumer and regulatory concerns regarding traditional aquaculture practices.

Feed technology is another critical area of innovation, given the nutritional requirements of eels and the global push for sustainable protein sources. Research and development are intensely focused on creating high-performance, cost-effective feed pellets that reduce or eliminate the reliance on fishmeal and fish oil derived from wild fisheries. Substituting traditional marine ingredients with novel proteins, such as insect meal, single-cell proteins, and plant-based concentrates, is a key technological frontier. Successful feed formulation must mimic the natural diet of eels while ensuring excellent palatability and optimal nutrient bioavailability to support rapid growth and high-fat content desired by the market. Simultaneously, technology related to feed automation and precise dosing, often managed by AI-driven systems, ensures minimal feed waste and optimized conversion rates, substantially impacting the final cost of production and profitability of large-scale eel farming operations globally.

Furthermore, post-harvest and processing technologies play a significant role in maintaining the high value of eel products across the global supply chain. Advanced freezing techniques, such as cryogenic freezing and individual quick freezing (IQF), are essential for preserving the texture and flavor of processed products like Unagi Kabayaki for prolonged international transport. Processing plants utilize specialized machinery for automated filleting, grading, and vacuum packaging, ensuring uniformity and adherence to strict hygiene standards required for export. Traceability technology, including RFID tagging and blockchain integration, is becoming standard practice, allowing consumers and regulatory bodies to track the eel product from the final processed package back to the specific farm or sourcing point of the glass eel. This technological integration is necessary not only for regulatory compliance but also as a fundamental marketing tool, assuring premium markets of the product's origin, legality, and adherence to sustainable production standards throughout its complex journey to the plate.

Regional Highlights

- Asia Pacific (APAC): Dominance in Production and Consumption

APAC is the undisputed leader in both the production and consumption of eels globally, primarily driven by the massive markets in China, Japan, and South Korea. China is the world's largest producer of farmed eel, leveraging extensive aquaculture infrastructure, although it relies heavily on imported glass eels (elvers) from other regions due to local stock constraints. Japan, conversely, is the largest consumer market, where eel (Unagi) is a culturally significant and high-value delicacy, driving premium pricing and demanding the highest quality standards. Regional strategies often center on improving cross-border trade efficiency for live elvers and processed products, while simultaneously investing heavily in domestic high-tech farming systems to reduce reliance on volatile wild stocks. The high demand and entrenched culinary traditions ensure APAC remains the primary revenue generation hub for the global eel industry, influencing global trading prices and product standards significantly.

- Europe: Focus on Conservation and Niche Smoked Eel Markets

The European market is primarily characterized by strict conservation measures concerning the critically endangered European Eel (Anguilla anguilla). Regulations, particularly the EU ban on the export of European glass eels outside the EU, have fundamentally reshaped global trade flows, creating severe supply constraints. While Europe has a historic and premium market for smoked eel (particularly in countries like the Netherlands and Germany), domestic production volumes are limited and heavily regulated. The market relies on legal farmed imports of processed eel, predominantly from Asia, to meet consumer demand. Future growth in Europe is contingent upon the success of sustainable farming methods within the continent or the easing of regulatory constraints surrounding certain species, although conservation status remains paramount to regional policy.

- North America: Growing Import Market for Processed Products

North America is predominantly an import-driven market for eel products, with demand fueled by growing East Asian populations and the increasing popularity of Asian cuisine in mainstream food service. Processed and frozen Unagi Kabayaki, imported primarily from China and Taiwan, constitutes the bulk of market consumption. The native American Eel (Anguilla rostrata) faces significant conservation pressures, limiting its commercial utilization, although localized fisheries exist for supplying regional markets and, historically, for exporting glass eels. The market is witnessing accelerated growth in the retail and e-commerce segments as convenience-focused processed eel products become more readily available to American and Canadian consumers, requiring robust cold chain infrastructure and FDA compliance for imported goods.

- Latin America & Middle East/Africa (LAMEA): Nascent and Emerging Markets

The LAMEA regions represent relatively nascent markets for eel consumption, with demand largely confined to upscale hotels, specialized international restaurants, and export processing facilities that cater to global demand. South America has some limited domestic production and processing, primarily focused on Asian export markets rather than local consumption. Investment opportunities exist in developing aquaculture infrastructure in areas with favorable climatic conditions for eel farming, particularly using modern RAS technology. However, infrastructural limitations, high operational costs, and low local consumer awareness mean that these regions are unlikely to become major consumption hubs within the short-to-medium term, serving instead as potential sourcing or processing locations for global supply chains targeting Asian and Western import markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eel Market.- Uni-President Enterprises Corp.

- Maruha Nichiro Corporation

- Tassal Group Ltd (Focus on general aquaculture but relevant technology)

- Marine Harvest ASA (Mowi) (Major seafood conglomerate with high tech aquaculture focus)

- Guangdong Hailian Aquatic Group

- Zhejiang Dadi Agriculture Development

- Huahong Group

- Jiangsu Haishun Seafood Co. Ltd.

- Shandong Oriental Ocean Sci-Tech

- Eel Aquaculture Co. Ltd.

- Shanghai Kaichuang Marine International

- Hangzhou Qiandaohu Xunlong Aquaculture Co. Ltd.

- Anguillicola, Inc.

- Fuzhou Golden Eel Co., Ltd.

- China Fishery Group Limited

- A & E Enterprise, Inc.

- American Eel Company

- Seafresh Group

- Ocean Harvest Technology (Feed supplier focus)

- Piscifactoría El Pilar S.L. (European focus)

Frequently Asked Questions

Analyze common user questions about the Eel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary constraint limiting the growth of the global Eel Market?

The most significant constraint is the biological bottleneck in fully closing the life cycle of the eel (Anguilla species) in captivity. Nearly all commercial eel farming worldwide still depends on the seasonal capture of wild glass eels (elvers), leading to extreme supply volatility, high sourcing costs, and vulnerability to stringent international conservation regulations like CITES, which restricts trade for endangered species like the European Eel.

Which geographical region dominates both the production and consumption of eel products?

The Asia Pacific (APAC) region dominates the global eel market. China is the largest producer of farmed eels, benefiting from extensive aquaculture infrastructure, while Japan is the world's largest consumer market, where eel (Unagi) is a high-value culinary staple. The region dictates global trade flows, pricing, and quality standards for processed eel products.

How is technology, specifically AI, influencing the sustainability of eel farming?

AI is crucial for enhancing the sustainability and efficiency of eel farming, primarily through precision aquaculture in Recirculating Aquaculture Systems (RAS). AI algorithms optimize water quality parameters, predict disease outbreaks based on real-time data analysis, and manage automated feeding to improve the Feed Conversion Ratio (FCR), significantly reducing operational costs and minimizing the environmental discharge from farming facilities.

What are the key value-added products driving export growth in the Eel Market?

The most important value-added product driving international trade is frozen Unagi Kabayaki (marinated and grilled eel). This processed form is favored by global food service and retail sectors due to its convenience, extended shelf life, standardized preparation, and ease of transport in the complex international cold chain. Smoked eel is a key niche product, particularly popular in European markets.

What are the risks associated with the trade of wild-caught glass eels?

The trade of wild-caught glass eels (elvers) carries significant risks, including extreme price volatility due to scarcity, high mortality rates during long-distance transport, and susceptibility to illegal, unreported, and unregulated (IUU) fishing. Furthermore, legal trade is heavily restricted by international conservation laws (CITES), leading to high regulatory complexity and the potential for severe penalties for non-compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Stainless Steel Flanges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Helicopter Wheel Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Seamless Stainless Steel Pipes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wheel Spacer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Clad Steel Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager