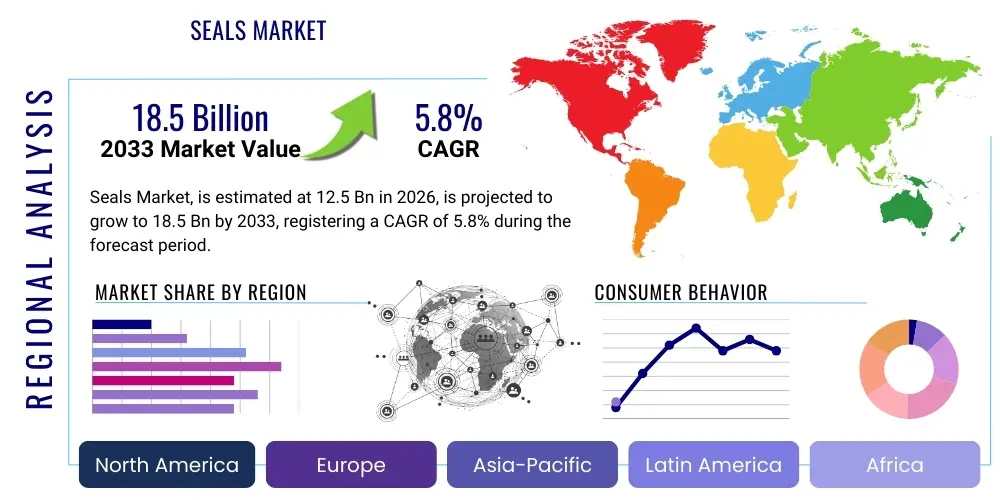

Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441823 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Seals Market Size

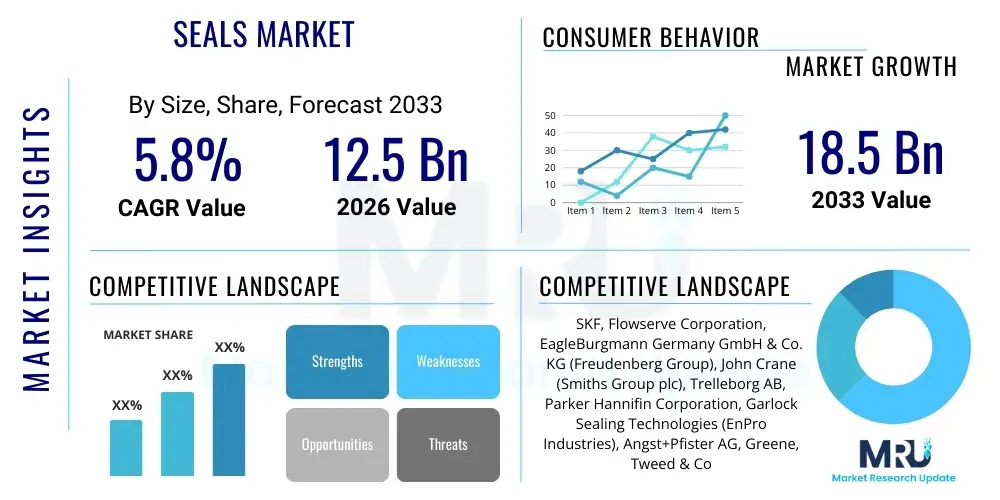

The Seals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $18.5 Billion by the end of the forecast period in 2033.

Seals Market introduction

The global Seals Market encompasses a critical segment of industrial components designed to prevent leakage, exclude contaminants, and maintain pressure differentials within mechanical systems. These components, which include O-rings, gaskets, mechanical seals, and hydraulic seals, are essential for ensuring the reliable and efficient operation of rotating and reciprocating machinery across nearly every sector. They play a pivotal role in maintaining fluid integrity, preventing system downtime, and complying with stringent environmental and safety regulations, particularly in industries dealing with hazardous fluids or high-pressure environments. The core product function revolves around creating a physical barrier between two environments, thereby optimizing performance and prolonging the lifespan of expensive equipment.

Major applications of industrial seals span crucial sectors such as automotive manufacturing, where they are vital for engines, transmissions, and braking systems; oil and gas exploration and refining, where high-performance seals handle extreme temperatures and corrosive media; and general industrial machinery, including pumps, compressors, and valves. The primary benefits derived from high-quality sealing solutions include reduced maintenance costs due to decreased leakage, enhanced energy efficiency by minimizing friction, and improved operational safety. Demand is consistently driven by the global expansion of the manufacturing base, the necessity for robust infrastructure development, and the increasing complexity and severity of operating conditions in new energy technologies like hydrogen and advanced battery cooling systems.

The market expansion is significantly propelled by several key driving factors. Firstly, the stringent environmental regulations concerning fugitive emissions, especially in the chemical and petrochemical industries, mandate the adoption of advanced, zero-leakage sealing technologies. Secondly, the continuous advancements in material science, leading to the development of seals made from highly resilient elastomers and advanced PTFE compounds, allow equipment to operate under harsher conditions (higher temperatures and pressures). Finally, the sustained growth in the global automotive sector and capital expenditure in the industrial machinery segment, particularly in emerging economies, ensure a consistent demand base for both original equipment manufacturing (OEM) and aftermarket replacements.

Seals Market Executive Summary

The Seals Market demonstrates robust resilience driven by non-discretionary maintenance cycles and mandated operational efficiency improvements across heavy industries. Current business trends indicate a strong shift towards condition monitoring and predictive maintenance strategies, necessitating the integration of smart sealing solutions equipped with embedded sensors for real-time performance tracking and failure anticipation. Consolidation among major market players is accelerating, allowing larger entities to leverage economies of scale and invest heavily in proprietary materials research, thereby dominating the high-performance segment required by aerospace and deep-sea oil and gas applications. Furthermore, the push towards sustainability is influencing material choices, favoring recyclable, low-friction, and durable sealing materials that contribute to overall system energy savings, aligning with global corporate social responsibility objectives and generating a significant competitive differentiator.

Regionally, Asia Pacific (APAC) stands as the primary growth engine, fueled by rapid industrialization, extensive infrastructural investments, and burgeoning automotive production, particularly in China and India. North America and Europe maintain leading positions in terms of technological adoption and demand for high-specification products, primarily driven by stringent regulatory frameworks and the presence of mature aerospace and pharmaceutical manufacturing bases. The segmentation trends reveal that mechanical seals, particularly cartridge seals, are experiencing the highest value growth due to their superior performance in preventing catastrophic failures in critical pumping applications. Concurrently, the Materials segment is witnessing rapid innovation, with fluorocarbon elastomers (FKM) and perfluoroelastomers (FFKM) seeing surging demand due to their chemical resistance and thermal stability, crucial for demanding operational environments.

Overall, the market remains highly competitive, characterized by intense focus on precision engineering and supply chain robustness. Key segments, such as hydraulic and pneumatic seals, are inextricably linked to the performance of capital equipment, meaning demand volatility often mirrors macroeconomic investment cycles in machinery. However, the consistent need for aftermarket replacement due to standard wear and tear provides a stable revenue baseline, mitigating some risk associated with new equipment sales cycles. Strategic manufacturers are prioritizing digitalization, incorporating 3D printing for rapid prototyping and low-volume specialized seal production, enhancing responsiveness to custom demands from highly specialized end-users, thus optimizing time-to-market for complex sealing geometries.

AI Impact Analysis on Seals Market

User queries regarding the impact of Artificial Intelligence (AI) on the Seals Market predominantly center on how AI enhances predictive maintenance, optimizes material selection, and automates manufacturing processes. Users are concerned about the implementation costs versus the return on investment (ROI) derived from reduced downtime and improved operational longevity. Key themes emerging include the potential for AI-driven algorithms to analyze sensor data from smart seals, accurately predicting seal failure hours in advance, a significant leap forward from current scheduled maintenance models. There is also substantial interest in how machine learning can accelerate the discovery and testing of novel elastomer and composite materials, shortening the research and development lifecycle for seals designed for extremely harsh environments, thereby directly addressing performance bottlenecks in critical industries like nuclear and high-pressure chemical processing.

- AI facilitates predictive maintenance programs by analyzing vibration and temperature data from operational seals, drastically reducing unplanned downtime.

- Machine Learning algorithms optimize the selection of sealing materials based on specific chemical compatibility, pressure, and temperature parameters, ensuring maximum Mean Time Between Failure (MTBF).

- Generative AI supports the design of complex, optimized seal geometries (e.g., O-ring grooves, lip seal profiles) that minimize friction and improve sealing efficacy.

- Automated Quality Control (AQC) using computer vision and AI enhances the inspection process during manufacturing, ensuring zero defects in critical high-volume batches.

- Supply chain management benefits from AI, optimizing inventory levels of diverse seal types and raw materials based on forecasted industrial demand fluctuations.

- AI-driven simulation tools significantly reduce the physical prototyping and testing required for developing new high-performance sealing solutions.

DRO & Impact Forces Of Seals Market

The dynamics of the Seals Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces determining market direction. Primary drivers include the global mandate for emission control, particularly the reduction of volatile organic compound (VOC) emissions, which necessitates the widespread adoption of superior mechanical seals. Furthermore, the global expansion and refurbishment of industrial infrastructure, coupled with the rising demand for sophisticated fluid handling equipment in the water and wastewater treatment sector, consistently fuels the replacement and new installation market for seals. The increasing operational severity in applications such as ultra-deep-water oil and gas drilling requires seals capable of withstanding unprecedented levels of pressure and temperature, directly boosting the revenue stream for specialized high-performance materials.

Conversely, the market faces significant restraints. Price volatility in raw materials, particularly synthetic rubber polymers, PTFE, and specialized metals, can compress manufacturer margins, leading to cost pass-through challenges for end-users. Additionally, the proliferation of counterfeit or sub-standard sealing products in certain emerging markets poses a threat to legitimate manufacturers, undermining trust and potentially leading to catastrophic equipment failure if uncertified seals are installed in critical systems. The long service life of some high-specification seals, while beneficial to the customer, can slow the replacement cycle, particularly in sectors where maintenance intervals are extensive, resulting in cyclical demand patterns for aftermarket services.

Significant opportunities are present in the transition towards sustainable and renewable energy sources. The burgeoning green hydrogen economy requires seals compatible with gaseous hydrogen, a highly aggressive and difficult-to-contain medium, opening a specialized, high-growth niche for manufacturers. Furthermore, the integration of Industry 4.0 concepts, including the development of 'smart seals' embedded with sensors for continuous monitoring, presents a future pathway for high-value product offerings and recurring subscription-based services related to predictive maintenance analytics. These impact forces—regulatory push, material cost pressures, and technological advancements—create a highly dynamic environment where specialization and innovation in material science offer the most substantial competitive advantage.

Segmentation Analysis

The Seals Market is comprehensively segmented based on material, product type, end-user industry, and geographical region, reflecting the diverse application landscape and varying performance requirements. This granular structure helps manufacturers tailor their product portfolios to specific industrial demands, ranging from commodity O-rings used in general manufacturing to highly engineered, proprietary mechanical seals required for hazardous chemical transport. Segmentation analysis reveals critical shifts in demand, such as the increasing preference for composite materials in aerospace applications due to weight reduction imperatives, and the surging need for application-specific elastomers that offer optimized chemical resistance in the rapidly expanding pharmaceutical manufacturing sector.

The Type segmentation is particularly important, differentiating between static seals (like gaskets) and dynamic seals (like mechanical seals and hydraulic seals), each addressing distinct operational challenges. Dynamic seals, which interface with moving parts, require advanced design consideration regarding friction and wear, making them higher-value products. End-user segmentation highlights the market's dependence on capital expenditure cycles in industries such as Oil & Gas and General Industrial Machinery, with the Automotive sector driving massive volumes in standardized seal formats. Understanding these segment dynamics is crucial for strategic resource allocation and targeted product development efforts.

- By Type:

- Mechanical Seals (Cartridge Seals, Component Seals, Agitator Seals)

- O-Rings

- Gaskets (Sheet Gaskets, Spiral Wound Gaskets, Metal Gasket)

- Hydraulic & Pneumatic Seals (Rod Seals, Piston Seals, Wiper Seals)

- Lip Seals

- Others (Oil Seals, Rotary Seals)

- By Material:

- Elastomers (NBR, FKM, EPDM, FFKM, Silicone)

- Thermoplastics (PTFE, PEEK, Polyurethane)

- Metals (Steel, Nickel Alloys)

- Composites

- By End-User Industry:

- Automotive & Transportation

- Oil & Gas

- Aerospace & Defense

- Chemical & Petrochemical

- Power Generation (Nuclear, Thermal, Renewables)

- Water & Wastewater Treatment

- Food & Beverage

- General Industrial Machinery

Value Chain Analysis For Seals Market

The Seals Market value chain begins with the sourcing and processing of essential raw materials, primarily synthetic rubber polymers, specialty plastics (like PTFE and PEEK), and various metals for components such as faces and casings. This upstream segment is highly concentrated, with a few chemical giants dictating the price and supply of specialized high-performance elastomers (e.g., FFKM). Material innovation at this stage directly influences the final performance parameters of the seal, necessitating strong partnerships between seal manufacturers and material suppliers to ensure compliance with extreme industrial specifications. Manufacturers then engage in complex processes including compounding, molding, machining, and assembly, focusing heavily on precision engineering and stringent quality control to produce finished sealing solutions.

The distribution channel is bifurcated into direct sales to Original Equipment Manufacturers (OEMs) and indirect sales through a robust network of distributors for the aftermarket (MRO – Maintenance, Repair, and Overhaul) sector. OEMs, particularly large automotive or pump manufacturers, typically engage in long-term contracts for standardized high-volume orders, requiring just-in-time delivery and strict adherence to geometric specifications. Conversely, the aftermarket segment, which accounts for a substantial portion of revenue, relies on specialized regional distributors and service centers that provide technical support, rapid availability of replacement parts, and installation services, ensuring industrial equipment remains operational with minimal downtime. The distributor network’s efficacy in managing inventory for thousands of different seal types is a crucial factor in the market’s operational efficiency.

Downstream analysis involves the direct integration of seals into high-value machinery and systems across various end-user industries. The efficiency of the sealing system directly impacts the reliability and safety metrics of the end-user’s operations, meaning procurement decisions are rarely based solely on price; rather, total cost of ownership (TCO), reliability, and technical support are paramount. The long-term performance data collected from end-user installations often loops back to inform research and development efforts, driving incremental improvements in material science and seal geometry, thus completing a feedback cycle critical for continuous product innovation and maintaining market leadership in high-specification sealing applications.

Seals Market Potential Customers

The potential customer base for the Seals Market is exceptionally broad, spanning nearly every heavy and process industry where fluid or gas management under pressure is required. The primary purchasers fall into three major categories: Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MRO) service providers, and specialized engineering procurement and construction (EPC) companies. OEMs, such as manufacturers of industrial pumps, compressors, valves, and heavy-duty vehicles, represent the initial demand source, integrating seals directly into their new machinery builds. These customers prioritize consistency, high-volume capacity, and technical compliance with their system design specifications. The relationship with OEMs is strategic, often involving joint design efforts.

MRO customers constitute the largest stable revenue stream, purchasing replacement seals for scheduled or unscheduled maintenance of existing industrial assets. These end-users, which include plant maintenance departments across refineries, power stations, and chemical plants, prioritize rapid delivery, local availability, and certified quality to minimize costly operational downtime. The demand in the MRO segment is less sensitive to macroeconomic cycles than OEM demand, providing stability to the market. Furthermore, EPC firms act as large-scale intermediaries, purchasing complex sealing packages for major industrial projects, such as new pipeline installations or refinery expansions, demanding highly specialized and project-specific sealing solutions often governed by international safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $18.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Flowserve Corporation, EagleBurgmann Germany GmbH & Co. KG (Freudenberg Group), John Crane (Smiths Group plc), Trelleborg AB, Parker Hannifin Corporation, Garlock Sealing Technologies (EnPro Industries), Angst+Pfister AG, Greene, Tweed & Co., AESSEAL plc, Meccanotecnica Umbra S.p.A., Timken Company, Hutchinson S.A., Federal-Mogul LLC, James Walker Group, Gallagher Fluid Seals Inc., Kastas Sealing Technologies, Pioneer Industrial Products Co., Seal Group, Technetics Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Seals Market Key Technology Landscape

The technological evolution within the Seals Market is primarily focused on achieving superior longevity, enhanced chemical resistance, and minimized friction through advanced material science and design methodologies. A major trend involves the increased adoption of proprietary fluorinated elastomers, such as FFKM (Perfluoroelastomer), which offer near-universal chemical compatibility and thermal stability up to 300°C, making them essential for critical processes in semiconductor and pharmaceutical manufacturing. Furthermore, the development of specialized polymer blends and composites, often reinforced with carbon or glass fibers, is critical for achieving the strength and wear resistance required in demanding high-speed rotational applications, replacing traditional metallic components to reduce weight and complexity.

In terms of product design, the industry is heavily utilizing Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) simulations to optimize seal geometry and predict performance under real-world stresses before physical prototyping begins. This digital approach is vital for designing high-pressure cartridge mechanical seals that require absolute precision to ensure zero leakage and dynamic balance. Additionally, there is a clear movement towards modular sealing systems, such as standardized cartridge mechanical seals, which simplify installation and maintenance procedures, reducing the likelihood of human error during replacement, thereby improving overall system reliability and cutting total operational costs for end-users.

The burgeoning field of smart sealing technology represents the future frontier. This involves embedding miniature sensors (e.g., temperature, pressure, or acoustic sensors) directly into or adjacent to the seal structure. These smart seals transmit real-time operational data via wireless networks (e.g., IoT infrastructure) to centralized analytics platforms. This capability enables true condition-based monitoring, allowing operators to preemptively identify potential seal degradation or impending failure caused by abnormal operating conditions. This technological integration is transforming seals from passive components into active, data-generating assets crucial for the digitalization goals of heavy industrial sectors, driving higher average selling prices for these advanced solutions.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by massive investments in infrastructure development, burgeoning manufacturing activity across electronics and automotive sectors, and substantial capital expenditure in chemical processing and power generation, particularly in China, India, and Southeast Asia. The region’s low operating costs and expanding consumer base make it a primary target for global seal manufacturers.

- North America: This region holds a significant market share characterized by high technological maturity, stringent regulatory enforcement (especially in oil and gas and aerospace), and a strong focus on high-performance sealing solutions. Demand is spurred by the modernization of aging infrastructure and the critical need for reliable seals in deep-water offshore drilling and specialized pharmaceutical manufacturing.

- Europe: Europe represents a mature market with a high emphasis on environmental compliance (e.g., REACH regulations) and energy efficiency, driving demand for innovative, low-friction, and long-life sealing products. Germany, with its robust machinery and automotive industry, remains a key consumption hub, focusing on precision-engineered seals for demanding industrial applications.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity markets, particularly the oil and gas sector (Brazil and Mexico) and mining operations. The region requires durable seals capable of handling corrosive media and harsh operating environments, though market volatility often follows global commodity price fluctuations.

- Middle East and Africa (MEA): The MEA region is dominated by the massive oil and gas and petrochemical industries, driving the demand for highly specialized mechanical and hydraulic seals designed for extreme temperature and pressure conditions inherent in large-scale refining and extraction operations. Infrastructure projects in the GCC countries further support steady, high-value demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Seals Market.- SKF

- Flowserve Corporation

- EagleBurgmann Germany GmbH & Co. KG (Freudenberg Group)

- John Crane (Smiths Group plc)

- Trelleborg AB

- Parker Hannifin Corporation

- Garlock Sealing Technologies (EnPro Industries)

- Angst+Pfister AG

- Greene, Tweed & Co.

- AESSEAL plc

- Meccanotecnica Umbra S.p.A.

- Timken Company

- Hutchinson S.A.

- Federal-Mogul LLC

- James Walker Group

- Gallagher Fluid Seals Inc.

- Kastas Sealing Technologies

- Pioneer Industrial Products Co.

- Seal Group

- Technetics Group

Frequently Asked Questions

Analyze common user questions about the Seals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Seals Market?

The primary driver is the increasing stringency of global environmental regulations, particularly regarding fugitive emissions (VOCs), which mandates the use of higher-performance, zero-leakage sealing technologies in process industries like oil, gas, and chemical manufacturing.

How do 'smart seals' enhance industrial operations?

Smart seals are integrated with sensors that provide real-time data (temperature, pressure) for condition monitoring, enabling predictive maintenance strategies, drastically reducing unplanned downtime, and optimizing operational reliability and efficiency (Industry 4.0 integration).

Which sealing material is seeing the fastest adoption in high-performance applications?

Perfluoroelastomers (FFKM) are experiencing rapid adoption due to their exceptional chemical compatibility and thermal stability, making them critical for highly demanding environments in aerospace, pharmaceutical, and aggressive chemical processing industries.

Is the aftermarket (MRO) or OEM segment more valuable for seal manufacturers?

While the OEM segment provides high volume stability for new equipment, the aftermarket (MRO) segment typically accounts for a higher and more consistent value stream over the long term, driven by the non-discretionary replacement cycles necessary for continuous industrial operation.

Which geographical region dominates the consumption of industrial seals?

The Asia Pacific (APAC) region dominates the consumption market in terms of volume and growth rate, primarily fueled by extensive infrastructure development, rapid industrialization, and high output volumes from its automotive and general manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Semiconductor Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Superalloy Honeycomb Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Perfluoroelastomer (FFKM) Parts and Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Rotary Seals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Magnetic Mechanical Seals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager