Sausage Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442864 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Sausage Market Size

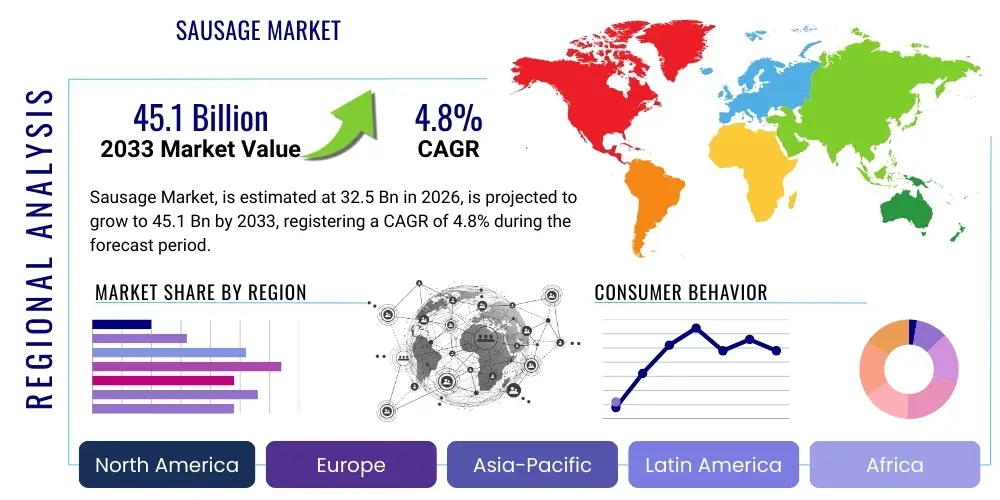

The Sausage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 32.5 Billion in 2026 and is projected to reach USD 45.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising global demand for protein-rich, convenient food options that align with modern consumer lifestyles characterized by reduced time for meal preparation. The market valuation reflects sustained innovation in product offerings, including healthier formulations, plant-based alternatives, and the incorporation of ethnic and gourmet flavors, which appeal to a broader demographic spectrum beyond traditional meat consumers.

Market expansion is also supported by advanced cold chain infrastructure development across emerging economies, which ensures the integrity and shelf life of perishable sausage products from production facility to retail shelf. Furthermore, strategic investments by major food processing companies in automation and high-speed production lines are enhancing efficiency and reducing operational costs, contributing positively to overall market growth metrics. The shift toward packaged and processed meat products, away from fresh butchery, particularly in urbanization centers, provides a robust foundation for consistent revenue generation throughout the forecast period.

Sausage Market introduction

The Sausage Market encompasses a diverse range of processed meat products prepared from ground meat, fat, and seasonings, often enclosed in a casing (natural or synthetic). Key product categories include fresh sausages (e.g., Italian sausage, breakfast links), smoked and dried sausages (e.g., salami, pepperoni), and cooked sausages (e.g., hot dogs, bologna). Major applications span across retail consumption (supermarkets, convenience stores), food service channels (restaurants, quick-service restaurants, hotels), and institutional feeding. The primary benefit derived by consumers is the unparalleled convenience, high protein content, versatility in cooking, and the rich, satisfying flavor profile offered by these products, making them staples in numerous global cuisines.

Market growth is significantly influenced by several key driving factors. Firstly, the escalating global population coupled with increasing disposable income, particularly in Asia Pacific, drives higher per capita consumption of processed protein products. Secondly, the accelerating pace of urbanization leads to a greater reliance on ready-to-eat and easy-to-prepare meal solutions, perfectly positioning sausages as an ideal choice. Thirdly, continuous innovation in the ingredient matrix—including reduced sodium content, use of clean label ingredients, and the introduction of specialty meat sources (like poultry or venison)—maintains consumer interest and addresses evolving health consciousness. The integration of high-quality, traceable sourcing is becoming a competitive necessity, further standardizing quality across the industry.

Moreover, the increasing demand for culturally diverse and authentic food experiences globally fuels the adoption of various regional sausage specialties, such as bratwurst in Europe or chorizo in Latin America, within new geographic markets. Marketing efforts focusing on product convenience, coupled with extended shelf life capabilities provided by modern packaging technologies, enhance market penetration across all retail formats. The synergy between traditional meat processors and emerging manufacturers focused on plant-based analogues ensures that the sausage market remains dynamic and responsive to contemporary dietary shifts, maintaining its trajectory of sustainable growth throughout the analysis period.

Sausage Market Executive Summary

The Sausage Market Executive Summary highlights robust business trends characterized by the dual pursuit of convenience and health, driving innovation across product formulation and packaging. Globally, the industry is witnessing a distinct surge in premiumization, where consumers are willing to pay more for products featuring higher-quality ingredients, artisanal preparation methods, and clear traceability back to ethical or sustainable farms. Key players are focusing heavily on mergers and acquisitions to expand their geographical footprint and diversify their product portfolios, especially integrating successful plant-based alternatives to capture the growing flexitarian demographic. Operational efficiency remains a core strategic objective, achieved through significant investment in advanced food processing automation and predictive supply chain analytics to minimize waste and optimize inventory management.

Regionally, Europe continues to dominate the market in terms of value, supported by deep-rooted traditions of sausage consumption and highly developed retail networks, although the Asia Pacific (APAC) region exhibits the highest projected growth rate (CAGR). This APAC acceleration is largely attributed to rapid economic development, increasing Westernization of diets, and substantial expansion of cold chain logistics necessary for distributing chilled and frozen products. North America showcases strong innovation in the frozen and pre-cooked segments, catering specifically to time-pressed consumers, while also leading the global shift toward cleaner labels and non-GMO verified inputs. Regulatory environments across all major regions are intensifying regarding food safety and labeling transparency, requiring manufacturers to invest continuously in compliance technologies and rigorous quality assurance protocols.

Segmentation analysis reveals that the processed and cooked segment holds the largest market share due to its extended shelf life and immediate usability, appealing greatly to both food service operators and home cooks. However, the market for fresh and chilled sausages is experiencing significant incremental growth, favored by consumers seeking perceived freshness and customization during meal preparation. Based on casing material, natural casings, while representing a smaller volume, command a higher price point due to perceived quality and traditional appeal, whereas synthetic collagen and cellulose casings dominate the mass-market volume due to cost-effectiveness and uniformity. The poultry-based sausage segment is emerging as a critical growth driver, primarily due to prevailing consumer preferences for leaner protein options over traditional pork and beef products, particularly within health-conscious markets.

AI Impact Analysis on Sausage Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Sausage Market reveals several core themes centered around efficiency, quality, safety, and personalization. Users frequently inquire about how AI can enhance the consistency of flavor profiles and texture (a critical challenge in processed meats), how predictive analytics might reduce raw material waste and optimize inventory, and the potential for AI-driven vision systems to ensure stringent quality control across high-volume production lines. There is significant interest in AI's role in tracing ingredients back to the source (improving transparency and managing recall risks) and whether AI-powered demand forecasting can accurately predict fluctuating consumer preferences, especially concerning niche dietary requirements like gluten-free or low-sodium options. Users are also keen to understand how automation, guided by AI, will affect labor requirements and operational throughput in traditional processing facilities.

The application of AI algorithms is fundamentally reshaping operational strategies within the sausage production cycle, moving beyond simple automation to sophisticated decision support systems. In raw material management, AI leverages sensor data and historical performance metrics to optimize the blending of fat and lean meat ratios, critical for achieving desired product specifications consistently, which historically relied heavily on subjective human expertise. Furthermore, AI-driven maintenance predictive scheduling minimizes unplanned downtime of expensive high-speed linking and filling machinery, significantly boosting overall equipment effectiveness (OEE). This focus on precision and uptime directly translates into lower production costs and enhanced market competitiveness for companies adopting these advanced solutions.

Looking forward, the influence of Generative AI is expected to revolutionize product development and marketing. AI models can simulate thousands of flavor combinations and ingredient interactions based on current market trends and sensory data, speeding up the R&D cycle for new sausage varieties. On the consumer-facing side, AI is enabling hyper-personalized marketing campaigns and optimizing e-commerce platforms to suggest tailored sausage products based on individual purchase history and stated dietary goals. Ultimately, AI serves as an indispensable tool for achieving the dual objectives of maximizing operational yield while simultaneously delivering unprecedented levels of product safety, consistency, and alignment with complex consumer demand patterns.

- AI-powered vision systems for automated foreign material detection and quality grading based on color, size, and shape consistency.

- Predictive maintenance analytics optimizing the performance and lifespan of high-throughput emulsifiers and stuffing machines.

- Machine learning algorithms optimizing meat blending ratios and ingredient costs based on real-time commodity pricing fluctuations.

- Advanced supply chain visibility and traceability using AI to monitor temperature and humidity throughout the cold chain logistics.

- AI-driven demand forecasting improving inventory accuracy, reducing spoilage, and optimizing stock levels at retail distribution centers.

- Generative AI assisting in rapid flavor profile creation and recipe modification tailored to specific regional or demographic tastes.

DRO & Impact Forces Of Sausage Market

The dynamics of the Sausage Market are governed by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its trajectory. A primary driver is the accelerating consumer preference for convenience foods due to busy schedules and smaller household sizes globally, making ready-to-eat sausage products highly desirable. Coupled with this, the continuous expansion of the organized retail sector (supermarkets and hypermarkets) in developing nations significantly improves product accessibility and visibility. However, the market faces significant restraints, chiefly heightened consumer awareness regarding the potential health risks associated with high consumption of processed meats, leading to concerns over sodium, fat, and nitrate content. Furthermore, the volatility and rising cost of essential raw materials, particularly pork and beef commodities, directly impact profit margins and necessitate continuous cost-optimization strategies for manufacturers, influencing pricing stability.

Opportunities for growth are predominantly centered on product diversification and market penetration into untapped regions. The increasing demand for cleaner, healthier, and specialty sausage offerings—including organic, preservative-free, low-sodium, and premium exotic meat variants—opens lucrative niches. The rapid growth of the plant-based meat alternative segment presents a dual opportunity: for existing meat processors to diversify their offerings and for new entrants to capture consumers seeking sustainable or ethical protein sources. Export opportunities, facilitated by improving global trade relations and cold chain standards, allow established manufacturers to introduce regional specialties into international markets, thereby scaling production volumes and enhancing brand recognition.

Impact forces on the market are profound and include stringent governmental regulations concerning meat processing hygiene, labeling standards, and sustainable sourcing mandates, which require significant operational investment. Societal shifts towards environmental consciousness necessitate that manufacturers adopt sustainable packaging solutions and demonstrate reduced carbon footprints, influencing consumer purchasing decisions. Technological advancements in packaging (e.g., Modified Atmosphere Packaging (MAP) and vacuum skin packaging) are critical impact forces extending shelf life and maintaining product quality, essential for effective global distribution. The cumulative effect of these forces demands continuous adaptation, strategic innovation in product development, and proactive engagement with regulatory bodies to ensure long-term market viability and sustained profitability within the competitive food sector.

Segmentation Analysis

The Sausage Market is intricately segmented based on meat type, product type, casing, distribution channel, and geography, allowing for precise market analysis and tailored strategic targeting. Understanding these segmentation variables is essential as they directly reflect shifting consumer preferences and the varying operational requirements across the food industry value chain. The dominance of traditional meat sources like pork and beef continues, yet poultry and specialty meats are gaining significant traction due to health perceptions. Product segmentation differentiates between perishable fresh products and shelf-stable processed varieties, directly influencing logistics and retail strategy. Distribution channel segmentation highlights the ongoing power struggle between traditional retail and the rapidly expanding e-commerce sector, which requires specialized cold chain fulfillment capabilities.

Furthermore, segmentation by casing type—natural vs. artificial (collagen, cellulose)—impacts both the production cost and the final texture and consumer experience, catering to different price points and quality expectations. Geographically, mature markets like North America and Europe prioritize premiumization and clean labels, while developing markets in Asia Pacific focus primarily on volume, affordability, and improved accessibility. Manufacturers leverage this detailed segmentation data to optimize resource allocation, launch geographically relevant products, and achieve high market saturation by addressing specific unmet consumer needs within each categorized sub-market. This structured approach to market segmentation drives targeted marketing campaigns and efficient distribution network design.

- By Meat Type:

- Pork Sausage

- Beef Sausage

- Poultry Sausage (Chicken, Turkey)

- Lamb/Mutton Sausage

- Specialty Meat Sausage (Game, Veal)

- By Product Type:

- Fresh Sausages (Raw, Uncured)

- Pre-Cooked/Cooked Sausages (Hot Dogs, Bologna, Frankfurter)

- Dried/Cured Sausages (Salami, Pepperoni, Chorizo)

- Frozen Sausages

- By Casing Type:

- Natural Casings (Intestine-based)

- Artificial Casings (Collagen, Cellulose, Fibrous)

- By Distribution Channel:

- Retail (Supermarkets/Hypermarkets, Convenience Stores, Butcher Shops)

- Food Service (Hotels, Restaurants, Cafes, Institutional)

- E-commerce/Online Retail

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (South Africa, GCC Countries, Rest of MEA)

Value Chain Analysis For Sausage Market

The Value Chain for the Sausage Market is a highly integrated system spanning sourcing, processing, distribution, and final sale, heavily reliant on stringent cold chain management at every step. The upstream segment involves the procurement of high-quality raw meat (pork, beef, poultry), fat, and essential ingredients like seasonings, spices, and casings. Strategic supplier relationships, often involving long-term contracts with livestock farmers and rendering facilities, are critical for ensuring stable quality and managing price volatility in meat commodities. Furthermore, the sourcing of certified natural or advanced synthetic casings is a specialized upstream activity, impacting product differentiation and cost structure. Efficiency in this phase focuses on rapid handling and standardized inspection protocols to maintain ingredient integrity before entering the processing stage.

The processing segment forms the core of the value chain, involving complex operations such as grinding, emulsifying, blending with spices, stuffing into casings, and subsequent cooking, curing, or smoking processes. This stage is capital-intensive, requiring advanced machinery for high-speed automated production and rigorous quality control measures, including microbial testing and fat analysis. Downstream, the distribution channel is bifurcated into direct and indirect routes. Direct distribution involves manufacturers supplying large institutional clients or maintaining proprietary retail outlets. Indirect distribution, which constitutes the majority of sales, utilizes third-party logistics (3PL) providers specialized in refrigerated transport to move products efficiently to retail distribution centers (supermarkets, hypermarkets) and food service distributors.

The distribution network relies heavily on efficient cold chain logistics to prevent spoilage and maintain product safety, a non-negotiable requirement for perishable processed meats. The final point of sale involves both traditional physical retail formats, which emphasize visibility and in-store promotions, and the burgeoning e-commerce channel, demanding specialized chilled home delivery services. Direct distribution channels often offer manufacturers higher control over pricing and brand presentation, while indirect channels provide unparalleled market reach and volume capabilities. Optimization across the entire value chain involves adopting digital tracking technologies, minimizing waste at the processing level, and establishing robust, real-time inventory synchronization between production and retail demands to maximize shelf life utilization.

Sausage Market Potential Customers

Potential customers for the Sausage Market are diverse, encompassing institutional buyers, commercial food service operators, and individual consumers, segmented by their consumption patterns and purchasing drivers. Business-to-Consumer (B2C) customers, including households and individual shoppers, constitute the largest end-user segment. Their purchasing decisions are primarily influenced by factors such as convenience, price sensitivity, brand loyalty, and increasingly, dietary alignment (e.g., preference for low-fat, high-protein, or plant-based options). Convenience-seeking families frequently purchase pre-cooked and frozen sausages for quick meals, while gourmet consumers might seek out artisanal, fresh, or specialty cured products through independent butcher shops or high-end retailers. Seasonal consumption also drives purchasing, particularly around major holidays or grilling seasons.

The Business-to-Business (B2B) customer segment comprises the vast food service industry, including Quick Service Restaurants (QSRs), full-service restaurants, hotels, catering companies, and institutional entities like schools, hospitals, and corporate cafeterias. These customers demand bulk quantities, consistent quality, precise specifications (e.g., size, weight, fat content), and reliable delivery schedules. QSRs, for instance, are high-volume users of standardized sausage products (e.g., hot dogs and breakfast links) where consistency is paramount for maintaining brand identity across multiple locations. Institutional buyers prioritize cost-effectiveness and strict adherence to nutritional guidelines and food safety certification standards, often relying on long-term supply contracts with major processors.

Retailers themselves also serve as significant customers, procuring sausages to stock their shelves and drive foot traffic. Large supermarkets and hypermarkets require a wide variety of SKUs, including private label offerings, and expect robust cold chain management and promotional support from manufacturers. E-commerce platforms, though acting as a distribution channel, are increasingly seen as strategic customers requiring tailored packaging solutions and integration with complex digital inventory systems. Targeting potential customers effectively requires processors to segment their offerings—standardized, cost-effective products for institutional use, and premium, highly differentiated products for affluent B2C demographics—ensuring maximum market penetration across all viable consumption points.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 32.5 Billion |

| Market Forecast in 2033 | USD 45.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tyson Foods Inc., Hormel Foods Corporation, JBS S.A., WH Group Limited (Smithfield Foods), Nestlé S.A. (Herta), Conagra Brands Inc., The Kraft Heinz Company, Johnsonville Sausage LLC, Oscar Mayer, Cherkizovo Group, Premium Brands Holdings Corporation, Vion Food Group, Pilgrim's Pride Corporation, Hillshire Brands, Beyond Meat (Plant-based focus), Impossible Foods (Plant-based focus), BRF S.A., General Mills Inc. (Meat Snacks), Clemens Food Group, Pini Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sausage Market Key Technology Landscape

The Sausage Market relies heavily on sophisticated processing and preservation technologies to ensure high volume throughput, product consistency, and extended shelf life, essential for global distribution. Central to the modern manufacturing process is advanced automated stuffing and linking machinery, often utilizing servo-driven systems, which enable incredibly precise weight control and high-speed production (thousands of links per minute). This technology minimizes giveaway weight and maximizes operational efficiency. Furthermore, High-Pressure Processing (HPP) has emerged as a crucial non-thermal preservation technique, significantly extending the shelf life of fresh and cooked sausages without relying on chemical preservatives, directly addressing consumer demand for clean-label products while enhancing food safety profiles.

In terms of packaging, Modified Atmosphere Packaging (MAP) remains a foundational technology, utilizing precise gas mixtures (e.g., nitrogen and carbon dioxide) to inhibit microbial growth and maintain the fresh color and texture of raw or semi-processed sausages. Beyond MAP, vacuum skin packaging (VSP) technology is gaining prominence, particularly for premium and artisanal sausage products, offering a tighter seal that conforms to the product shape, thereby reducing purge and improving visual appeal in the retail case. These advanced packaging methods are non-negotiable for manufacturers aiming for international export or distribution across vast geographical distances where extended transit times are common, requiring robust protection against physical and microbiological degradation.

Furthermore, digital technologies are integrating seamlessly into the processing environment. Automated visual inspection systems utilizing high-resolution cameras and AI are deployed for continuous, objective quality control, verifying casing integrity, seasoning distribution, and link size uniformity far beyond human capability. Traceability technology, often incorporating blockchain solutions, is increasingly utilized to track raw meat origin, processing parameters, and cold chain conditions in real-time. This technological investment addresses the critical consumer and regulatory need for transparency and rapid recall management, elevating the entire market's safety standards and ensuring compliance with increasingly complex global food safety frameworks.

Regional Highlights

The global Sausage Market exhibits significant regional variation in terms of consumption habits, product preferences, and growth trajectories. Europe, historically the birthplace of numerous sausage varieties (e.g., German bratwurst, Spanish chorizo), remains the largest market segment in terms of value, driven by strong culinary traditions, high per capita consumption, and a mature, sophisticated food retail infrastructure. Western European countries, particularly Germany and the UK, are leaders in both conventional and advanced product innovation, focusing heavily on sustainability and animal welfare sourcing standards. The regulatory environment in the EU, though strict, facilitates high-quality standards across member states, supporting extensive intra-regional trade of specialty sausage products.

Asia Pacific (APAC) stands out as the fastest-growing region globally, primarily fueled by rapid urbanization, substantial growth in disposable income, and the increasing adoption of Westernized dietary habits, which include higher consumption of packaged and processed meat products. Key growth markets such as China and India are seeing massive investment in cold chain logistics and retail infrastructure expansion, making chilled sausage products accessible to a burgeoning middle class. Local manufacturers are rapidly scaling production capabilities while international players are entering through joint ventures to adapt product formulations to local flavor preferences (e.g., incorporating specific Asian spices or using poultry to cater to specific religious dietary restrictions), thus unlocking enormous volume potential.

North America holds a dominant position in market technological adoption and product convenience, characterized by high consumption of pre-cooked and frozen sausages designed for rapid preparation. The United States market is highly competitive and dynamic, witnessing intense innovation in the plant-based and clean-label segments, responding directly to a health-conscious consumer base. Latin America, led by Brazil and Argentina, shows robust growth, heavily favoring traditional beef and pork-based products, with regional market development tied closely to domestic livestock production and economic stability. The Middle East and Africa (MEA) market growth is driven by rising tourism and the necessity to import certified Halal products, requiring specialized production and strict compliance, offering high-value opportunities for certified global exporters.

- Europe: Leading market value; characterized by strong artisanal tradition, high consumption of pork and beef sausages, and intense focus on clean label, organic, and locally sourced ingredients. Germany, UK, and France are key contributors.

- Asia Pacific (APAC): Highest CAGR; driven by urbanization, expanding cold chain infrastructure, and rising disposable incomes. China and India are the primary growth engines, seeing increased demand for both Western-style and localized sausage products.

- North America: Significant technological adopters; strong focus on convenience products (frozen, pre-cooked), dominance of major food processing conglomerates, and high penetration of plant-based sausage alternatives.

- Latin America (LATAM): Growth tied to livestock sector performance; strong cultural affinity for fresh and traditional meat products; Brazil and Argentina drive regional consumption volume.

- Middle East & Africa (MEA): Growth dependent on tourism and Halal certification compliance; expanding modern retail sector creating demand for high-quality, imported processed meats in GCC nations and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sausage Market, including established multinational food conglomerates, specialized meat processors, and disruptive plant-based product innovators. These companies drive innovation in flavor profiles, sustainability, and distribution efficiency, maintaining highly competitive market dynamics through strategic acquisitions and product line expansion.- Tyson Foods Inc.

- Hormel Foods Corporation

- JBS S.A.

- WH Group Limited (Smithfield Foods)

- Nestlé S.A. (Herta)

- Conagra Brands Inc.

- The Kraft Heinz Company

- Johnsonville Sausage LLC

- Oscar Mayer

- Cherkizovo Group

- Premium Brands Holdings Corporation

- Vion Food Group

- Pilgrim's Pride Corporation

- Hillshire Brands

- Beyond Meat

- Impossible Foods

- BRF S.A.

- General Mills Inc. (Meat Snacks)

- Clemens Food Group

- Pini Group

- Zwanenberg Food Group

- Kunzler & Company, Inc.

- Goya Foods, Inc.

- Olymel S.E.C./L.P.

- Atria Plc

- Kerry Group plc

- Fonterra Co-operative Group

- Maple Leaf Foods Inc.

- Tulip Food Company (Danish Crown)

- Cargill, Incorporated

Frequently Asked Questions

Analyze common user questions about the Sausage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Sausage Market from 2026 to 2033?

The Sausage Market is forecasted to exhibit a steady Compound Annual Growth Rate (CAGR) of 4.8% during the period spanning 2026 to 2033, driven primarily by increased demand for convenient processed protein and global urbanization trends.

Which geographical region currently holds the largest market share in the global Sausage Market?

Europe holds the largest market share by value, sustained by deep-seated cultural consumption habits and a highly established distribution network, though the Asia Pacific region is expected to demonstrate the fastest growth rate in the forecast period.

How are health and dietary trends influencing sausage product development?

Health and dietary trends are driving significant innovation, leading manufacturers to focus on low-sodium, low-fat formulations, clean-label ingredients (minimal artificial preservatives), and rapidly expanding the offering of plant-based sausage alternatives to cater to flexitarian and vegan consumers.

What key technological advancements are essential for modern sausage production?

Key technological advancements include highly automated high-speed stuffing and linking machines, High-Pressure Processing (HPP) for non-thermal preservation, and Modified Atmosphere Packaging (MAP) to extend shelf life and maintain product quality throughout the cold chain logistics.

What role does Artificial Intelligence (AI) play in optimizing the Sausage Market supply chain?

AI optimizes the sausage supply chain through predictive demand forecasting to minimize inventory spoilage, advanced vision systems for rigorous quality control during processing, and predictive maintenance to ensure maximum uptime of critical production machinery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sausage Enema Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Natural Sausage Casings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Sausage Hotdog Casings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fresh Sausage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chicken Sausage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager