Esters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441002 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Esters Market Size

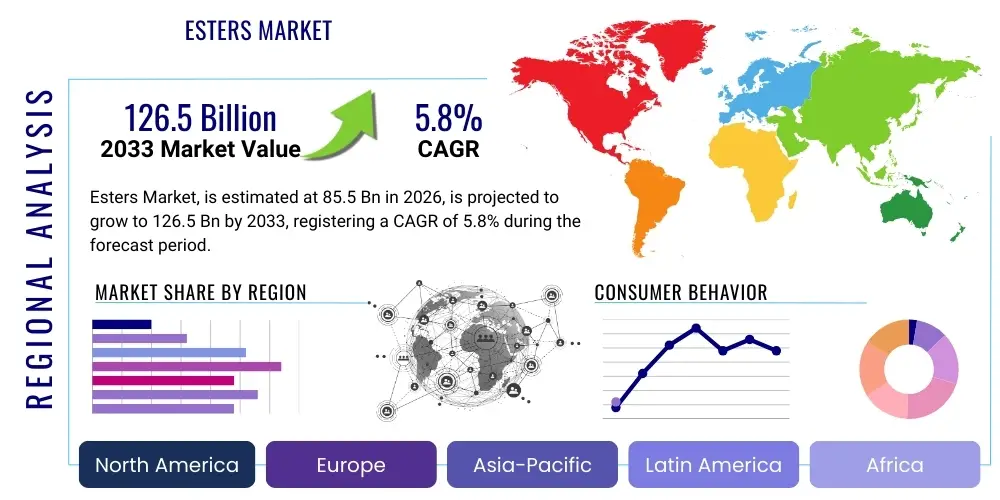

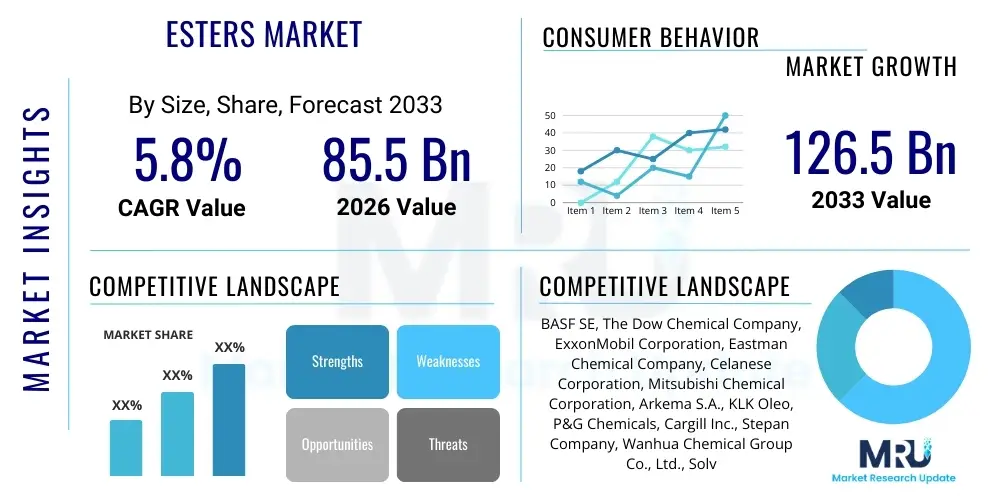

The Esters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 126.5 Billion by the end of the forecast period in 2033.

Esters Market introduction

Esters constitute a significant class of organic compounds derived typically from the reaction of an alcohol and an acid (usually carboxylic acid), forming the functional group R-COO-R'. These versatile compounds are integral to numerous industrial sectors due to their excellent solvent properties, low toxicity profile, and ability to impart desirable characteristics such as lubricity, plasticity, and unique flavor or fragrance notes. The primary driving factors for the Esters market include the escalating demand from the rapidly expanding cosmetics and personal care industry, where esters serve as emollients and emulsifiers, and the shift towards biodegradable and high-performance lubricants, particularly in the automotive and industrial machinery sectors.

The product description spans a vast array of compounds, ranging from simple short-chain esters used as flavorings (e.g., ethyl acetate, butyl acetate) to complex, long-chain fatty acid esters used in advanced polymeric applications. Major applications encompass their use as plasticizers in polymers, solvents in coatings and inks, base fluids in synthetic lubricants, flavorants and fragrances in food and beverage products, and active ingredients in high-performance cosmetic formulations. Esters offer benefits such as improved stability, better environmental compliance (especially bio-based esters), and enhanced product performance compared to traditional alternatives. The market is propelled by technological advancements in transesterification processes and the increasing regulatory pressure favoring environmentally friendly chemicals, which esters, particularly those derived from natural sources, often fulfill.

Esters Market Executive Summary

The Esters Market exhibits robust growth driven primarily by structural shifts across key end-use sectors and favorable regulatory landscapes promoting sustainable chemicals. Business trends show a distinct movement toward specialization, with companies focusing on developing niche, high-value esters such as complex polyol esters for synthetic lubricants and medium-chain triglycerides (MCTs) for the rapidly evolving nutraceutical and food industries. Merger and acquisition activities remain prevalent as large chemical conglomerates seek to vertically integrate their supply chains and acquire specialized technology portfolios related to bio-based and sustainable ester synthesis. Furthermore, the market is characterized by intense R&D investment aimed at developing non-phthalate plasticizers to replace conventional options, ensuring compliance with stringent global health and environmental standards.

Regionally, the Asia Pacific (APAC) continues to dominate market growth, primarily fueled by rapid industrial expansion in countries like China, India, and Southeast Asian nations, leading to massive consumption of esters in construction (paints/coatings), automotive production, and consumer goods manufacturing. North America and Europe, while mature, are characterized by high regulatory stringency, driving demand for premium, sustainable, and bio-based esters, particularly within the lubricants and cosmetics segments. Segmentation trends underscore the rising prominence of synthetic esters in high-performance applications like jet engine lubricants, while fatty acid esters derived from natural oils are seeing exponential growth in the personal care and biodiesel sectors due to their inherent biodegradability and renewable status. The solvents segment is specifically witnessing a pivotal shift towards safer, low-VOC (Volatile Organic Compounds) ester solvents, aligning with global environmental safety protocols.

AI Impact Analysis on Esters Market

User queries regarding AI's influence on the Esters market predominantly revolve around three critical areas: optimizing complex synthesis reactions, predicting molecular properties for specialized applications, and enhancing supply chain efficiency, particularly concerning fluctuating raw material prices (e.g., crude oil derivatives or natural oils). Users are keen to understand how machine learning models can accelerate the discovery and formulation of novel esters with specific characteristics, such as enhanced thermal stability or better skin penetration profiles. Concerns often focus on the required capital investment for implementing AI-driven laboratories and the need for highly specialized data scientists familiar with chemical processes. Expectations are high regarding AI's role in predictive maintenance within ester production facilities and optimizing energy consumption during continuous manufacturing processes, ultimately leading to cost reduction and increased purity levels.

Artificial Intelligence and machine learning are increasingly integrated into the R&D cycle of ester manufacturers. AI algorithms can swiftly screen thousands of potential acid and alcohol combinations to predict the optimal reaction pathways, yields, and final product characteristics (like viscosity or flash point), dramatically reducing the time and cost associated with traditional laboratory experimentation. Furthermore, AI-driven demand forecasting tools provide ester producers with superior visibility into fluctuating consumption patterns across diverse downstream industries, enabling optimized inventory management and mitigating risks associated with supply chain disruptions, especially for bio-based feedstock procurement.

- AI-driven optimization of transesterification and esterification reaction parameters, leading to higher yields and reduced byproducts.

- Machine learning models used for predicting the performance characteristics (e.g., rheology, biodegradability) of novel ester formulations before physical synthesis.

- Enhanced quality control through real-time AI monitoring of continuous ester production processes, ensuring consistent purity and adherence to regulatory specifications.

- Predictive maintenance schedules for processing equipment, minimizing downtime and extending the operational lifespan of synthesis reactors and distillation columns.

- Optimization of complex supply chains, specifically for managing volatile feedstock availability (e.g., palm oil, rapeseed oil, petrochemical derivatives).

- Accelerated discovery of sustainable, non-toxic ester alternatives for plasticizers and solvents through advanced computational chemistry.

DRO & Impact Forces Of Esters Market

The Esters Market is shaped by a confluence of accelerating growth drivers, significant constraining factors, and burgeoning strategic opportunities that collectively determine its trajectory. A primary driver is the pervasive use of high-performance synthetic esters as base fluids in advanced lubricants for aerospace and automotive sectors, demanding superior thermal and oxidative stability. Concurrently, the consumer goods industry's fervent shift towards natural and bio-degradable ingredients significantly boosts the demand for fatty acid esters in cosmetics and detergents. However, the market faces constraints, notably the inherent volatility and price fluctuations of essential raw materials, including crude oil derivatives for synthetic routes and natural oils (like palm or soybean oil) for bio-based production. Furthermore, rigorous global regulatory scrutiny, particularly concerning phthalate plasticizers and certain short-chain ester solvents, necessitates costly reformulation and restricts their usage in sensitive applications.

Opportunities in the market are concentrated around the innovation of novel bio-based and complex esters that can serve multiple high-value functions. The increasing investment in R&D to commercialize non-phthalate plasticizers derived from renewable sources presents a lucrative avenue. Additionally, the growing application of specialty esters in energy storage technologies, such as electrolytes in lithium-ion batteries, offers a promising growth frontier. The overall impact forces suggest a market moving towards premiumization and sustainability; while cost management remains a challenge, environmental performance and regulatory compliance are increasingly paramount determinants of market success, favoring companies capable of navigating complex sustainability requirements and offering specialized, high-performance solutions.

Segmentation Analysis

The Esters market is broadly segmented based on Type (Natural and Synthetic), Application (Solvents, Plasticizers, Lubricants, Flavors and Fragrances, Cosmetics, Surfactants, and Others), and End-Use Industry (Automotive, Food & Beverage, Consumer Goods, Packaging, and Industrial). This segmentation reflects the highly diverse chemical structures and functionalities of esters, which dictate their suitability across various industrial requirements. Analysis of these segments is crucial for understanding specific market dynamics, regional consumption patterns, and the underlying technological trends driving growth in specialized areas like bio-lubricants and non-phthalate plasticizers. The synthetic segment, historically dominant, is increasingly challenged by the rapid growth of natural/bio-based esters, particularly in regulated markets like Europe and North America, necessitating strategic diversification by major players.

- By Type:

- Natural Esters (Fatty Acid Esters, Glycerides)

- Synthetic Esters (Phthalates, Non-Phthalates, Phosphates, Complex Esters)

- By Application:

- Plasticizers

- Solvents

- Lubricants (Base Fluids)

- Flavors and Fragrances

- Cosmetics and Personal Care

- Surfactants and Detergents

- Food Additives

- By End-Use Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Consumer Goods (Personal Care, Home Care)

- Food and Beverage

- Pharmaceuticals

- Paints and Coatings

Value Chain Analysis For Esters Market

The Esters market value chain begins with the upstream sourcing of crucial raw materials, which are bifurcated into petrochemical derivatives (alcohols and acids derived from crude oil, necessary for synthetic esters) and natural oils/fats (triglycerides derived from sources like palm, soy, or rapeseed, used for fatty acid esters). Upstream stability is paramount, as volatility in global commodity markets directly impacts production costs and profitability margins for ester manufacturers. Key upstream activities include the refining and cracking of crude oil, and the specialized extraction and purification of vegetable oils. Suppliers in this phase are large integrated petrochemical firms and global agricultural commodity traders, whose pricing power significantly influences the downstream market.

The midstream phase involves the core manufacturing process, primarily esterification and transesterification reactions, where alcohols and acids are chemically reacted to produce various ester types. This phase is capital-intensive and requires high technical expertise for catalysis and purification (distillation, extraction) to meet stringent purity requirements for end-use applications like food-grade flavorings or high-performance lubricants. Manufacturers focus on optimizing process efficiency, improving energy consumption, and scaling up production for mass-market solvents and plasticizers, while simultaneously developing complex, specialty esters in smaller, dedicated plants. Competitive differentiation in the midstream often hinges on proprietary catalyst systems and continuous process optimization.

The downstream sector is characterized by specialized distribution channels and diverse end-use industries. Distribution often involves both direct sales to large, captive consumers (e.g., automotive lubricant blenders, large PVC manufacturers) and indirect sales through regional chemical distributors who handle smaller orders and manage inventory for fragmented end-users, such as small-to-medium-sized paint or cosmetics formulators. The final consumption is spread across construction, automotive, consumer goods, and food sectors. Successful penetration in the downstream market requires tailored product formulations and robust technical support to integrate esters effectively into complex end-user products, emphasizing their role as functional ingredients rather than mere commodities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 126.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, The Dow Chemical Company, ExxonMobil Corporation, Eastman Chemical Company, Celanese Corporation, Mitsubishi Chemical Corporation, Arkema S.A., KLK Oleo, P&G Chemicals, Cargill Inc., Stepan Company, Wanhua Chemical Group Co., Ltd., Solvay S.A., Huntsman Corporation, Croda International Plc, Emery Oleochemicals, Lanxess AG, DuPont, Sinopec, Shell Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Esters Market Key Technology Landscape

The technological landscape of the Esters market is defined by continuous process innovation aimed at improving efficiency, purity, and sustainability. The fundamental production methods, primarily batch and continuous esterification and transesterification, are constantly being optimized through the implementation of advanced catalytic systems. Heterogeneous catalysis, involving solid acid or metal-oxide catalysts, is gaining preference over traditional homogenous acid catalysis because it simplifies product separation, reduces corrosion, and minimizes effluent waste, thereby lowering operational costs and improving the environmental footprint. Furthermore, reactive distillation columns are being employed more frequently for high-volume ester production, allowing for simultaneous reaction and separation, which significantly enhances reaction conversion rates and throughput.

A crucial technological trend is the development of enzymatic esterification and transesterification using lipases. This technology is highly valued for the production of specialty, high-purity esters, particularly those used in pharmaceutical, food, and cosmetic applications, as it operates under mild conditions, avoids harsh chemicals, and is stereospecific, yielding high-quality products. Although enzymatic processes are generally more costly than chemical methods, their ability to produce highly specific, clean-label esters justifies the expense for premium markets. Additionally, micro-reactor technology is emerging for producing small volumes of specialty esters, offering enhanced safety, improved temperature control, and faster reaction kinetics, vital for research and development scale-up before commercial production.

Esters Market Potential Customers

The potential customers for esters are extraordinarily diverse, reflecting the functional versatility of these chemical compounds across the global manufacturing landscape. Primary end-users include major chemical formulators and compounding companies that utilize esters as essential components in their final products. For instance, large PVC manufacturers are primary buyers of plasticizers (e.g., DINP, DOTP), while global lubricant blending companies purchase synthetic polyol esters (POEs) and diesters as base stock for high-performance synthetic oils used in aircraft and heavy industrial gearboxes. The cosmetics and personal care industry represents a high-growth customer segment, where multinational corporations purchase fatty acid esters (like isopropyl myristate or capric/caprylic triglycerides) for their emollient, thickening, and solvent properties in creams, lotions, and color cosmetics.

Furthermore, the food and beverage industry constitutes a significant customer base, relying heavily on simple, short-chain esters (e.g., ethyl butyrate, isoamyl acetate) as artificial and natural flavor compounds to mimic fruit flavors in confectionery, beverages, and processed foods. The paints, coatings, and adhesives sectors are also major consumers, utilizing ester solvents like ethyl acetate and butyl acetate for their effective solvency and controlled evaporation rates. These buyers prioritize product consistency, reliable supply, and compliance with specific regulatory standards (e.g., food safety, VOC limits, REACH compliance), making long-term strategic relationships with reliable ester suppliers essential for their operational integrity.

Detailed Segmentation Analysis: By Application

Esters in Plasticizers Segment

Esters dominate the plasticizers market, acting as essential additives that increase the plasticity or fluidity of a material, most notably polymers like Polyvinyl Chloride (PVC). They achieve this by embedding themselves between polymer chains, reducing the attractive forces between them, which in turn lowers the glass transition temperature and makes the plastic softer and more flexible. Historically, phthalate esters (such as Dioctyl Phthalate or DOP) formed the cornerstone of this application due to their cost-effectiveness and excellent performance characteristics. However, increasing global regulatory pressure and health concerns regarding phthalates, particularly in children's products and medical devices, have spurred a massive shift toward non-phthalate alternatives.

The market is now intensely focused on developing and commercializing safer alternatives, including benzoate esters, citrate esters, and particularly terephthalate esters (like Dioctyl Terephthalate or DOTP), which offer comparable performance with significantly reduced toxicological profiles. This segment's growth is inherently tied to the construction, automotive, and wire and cable industries, where flexible plastics are indispensable. Suppliers must invest heavily in toxicology testing and achieve complex regional certifications (e.g., EU REACH, US EPA) to ensure market viability. The increasing demand for flexible materials in electric vehicle battery components further drives the need for highly specialized, heat-resistant ester plasticizers.

- Primary function: Enhancing flexibility, durability, and processability in PVC and other polymers.

- Dominant Type Shift: Transition from traditional phthalates (DOP, DINP) to non-phthalate esters (DOTP, adipates, citrates).

- Key End-Uses: Flooring, roofing membranes, wire and cable sheathing, automotive interiors, and medical devices.

- Regulatory Influence: Strict regulations in North America and Europe mandate the adoption of bio-based and non-toxic plasticizer alternatives.

Esters in Solvents Segment

Esters are highly valued as industrial solvents due to their effective solvency power for resins, polymers, and lacquers, coupled with favorable evaporation rates and relatively low toxicity compared to many hydrocarbon solvents. Short-chain esters like ethyl acetate (EA) and butyl acetate (BA) are staple solvents in the coatings, inks, and adhesives industries. Ethyl acetate, for instance, is a preferred solvent in the packaging industry for flexible laminates and printing inks, owing to its rapid drying time and low residual odor, which is critical for food contact materials.

Market growth in this segment is strongly influenced by environmental regulations targeting VOC emissions. As governments worldwide enforce stricter air quality standards, there is a sustained push away from high-VOC aromatic solvents toward medium-VOC ester solvents and, increasingly, toward bio-based esters (e.g., ethyl lactate) that are classified as safer alternatives. Manufacturers are focused on developing specialty ester blends that maintain high performance while adhering to stringent environmental guidelines. The electronics sector also utilizes high-purity ester solvents for cleaning and degreasing sensitive components, demanding exceptionally low residue specifications.

- Primary function: Dissolving resins and polymers in coatings, inks, adhesives, and cleaning formulations.

- Common Types: Ethyl Acetate, Butyl Acetate, Propyl Acetate, Dibasic Esters (DBE).

- Market Trend: Strong movement toward bio-based and low-VOC ester solvents to meet environmental compliance.

- Major Consumers: Printing industry (flexographic and rotogravure inks), Paints and Coatings, Pharmaceutical manufacturing.

Esters in Lubricants Segment (Base Fluids)

Synthetic esters represent one of the highest-value application segments for the Esters market, primarily utilized as high-performance base fluids in synthetic lubricants. Esters, particularly polyol esters (POEs), diesters, and complex esters, offer superior properties that mineral oils cannot match, including excellent thermal stability, high viscosity index, low volatility, good boundary lubrication capability, and inherent biodegradability. These characteristics make them essential for extreme operating conditions found in aerospace, refrigeration, and specialized industrial machinery.

The aerospace industry relies heavily on POEs for jet engine oils due to their ability to maintain viscosity and oxidative stability at extreme temperatures and pressures. Similarly, the growing demand for energy-efficient HFO (hydrofluoroolefin) refrigerants drives the market for specialty POE lubricants in air conditioning and refrigeration systems, as esters are uniquely compatible with these novel refrigerants. Furthermore, bio-based esters are increasingly used in environmentally sensitive applications, such as marine and agricultural lubricants, offering high performance combined with reduced ecological impact in case of leaks or spills, significantly capitalizing on the green chemistry trend.

- Primary function: Serving as base fluids for high-performance synthetic lubricants and metalworking fluids.

- Key Types: Polyol Esters (POEs), Diesters, Complex Esters, Trimellitates.

- High-Value Applications: Aviation lubricants, automotive synthetic engine oils, refrigeration compressor oils, and biodegradable hydraulic fluids.

- Driving Factor: Need for superior thermal and oxidative stability in demanding, high-temperature environments.

Esters in Cosmetics and Personal Care Segment

The cosmetics and personal care segment is a major driver of the Esters market, where these compounds function primarily as emollients, thickeners, conditioning agents, and specialized solvents. Fatty acid esters derived from natural sources, such as Medium-Chain Triglycerides (MCTs) and isopropyl myristate (IPM), are highly favored for their excellent skin feel, low irritation potential, and superb spreadability, making them crucial components in moisturizers, sunscreens, and decorative cosmetics.

Esters enhance the texture and stability of cosmetic formulations, providing a non-greasy or light sensory feel, which is highly desired by consumers. The segment is witnessing tremendous growth driven by the 'clean beauty' movement, which favors naturally derived and sustainably sourced ingredients. Companies are continually developing novel, multifunctional esters that can serve as both emollients and emulsifying agents, simplifying formulations and enhancing product appeal. Strict adherence to safety standards and INCI naming conventions is critical for market success in this highly sensitive consumer sector.

- Primary function: Emolliency, solvent properties, skin conditioning, and texture modification.

- Key Types: Caprylic/Capric Triglycerides (MCTs), Isopropyl Palmitate (IPP), Jojoba Esters, Glyceryl Stearate.

- Growth Driver: Consumer demand for natural, biodegradable, and silicone-free alternatives in skin care and hair care.

- Market Characteristic: High R&D focus on achieving specific sensory attributes and stability requirements.

Esters in Flavors and Fragrances Segment

Esters are indispensable in the flavors and fragrances industry because they are responsible for many of the distinct, pleasant odors and tastes found in nature. Short-chain aliphatic esters are often utilized to mimic fruit flavors (e.g., ethyl butyrate smells like pineapple, isoamyl acetate like banana) in food, beverages, and confectioneries. In the fragrance sector, complex esters are foundational components in perfume formulation, acting as fixatives or contributing specific notes that blend well with essential oils.

Regulatory scrutiny is high in this segment, particularly regarding the classification of esters as "natural" or "artificial" flavors, which affects labeling and consumer perception. The food industry seeks high-purity, food-grade esters that comply with international flavor regulations (e.g., FEMA, EFSA). The trend is moving towards utilizing biotechnological methods, such as fermentation, to produce "natural identical" esters, which are chemically identical to those found in nature but manufactured more sustainably, satisfying the clean label consumer demand.

- Primary function: Imparting specific fruity, floral, or sweet notes in food, beverages, and perfumes.

- Examples: Ethyl Acetate (fruity), Benzyl Acetate (jasmine), Methyl Salicylate (wintergreen).

- Regulatory Requirement: Strict compliance with global food safety and flavor additive standards.

- Innovation Focus: Development of natural identical esters via bio-fermentation processes.

Detailed Segmentation Analysis: By Type

Natural Esters Segment

Natural esters encompass those derived from renewable resources, primarily vegetable oils (e.g., palm, coconut, soy) and animal fats, through processes like transesterification. The resultant products, known predominantly as Fatty Acid Methyl Esters (FAME) and various glycerides (mono-, di-, and triglycerides), are highly valued for their biodegradability, low toxicity, and environmental profile. This segment is robustly driven by the global push for sustainability, particularly in the production of biodiesel (where FAME is the primary component) and in the consumer goods market.

The cosmetic and pharmaceutical industries heavily rely on refined natural esters, such as MCTs, for their excellent compatibility with human skin and use as pharmaceutical excipients. Growth is dependent on the stable supply of agricultural feedstock and advancements in purification technologies that ensure the final product meets stringent quality standards. While natural esters face challenges related to potential supply chain volatility (e.g., climate impact on harvests) and sometimes lower oxidative stability compared to fully synthetic counterparts, their inherent eco-friendliness provides a powerful competitive advantage in regulatory-heavy regions.

- Source Material: Vegetable oils (palm, soy, rapeseed) and animal fats.

- Key Products: Fatty Acid Methyl Esters (FAME), Medium-Chain Triglycerides (MCTs), Glyceryl Esters.

- Primary Drivers: Biodiesel production and the cosmetics industry's shift toward natural ingredients.

- Market Challenge: Susceptibility to price fluctuations in agricultural commodity markets.

Synthetic Esters Segment

Synthetic esters are chemically engineered compounds derived primarily from petrochemical feedstocks, offering superior performance attributes tailored for highly demanding industrial applications. This category includes complex polyol esters (POEs), diesters (adipates, sebacates), and specialized ortho-phthalates or their non-phthalate replacements. Synthetic esters are characterized by their customized molecular structure, which allows manufacturers to precisely control properties such as viscosity index, thermal stability, oxidation resistance, and solvency power.

The premium end of the market, including aerospace lubricants, fire-resistant hydraulic fluids, and specialty plasticizers, is dominated by synthetic esters due to their unmatchable performance under extreme operational parameters. While synthetic esters generally command higher prices than mineral oil derivatives, their extended service life and superior protective qualities justify the investment for critical equipment. The primary focus of R&D in this segment is the development of next-generation, high-performance, non-toxic alternatives to traditional chemicals, ensuring market continuity despite evolving environmental legislation.

- Source Material: Petrochemical derivatives (synthetic acids and alcohols).

- Key Products: Polyol Esters (POEs), Adipate Esters, Benzoate Esters, Trimellitates, DOTP.

- Application Focus: High-performance lubricants, non-phthalate plasticizers, and flame retardants.

- Competitive Edge: Superior thermal and oxidative stability, customizable molecular design.

Detailed Segmentation Analysis: By End-Use Industry

Automotive and Transportation Industry

The automotive sector is a critical consumer of esters, utilizing them extensively in synthetic engine oils, gear oils, brake fluids, and transmission fluids, as well as in plastic components within the vehicle structure. In lubrication, synthetic esters provide the necessary thermal stability and reduced friction essential for modern, downsized, high-efficiency engines operating at high temperatures. The shift toward electric vehicles (EVs) introduces new demands for specialty esters known as E-fluids (electric vehicle transmission fluids and battery coolants), which must offer both lubrication and electrical insulation properties.

Furthermore, ester plasticizers are crucial for improving the flexibility and appearance of interior components such as dashboards, door panels, and vinyl seating, while meeting strict automotive volatile organic compound (VOC) standards. The increasing stringency of fuel efficiency and emissions regulations globally compels automotive manufacturers to prioritize high-quality synthetic lubricants containing specialty esters, ensuring long-term engine performance and minimizing environmental impact. Esters are also used in adhesives and sealants required for vehicle assembly.

- Primary Use: Synthetic engine and gear oils, specialty E-fluids, plasticizers for interiors.

- Key Requirement: Exceptional thermal resistance, high viscosity index, and low-temperature performance.

- Market Trend: Increased demand driven by the growth of electric vehicle technology and the need for E-fluids.

- Regulatory Impact: Strict mandates on automotive VOC emissions require the use of low-volatility ester solvents and plasticizers.

Construction and Infrastructure Industry

Esters play a vital supporting role in the construction and infrastructure sectors, primarily through their application in paints and coatings, adhesives, sealants, and flexible construction materials like PVC piping and roofing membranes. Ester solvents (e.g., butyl acetate, propylene glycol methyl ether acetate) are fundamental components in coatings formulations, controlling the viscosity, drying time, and finish quality of architectural and protective coatings applied to structural steel, wood, and concrete.

The segment's growth is directly linked to global infrastructure spending and construction activity, particularly in rapidly urbanizing regions like APAC. Crucially, the industry's increasing focus on sustainability and worker safety drives demand for high-solvency, low-VOC ester solvents and safer, non-phthalate plasticizers for use in PVC products like wires, cables, and flexible ducting. This reliance ensures that ester manufacturers must comply with regional environmental standards, such as those governing interior air quality in new buildings.

- Primary Use: Solvents for industrial and architectural paints/coatings, plasticizers for PVC roofing and wiring.

- Key Products: Acetate esters (BA, EA), Dibasic Esters (DBE), DOTP plasticizers.

- Driving Force: Global increase in residential and commercial construction projects, particularly in developing economies.

- Compliance Focus: Adherence to strict environmental regulations regarding VOC content in building materials.

Food and Beverage Industry

In the Food and Beverage (F&B) sector, esters are utilized almost exclusively as high-purity flavorings, crucial for enhancing or replicating specific natural flavors in processed foods, confectionery, and beverages. Due to their low concentration but high impact, these flavor esters (like ethyl butyrate, often synthesized for consistency and cost) must meet the most stringent regulatory standards globally, including those set by the FDA and EFSA, ensuring they are classified as food-grade and safe for consumption.

The demand for specific esters is dictated by consumer trends, such as the preference for natural or clean-label ingredients, which favors naturally derived esters or those produced through fermentation processes (natural identical). Beyond flavor, medium-chain triglycerides (MCTs) derived from coconut oil are increasingly used as specialized functional food ingredients, particularly in the health and wellness sector (e.g., supplements, ketogenic products) due to their unique metabolic properties. Ester compounds are also used in food packaging adhesives and coatings, where low migration and high purity are essential.

- Primary Use: Flavoring agents (synthetic and natural identical), functional ingredients (MCTs), and packaging components.

- Key Requirement: Extremely high purity, compliance with food safety regulations (e.g., kosher, halal, food-grade certifications).

- Growth Area: Functional foods, supplements, and clean-label flavor replication.

- Critical Factor: Maintaining consistency and sensory profile under long shelf-life conditions.

Regional Highlights

The Esters Market exhibits significant regional variations influenced by industrial maturity, regulatory frameworks, and demographic trends. Asia Pacific (APAC) currently holds the dominant market share and is projected to demonstrate the fastest growth rate over the forecast period. This growth is underpinned by massive urbanization, rapidly expanding manufacturing bases in China, India, and Southeast Asia (particularly automotive, electronics, and construction), and the resultant high consumption of solvents, plasticizers, and protective coatings. While environmental regulations are tightening in key APAC nations, the sheer scale of industrial output ensures sustained volume growth, although there is a notable demand surge for locally produced sustainable ester alternatives.

North America and Europe represent mature yet highly valuable markets, characterized by stringent environmental and health regulations (e.g., REACH in Europe) that accelerate the transition from commodity esters (like traditional phthalates) to high-performance, specialty, and bio-based esters. These regions are the global leaders in the consumption of premium synthetic esters for aerospace and specialized industrial lubricants, and they drive innovation in the cosmetic and bio-fuel sectors. Regulatory compliance and a strong consumer preference for sustainability are the primary market shapers in these regions, making product differentiation and certified eco-labels crucial competitive advantages.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets that offer substantial growth potential. LATAM's growth is tied to developing automotive and construction sectors, particularly in Brazil and Mexico, creating steady demand for commodity solvents and plasticizers. The MEA region, heavily reliant on its petrochemical industry, is investing in downstream chemical diversification, positioning itself as a growing consumer and producer of specialty chemicals, including esters used in oil and gas production (as drilling fluid components) and localized personal care product manufacturing.

- Asia Pacific (APAC): Dominates the market in terms of volume and growth rate; driven by construction, automotive manufacturing, and consumer goods production in China and India.

- North America: High-value market focused on premium synthetic lubricants (aerospace), non-phthalate plasticizers, and rapid adoption of advanced bio-based cosmetic esters.

- Europe: Regulatory leader (REACH compliance); strong demand for environmentally friendly ester solvents, fatty acid esters for biodiesel, and high-quality cosmetics ingredients.

- Latin America (LATAM): Emerging market driven by regional manufacturing expansion and moderate growth in the construction and paints & coatings industries.

- Middle East and Africa (MEA): Growth tied to downstream petrochemical investments and increasing consumption in localized consumer product and specialty oil and gas sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Esters Market.- BASF SE

- The Dow Chemical Company

- ExxonMobil Corporation

- Eastman Chemical Company

- Celanese Corporation

- Mitsubishi Chemical Corporation

- Arkema S.A.

- KLK Oleo

- P&G Chemicals

- Cargill Inc.

- Stepan Company

- Wanhua Chemical Group Co., Ltd.

- Solvay S.A.

- Huntsman Corporation

- Croda International Plc

- Emery Oleochemicals

- Lanxess AG

- DuPont

- Sinopec

- Shell Chemicals

Frequently Asked Questions

Analyze common user questions about the Esters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of specialty esters in modern industry?

Specialty esters are primarily used as high-performance base fluids in synthetic lubricants for aerospace and automotive sectors, as non-phthalate plasticizers in regulatory-sensitive products (e.g., medical devices), and as high-purity emollients in advanced cosmetic formulations.

How is the market shifting due to environmental regulations?

Environmental regulations, particularly regarding VOC emissions and substance toxicity (e.g., phthalates), are forcing a significant market shift toward bio-based esters, low-VOC ester solvents (like ethyl lactate), and high-performance, non-toxic alternatives (like DOTP and citrate esters).

Which geographical region exhibits the highest growth potential for esters?

The Asia Pacific (APAC) region is projected to show the fastest market growth, driven by rapid industrialization, large-scale infrastructure projects, and expanding consumer goods manufacturing bases across China, India, and Southeast Asia.

What is the main difference between natural and synthetic esters in terms of application?

Natural esters (fatty acid derivatives) are favored for applications prioritizing biodegradability, low toxicity, and renewable sourcing (e.g., biodiesel, cosmetics). Synthetic esters are chosen for superior technical performance, such as high thermal stability and predictable viscosity in extreme-condition applications like jet engine lubrication.

What challenges does the Esters market face regarding raw material supply?

The market faces significant challenges due to the volatility and price fluctuations of essential feedstocks, including crude oil derivatives (for synthetic routes) and agricultural commodities like palm and soybean oil (for natural esters), impacting production costs and supply chain stability globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cane Harvesters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Almond Harvesters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Polyoxyethylene Sorbitan Fatty Acid Esters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Pitot Static Testers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Leak Testers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager