Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434922 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Food Market Size

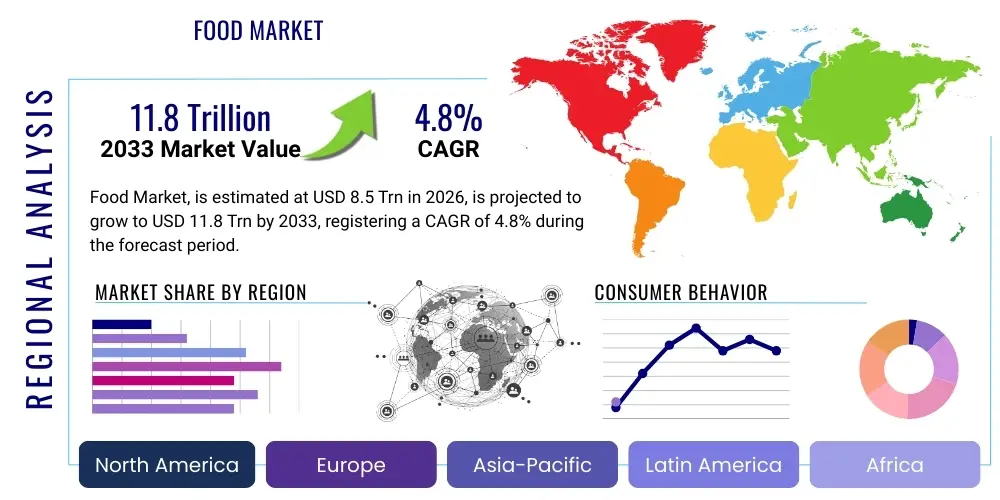

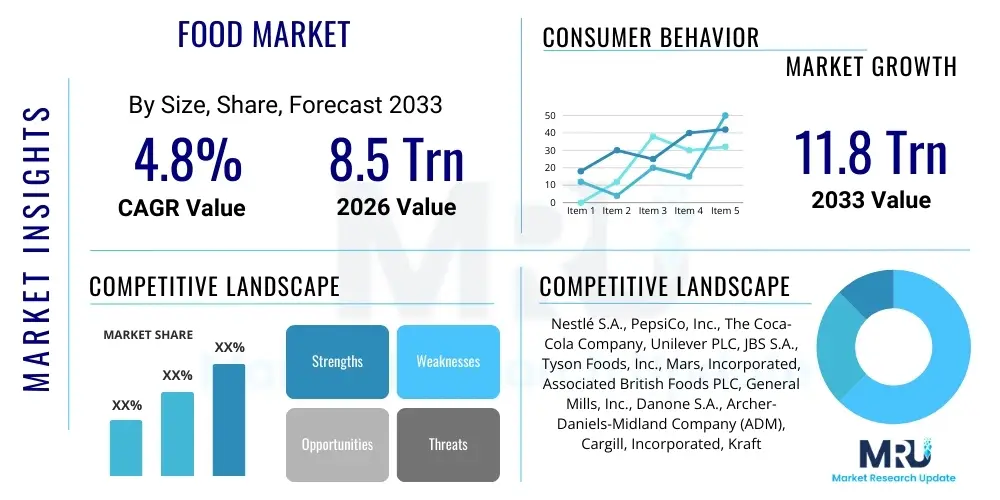

The Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 8.5 Trillion in 2026 and is projected to reach USD 11.8 Trillion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global demographic shifts, particularly sustained population growth in developing regions, coupled with escalating consumer demand for convenience foods, sustainable sourcing, and functional nutrition. The market size reflects the aggregate value of sales across all primary sectors, including fresh produce, packaged goods, dairy, meat, and beverages, encompassing both traditional retail and the rapidly expanding e-commerce distribution channels, making it one of the largest and most critical global industries.

Food Market introduction

The global Food Market encompasses the cultivation, processing, packaging, distribution, and consumption of all food and beverage products intended for human consumption. This vast ecosystem involves highly complex supply chains stretching from agricultural inputs (seeds, fertilizers) through primary and secondary processing to final consumer purchase points, such as supermarkets, restaurants, and online platforms. Major applications span essential nutrition, functional dietary supplements, specialized diets (e.g., vegan, gluten-free), and experiential consumption, driven by globalization and cultural exchange. The core benefits derived from this market include ensuring global food security, offering diverse nutritional options, and acting as a foundational engine for national economies, supporting billions of livelihoods worldwide. Key driving factors accelerating market evolution include relentless urbanization, which increases demand for processed and ready-to-eat meals; rising disposable incomes, enabling shifts towards premium and specialty products; and significant technological advancements in precision agriculture and cold chain logistics, enhancing efficiency and reducing waste across the entire value chain. Furthermore, increasing regulatory focus on food safety, traceability, and sustainability standards compels continuous innovation and capital investment across industry stakeholders.

The product description of the Food Market is inherently heterogeneous, covering staples like grains and legumes, perishable goods such as fresh fruits and vegetables, highly processed items, and various specialized commodities like organic, fortified, or bio-engineered foods. The market's structural components are often differentiated by shelf life, nutritional value, and processing complexity. Major applications include household consumption (the largest segment), commercial consumption (restaurants, hotels, institutions), and industrial use (as ingredients in other manufacturing processes, such as food additives or animal feed production). The overarching theme influencing all product categories is the increasing preference for transparent labeling, ethical sourcing, and health attributes, transforming consumer expectations from mere sustenance to wellness-oriented dietary choices. This shift is fueling product innovation, particularly in plant-based alternatives and personalized nutrition solutions, requiring market participants to rapidly adapt their portfolios and operational models.

The market dynamics are heavily influenced by the interplay between global commodity prices, geopolitical stability, and consumer demand elasticity. Driving factors also include digitalization, which is enabling more efficient demand forecasting and inventory management, thus minimizing operational costs and improving freshness. Simultaneously, the market faces constraints related to climate change impacts on crop yields, increasingly stringent global trade policies, and the pervasive challenge of food waste throughout the supply chain. Addressing these challenges requires collaborative efforts involving governments, non-governmental organizations, and private sector entities, focusing on sustainable intensification of agriculture and establishing resilient, climate-smart food systems capable of meeting the nutritional needs of a growing global population while minimizing environmental impact. The integration of advanced data analytics and IoT devices is becoming mandatory for maintaining competitiveness and ensuring compliance in complex international regulatory environments.

Food Market Executive Summary

The global Food Market is characterized by robust resilience and dynamic evolution, navigating challenges such as geopolitical instability and climate variability through accelerated digital transformation and supply chain localization efforts. Current business trends indicate a significant pivot towards sustainability, evidenced by escalating investments in alternative protein sources, regenerative agriculture practices, and advanced food waste reduction technologies. Furthermore, mergers and acquisitions remain prevalent, particularly as established food giants seek to integrate innovative, agile startups specializing in clean label ingredients, personalized nutrition, and direct-to-consumer (D2C) distribution models, signaling a strategic focus on capturing high-growth, niche segments. Companies are increasingly prioritizing supply chain transparency, utilizing tools like blockchain to provide verifiable data on sourcing and processing, addressing consumer demand for ethical provenance. This operational shift is mandatory for maintaining brand loyalty in mature markets where consumer skepticism regarding environmental and social governance (ESG) claims is rising.

Regional trends reveal highly disparate growth trajectories. Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, substantial demographic expansion, and the burgeoning middle class in countries like India and China, driving demand for packaged goods and diverse imported foods. Conversely, North America and Europe, while growing at slower rates, lead innovation in premium, organic, and functional food categories, focusing heavily on convenience and health optimization. Latin America and the Middle East and Africa (MEA) are experiencing high volatility but demonstrate strong potential, particularly in retail modernization and the integration of large-scale agricultural operations. Investment in cold chain infrastructure is a critical differentiator in these regions, essential for expanding the distribution of perishable goods and reducing post-harvest losses, thereby enhancing overall food security and market accessibility. Political stability and supportive governmental policies regarding trade and agriculture subsidies heavily influence the realization of this regional market potential.

Segmentation trends highlight the dominance of the Processed Foods segment in terms of absolute market value, though the fastest growth is observed within the Plant-Based Alternatives and Functional Beverages sub-segments, reflecting a fundamental consumer shift towards health and environmental consciousness. The E-commerce distribution channel is experiencing explosive, sustained growth globally, accelerated significantly by behavioral changes induced by global health crises, compelling traditional brick-and-mortar retailers to invest heavily in omnichannel capabilities and last-mile delivery logistics. Product innovation is heavily focused on addressing prevalent dietary concerns, leading to an proliferation of low-sugar, high-protein, and ingredient-minimal products, often marketed with clear claims regarding naturalness and traceability. Manufacturers are leveraging advanced food science techniques to improve the taste and texture profiles of sustainable ingredients, aiming to achieve parity with traditional products and thus broaden mass market acceptance, ensuring that these segment trends translate into long-term structural changes rather than temporary fads.

AI Impact Analysis on Food Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Food Market predominantly focus on three critical areas: efficiency improvements in complex supply chains, the future of food safety and quality assurance, and the potential for personalized nutrition at scale. Consumers and industry stakeholders are highly concerned about how AI-driven automation will affect employment in agriculture and processing, while simultaneously anticipating revolutionary changes in precision farming (optimizing yield and minimizing resource use) and predictive quality control (reducing spoilage). Key themes emerging from these questions include the need for robust data governance frameworks to manage the vast datasets generated by IoT sensors in farming and processing, and the ethical implications of using AI to tailor nutritional recommendations, ensuring equitable access to advanced food solutions. There is significant expectation that AI will be instrumental in achieving global sustainability goals by enhancing resource management and dramatically improving supply chain visibility from farm to fork, mitigating the perennial challenges of food fraud and traceability.

The implementation of AI algorithms across the Food Market value chain promises transformative changes, significantly enhancing operational resilience and precision. In agriculture, Machine Learning (ML) models analyze vast arrays of satellite imagery, weather data, and soil metrics to advise on optimal planting, irrigation, and fertilization schedules, a process known as precision agriculture. This leads to reduced resource consumption, including water and pesticides, while maximizing crop yields, directly addressing resource scarcity and climate adaptation challenges. Furthermore, within processing and manufacturing facilities, AI-powered computer vision systems are rapidly replacing human inspectors for quality control, instantly identifying contaminants, defects, or inconsistencies in product size and packaging with superior accuracy and speed, thereby minimizing the risk of product recalls and ensuring adherence to stringent safety standards.

Beyond the operational realm, AI is fundamentally changing consumer interaction and product development. Predictive analytics, driven by AI, allows retailers and manufacturers to forecast demand fluctuations with unprecedented accuracy, leading to optimized inventory management, reduced waste, and fresher products on shelves. Moreover, in the realm of personalized nutrition, AI analyzes individual genetic data, lifestyle factors, and microbiome health to recommend highly tailored dietary plans and custom food formulations, moving the industry beyond one-size-fits-all products. This capability is dependent on secure, ethical handling of sensitive personal health data, necessitating clear regulatory guidelines and robust cybersecurity measures. The overall integration of AI is expected to redefine competitiveness, placing data-driven decision-making at the core of successful food production and distribution enterprises globally.

- AI-Driven Precision Agriculture: Optimizing planting schedules, irrigation, and pest control using sensor data and machine learning to maximize yield and resource efficiency.

- Predictive Demand Forecasting: Utilizing historical sales data, weather patterns, and promotional activities to accurately predict consumer demand, reducing inventory costs and spoilage rates across the supply chain.

- Automated Quality Control: Employing computer vision and robotics in processing plants for real-time detection of contaminants, product defects, and packaging irregularities, enhancing food safety compliance.

- Supply Chain Traceability (Blockchain Integration): Using AI to analyze blockchain data records, ensuring rapid identification and isolation of contaminated batches, thereby mitigating large-scale recall risks.

- Personalized Nutrition Platforms: Developing custom dietary recommendations and food formulations based on individual biometric data, genetics, and health goals, facilitated by advanced algorithmic analysis.

- Flavor and Ingredient Discovery: Accelerating R&D by using AI to model molecular interactions, predicting the sensory profiles and shelf stability of novel ingredient combinations, especially for alternative proteins.

- Food Waste Reduction: Implementing AI-optimized routing and dynamic pricing strategies for perishable goods nearing expiration, minimizing environmental and economic losses at retail and distribution levels.

DRO & Impact Forces Of Food Market

The Food Market's trajectory is determined by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the core impact forces shaping investment and innovation. Primary drivers include sustained global population growth, particularly in Asia and Africa, which exponentially increases the fundamental demand for caloric intake and nutritional diversity. Coupled with this is the powerful shift in consumer preferences towards health, wellness, and sustainability, forcing rapid product reformulations and ethical sourcing commitments from manufacturers. Technological advancements, such as the adoption of IoT sensors for supply chain monitoring and vertical farming techniques for localized production, are also acting as significant enablers, improving efficiency and resilience. These drivers collectively exert a powerful forward momentum, compelling industry stakeholders to continuously upgrade infrastructure and adopt digital solutions to meet evolving consumer and demographic needs while maintaining competitive pricing in a highly sensitive market environment.

Conversely, the market faces significant restraints that dampen growth potential and introduce volatility. Prominent among these are the profound logistical challenges inherent in managing perishable goods across vast global distances, requiring immense investment in costly cold chain infrastructure, particularly in emerging economies. Furthermore, the volatility of commodity prices, often exacerbated by geopolitical conflicts, unpredictable weather events linked to climate change, and currency fluctuations, introduces substantial financial risk for processors and distributors. Regulatory hurdles also pose a persistent restraint; the fragmented and stringent food safety standards across different jurisdictions necessitate complex compliance operations and often limit the ease of international trade. These restraints require sophisticated risk management strategies, including comprehensive hedging against commodity price changes and strategic regional diversification to buffer against localized supply disruptions and regulatory changes.

Opportunities within the Food Market are primarily centered on innovation and diversification into high-growth, underserved segments. The clear opportunities lie in scaling alternative protein production (plant-based, cultivated meat, insect-based) to meet environmental demands and satisfy flexitarian consumers. Digitalization presents immense opportunities for enhancing transparency through blockchain, improving efficiency via automation, and connecting directly with consumers through D2C models, bypassing traditional, higher-cost intermediaries. Moreover, addressing the pervasive global challenge of food waste through technological solutions and systemic changes in retail practices offers a massive economic and ethical opportunity. The interplay of these forces ensures that the Food Market remains highly dynamic, requiring continuous strategic evaluation of investment priorities to navigate environmental risks while capitalizing on consumer trends favoring sustainable, traceable, and personalized food products.

- Drivers:

- Global Population Expansion: Increasing the baseline demand for staple and processed foods, driving volume growth, especially in high-density regions.

- Rising Disposable Incomes: Enabling consumers, particularly the middle class in emerging markets, to shift from staples to value-added, premium, and functional products.

- Focus on Health and Wellness: Surging demand for foods aligned with specific dietary trends (e.g., keto, low-carb, vegan) and functional ingredients like probiotics and vitamins.

- Technological Integration in Supply Chain: Adoption of IoT, AI, and blockchain enhances logistics efficiency, inventory control, and supply chain transparency, reducing time-to-market.

- Urbanization: Driving demand for convenient, ready-to-eat, and packaged food solutions due to time constraints inherent in urban lifestyles.

- Restraints:

- Climate Change Impact and Agricultural Volatility: Unpredictable weather events (droughts, floods) severely affecting crop yields, leading to price spikes and supply instability.

- Stringent and Fragmented Regulatory Landscape: Diverse food safety standards and labeling requirements across countries complicating international trade and requiring costly compliance efforts.

- High Investment Requirements for Cold Chain Logistics: Essential infrastructure for perishable goods is expensive, especially in regions with inadequate power supply, restricting market reach.

- Commodity Price Volatility: Fluctuations in input costs (energy, fertilizer, raw agricultural commodities) squeeze profit margins for processors and retailers.

- Growing Food Fraud and Safety Concerns: Incidents of contamination or mislabeling erode consumer trust and necessitate high-cost quality assurance measures.

- Opportunities:

- Alternative Protein Market Development: Significant opportunity to innovate and scale production of plant-based and cultivated protein sources, addressing sustainability concerns.

- Expansion of E-commerce and D2C Channels: Leveraging digital platforms to reach consumers directly, offering personalized products and improved freshness, bypassing traditional retail bottlenecks.

- Sustainable Packaging Innovation: Developing eco-friendly, biodegradable, and recyclable packaging materials to meet consumer demand and comply with environmental regulations.

- Reduction of Food Loss and Waste: Implementing advanced inventory management, storage solutions, and waste repurposing technologies to recover economic value from discarded food streams.

- Functional and Fortified Foods: Developing products that deliver specific health benefits beyond basic nutrition (e.g., gut health, immunity boosting), appealing to health-conscious demographics.

- Impact Forces:

- Technological Advancement (High Impact): Digitization and automation redefine production efficiency and supply chain visibility.

- Socio-Economic Shifts (High Impact): Changing consumer values (sustainability, ethics) fundamentally alter product demand and corporate strategy.

- Environmental Risks (Severe Impact): Climate change and resource scarcity threaten primary production stability and necessitate systemic adaptation in farming practices.

Segmentation Analysis

The Food Market segmentation provides crucial strategic insights, enabling businesses to target specific consumer needs and navigate the diverse distribution landscape. The market is typically categorized by Product Type, Distribution Channel, and End-Use Application, each exhibiting unique growth rates and competitive dynamics. Product Type segmentation reveals the robust performance of packaged and processed foods due to convenience, alongside the disproportionately high growth of nascent segments like organic and plant-based foods, driven by shifts in health perception. Distribution Channel analysis underscores the strategic importance of omnichannel strategies, where the traditional dominance of supermarkets and hypermarkets is increasingly challenged by the rapid, expansive growth of online retail, particularly for specialty and meal-kit services. End-Use segmentation helps differentiate between the needs of household consumers, who prioritize price and accessibility, and the food service industry, which emphasizes bulk supply, consistency, and specific preparation requirements. Understanding these granular segment behaviors is essential for effective product localization and targeted marketing campaigns.

Within Product Type, sub-segments such as dairy alternatives (oat milk, almond milk) and meat substitutes are experiencing double-digit growth, reflecting a global transition towards reduced meat consumption motivated by environmental and health concerns. The functional food segment, including items fortified with specific vitamins, minerals, or active ingredients, is also accelerating, capitalizing on consumers' proactive approach to managing their health. Conversely, the market for staple foods, while stable and enormous in volume, typically exhibits lower growth rates, often correlating directly with population growth rather than significant value increases. Manufacturers in this segment focus heavily on operational efficiency and cost management to maintain profitability in a high-volume, low-margin environment, utilizing advanced supply chain planning to minimize waste and optimize delivery networks.

The strategic differentiation based on Distribution Channel dictates operational investments. While convenience stores and traditional markets remain vital, particularly in rural and densely populated urban areas, the proliferation of digital platforms requires significant technological investment. E-commerce platforms offer unparalleled reach and data collection capabilities, enabling personalization and targeted advertising based on purchase history and demographics. Furthermore, the rise of specialized retailers focusing exclusively on organic, local, or ethically sourced products caters to niche, high-value consumer groups. A comprehensive market strategy must therefore balance sustaining traditional channels, which offer immediate access and sensory evaluation opportunities, with aggressively expanding digital presence to capture the fastest-growing consumer cohort and enhance overall market footprint and resilience against external shocks to physical retail.

- By Product Type:

- Staple Foods (Grains, Cereals, Rice, Wheat)

- Processed & Packaged Foods (Ready-to-Eat Meals, Snacks, Frozen Foods)

- Fresh Produce (Fruits, Vegetables, Herbs)

- Meat, Poultry, and Seafood

- Dairy Products (Milk, Cheese, Yogurt)

- Beverages (Non-Alcoholic, Alcoholic, Functional Drinks)

- Confectionery and Sweeteners

- Plant-Based Alternatives (Meat Substitutes, Dairy Alternatives)

- By Distribution Channel:

- Supermarkets and Hypermarkets (Mass Retail)

- Convenience Stores and Small Grocery Stores

- Specialty Food Stores (Organic, Gourmet, Health Food)

- E-commerce and Online Retail (Direct-to-Consumer, Third-Party Platforms)

- Food Service (Restaurants, Cafes, Institutional Catering)

- Traditional Markets and Wet Markets

- By End-Use Application:

- Household Consumption (Retail Purchases)

- Commercial/Food Service (Hotels, Restaurants, Cafes)

- Industrial Use (Ingredient Suppliers, Food Manufacturing)

- By Source:

- Organic

- Conventional

Value Chain Analysis For Food Market

The Food Market value chain is a complex, multi-stage process starting with upstream agricultural production and culminating in downstream consumer consumption, involving numerous highly interconnected stages designed to add value, ensure quality, and manage perishability. Upstream activities are dominated by agricultural inputs—seed producers, fertilizer manufacturers, and farming operations—where technological adoption, specifically precision agriculture using IoT and satellite data, determines efficiency and yield optimization. Efficiency in this initial stage directly impacts raw material costs and sustainability metrics for the entire chain. Midstream activities involve primary processing (e.g., milling grains, slaughtering livestock) and secondary processing (e.g., creating packaged meals, baking), where sophisticated manufacturing technologies and stringent quality control protocols are essential. The strategic integration of processing with sourcing is key to minimizing transport costs and maintaining product freshness, increasingly relying on localized sourcing models to shorten supply lines.

Downstream analysis focuses heavily on logistics, distribution, and retail, which represent the highest value-add segments due to brand development, packaging innovation, and last-mile efficiency. Distribution channels, spanning direct and indirect routes, are pivotal; direct distribution includes D2C sales and farmer’s markets, offering higher margins and direct consumer feedback but requiring substantial logistical investment. Indirect channels, which utilize wholesalers, distributors, and large retailers like supermarkets, benefit from economies of scale and broad market reach, though they introduce more intermediaries and margin stacking. The increasing role of third-party logistics (3PL) providers specializing in temperature-controlled shipping (cold chain) is crucial for maintaining the integrity of perishable goods during transport, a necessary expenditure that preserves product quality and extends shelf life.

The structure of the value chain is undergoing significant disruption due to digitalization and consumer demand for transparency. Blockchain technology is being rapidly adopted to create an immutable ledger of product movement, certifying the provenance and handling conditions, which strengthens consumer trust and facilitates rapid response to food safety incidents. Furthermore, the relationship between suppliers and retailers is evolving from transactional to strategic partnerships, focusing on collaborative planning, forecasting, and replenishment (CPFR) to minimize stockouts and overstocking. This high degree of complexity necessitates meticulous supply chain management and strategic use of data analytics across all segments—from farm production metrics to final consumer purchasing patterns—to maintain a competitive edge and ensure profitability against the backdrop of rising input costs and dynamic regulatory requirements, focusing heavily on sustainability throughout the entire network.

Food Market Potential Customers

The potential customers for the Food Market span a remarkably broad spectrum, categorized primarily into three major segments: individual consumers (households), commercial entities (food service), and industrial manufacturers. Individual consumers constitute the largest and most fragmented segment, with purchasing decisions driven by factors such as demographic profile (age, income, family size), lifestyle choices (convenience, health focus), and cultural preferences (local cuisine, ethical sourcing). Within the household segment, significant growth opportunities lie in targeting the high-income, health-conscious consumer demanding premium, organic, and functional foods, alongside the time-constrained urban demographic seeking efficient, ready-to-eat and meal-kit solutions. Understanding personalized nutritional needs and leveraging digital platforms for direct engagement are critical strategies for capturing share within this vast and highly dynamic customer base.

Commercial entities, primarily the Food Service industry—including restaurants, hotels, institutional caterers (schools, hospitals), and corporate cafeterias—represent a stable yet demanding customer base. These buyers prioritize consistency, volume capacity, precise ingredient specifications, and timely, reliable delivery, often requiring specific certifications and bulk packaging formats. The trend in this segment is moving towards sustainable and locally sourced ingredients to meet ethical consumer demand within their own clientele, requiring food producers to provide verified provenance data and robust supply chain commitments. Successfully servicing the commercial segment requires specialized B2B sales infrastructure, including dedicated account management and customized logistical solutions capable of handling high-volume, just-in-time delivery requirements common in the hospitality sector, ensuring seamless integration into their operational flows.

Industrial manufacturers, serving as intermediate buyers, use processed food products and ingredients for further manufacturing, such as producers of packaged snacks, confectioneries, infant formula, or animal feed. These customers demand highly standardized, large-volume raw materials or semi-finished products (e.g., flavorings, protein isolates, starches). Their purchasing decisions are overwhelmingly driven by price stability, quality assurance, regulatory compliance regarding additives, and innovation support for new product development. Suppliers targeting this segment must offer consistent quality, comprehensive technical support, and the capability to scale production efficiently. The strong focus on cost optimization and ingredient substitution research in the industrial segment makes long-term, price-competitive contracts essential, reinforcing the need for supply chain efficiency and reliable sourcing mechanisms to mitigate volatility in commodity ingredient markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Trillion |

| Market Forecast in 2033 | USD 11.8 Trillion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., PepsiCo, Inc., The Coca-Cola Company, Unilever PLC, JBS S.A., Tyson Foods, Inc., Mars, Incorporated, Associated British Foods PLC, General Mills, Inc., Danone S.A., Archer-Daniels-Midland Company (ADM), Cargill, Incorporated, Kraft Heinz Company, Conagra Brands, Inc., Kellogg Company, Mondelēz International, Inc., DSM-Firmenich, Ingredion Incorporated, Kerry Group PLC, Fonterra Co-operative Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Market Key Technology Landscape

The technological landscape of the Food Market is undergoing a rapid transition, driven by the imperative to increase efficiency, ensure safety, and meet sustainability goals. Precision agriculture, powered by IoT sensors, drones, and sophisticated data analytics, represents a foundational technology, allowing farmers to optimize resource use—such as water, fertilizer, and pesticides—on a highly localized basis, thereby maximizing yields and minimizing environmental runoff. This shift from blanket application to targeted intervention is critical for climate resilience. In the processing sector, advanced automation and robotics are enhancing production speed and consistency while simultaneously improving hygienic standards and reducing human error in packaging and handling. These technologies are crucial for reducing labor costs and ensuring compliance with increasingly strict global food safety regulations, particularly in high-volume meat and packaged goods production facilities.

Digital technologies are also redefining supply chain management and consumer interaction. Blockchain technology provides an immutable and transparent record of a product’s journey from its source to the shelf, drastically improving traceability and combating food fraud, a major concern for both regulators and consumers. Simultaneously, the proliferation of e-commerce necessitates continuous innovation in cold chain logistics, utilizing advanced monitoring systems (temperature and humidity tracking) and AI-optimized routing to ensure the integrity and freshness of perishable goods during last-mile delivery. The investment in these digital tools ensures that the supply chain is not only efficient but also resilient and highly responsive to dynamic consumer demands and unforeseen disruptions, a capability paramount in the modern volatile global market environment.

Furthermore, innovations in food science and biotechnology are fundamentally altering product development. The scaling of fermentation technologies and cellular agriculture is making the production of alternative proteins—such as cultivated meat and precision-fermented dairy proteins—economically viable, offering sustainable alternatives to traditional animal farming. These scientific breakthroughs address significant environmental externalities associated with conventional agriculture. Personalized nutrition platforms, leveraging AI and biometric data, are also emerging as a key technology, enabling the development of functional foods and dietary advice tailored to individual needs, moving the industry toward preventative health solutions. The integration of these diverse technologies—from soil sensors to consumer-facing apps—signals a market commitment to a future defined by efficiency, transparency, and sustainable innovation, positioning technology as the central competitive differentiator across the food ecosystem.

Regional Highlights

Regional dynamics within the global Food Market exhibit distinct patterns driven by variations in population density, economic development, regulatory frameworks, and cultural consumption habits, necessitating highly localized market entry and strategic operational approaches. North America and Europe, characterized by high disposable incomes and mature retail infrastructure, are defined by demanding consumers prioritizing premiumization, ethical sourcing, organic certifications, and functional health attributes. These regions lead global innovation in categories like plant-based proteins, clean-label ingredients, and advanced sustainable packaging solutions. However, growth rates are often tempered by market saturation and stringent regulatory oversight regarding food additives and environmental impact, compelling market players to focus intensely on value-added products and strategic brand differentiation rather than volume expansion.

The Asia Pacific (APAC) region stands out as the primary engine for volume-driven market growth globally. This robust expansion is fueled by massive demographic size, rapid urbanization, and the ascent of a substantial middle class in nations like China, India, and Southeast Asian countries. As disposable incomes rise, there is an accelerated shift from traditional, unprocessed foods to modern, packaged, and convenience-oriented products, alongside increasing demand for imported luxury and specialized Western foods. The key regional challenge lies in overcoming logistical bottlenecks and enhancing cold chain capacity to support the increasing distribution requirements across vast geographies. Investment in modern retail infrastructure and e-commerce expansion are crucial strategic imperatives for accessing and serving the highly fragmented yet rapidly growing APAC consumer base.

Latin America (LATAM), the Middle East, and Africa (MEA) represent high-potential, high-volatility markets. LATAM's growth is often linked to shifts in commodity export earnings and domestic economic stability, driving demand for both local staples and imported packaged goods. MEA, particularly Sub-Saharan Africa, faces immense challenges related to food security, necessitating investment in resilient supply chains, improved local agricultural productivity, and the modernization of retail systems. Despite the challenges, these regions offer significant opportunities in basic processing, dairy, and beverage categories as urbanization accelerates. Strategic success in LATAM and MEA depends heavily on navigating complex local regulatory environments and forming robust partnerships with local distribution networks to effectively manage risks associated with geopolitical instability and infrastructural deficits, while catering to a young, rapidly growing population with distinct and evolving dietary preferences.

- North America (NA): Leading in functional foods, personalized nutrition, and food technology adoption (e.g., vertical farming). Characterized by high R&D investment and strong e-commerce penetration.

- Europe: Dominated by strong regulatory focus on sustainability (e.g., Farm to Fork strategy), driving high demand for organic, clean label, and ethically sourced products. Germany, UK, and France are key innovators in plant-based alternatives.

- Asia Pacific (APAC): Highest volume growth driven by China, India, and ASEAN countries. Demand shifts from basic staples to packaged, convenient, and imported Western-style foods due to rapid urbanization and rising middle-class income. Major investment priority is cold chain infrastructure expansion.

- Latin America (LATAM): Market growth influenced by improving retail infrastructure and increasing consumption of processed meat and dairy, coupled with strong regional preference for local flavor profiles. Economic stability is a crucial determinant of market potential.

- Middle East and Africa (MEA): High growth potential in packaged goods and beverages due to youthful demographics and urbanization. Significant focus required on enhancing local agricultural output and improving fundamental food security amidst environmental and political instability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Market.- Nestlé S.A.

- PepsiCo, Inc.

- The Coca-Cola Company

- Unilever PLC

- JBS S.A.

- Tyson Foods, Inc.

- Mars, Incorporated

- Associated British Foods PLC

- General Mills, Inc.

- Danone S.A.

- Archer-Daniels-Midland Company (ADM)

- Cargill, Incorporated

- Kraft Heinz Company

- Conagra Brands, Inc.

- Kellogg Company

- Mondelēz International, Inc.

- DSM-Firmenich

- Ingredion Incorporated

- Kerry Group PLC

- Fonterra Co-operative Group Ltd.

Frequently Asked Questions

Analyze common user questions about the Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are currently dominating consumer demand in the global Food Market?

The global Food Market is overwhelmingly dominated by the demand for sustainable, plant-based, and functional foods. Consumers are increasingly seeking products with clear health benefits (e.g., immune support, gut health) and demanding verifiable ethical sourcing and environmental sustainability claims from manufacturers. This shift drives investment towards alternative proteins, regenerative agriculture, and transparent supply chain technologies like blockchain, making clean-label and traceable products the fastest-growing segments across mature economies.

How is technological innovation impacting efficiency and safety across the food supply chain?

Technological innovation, particularly the integration of AI, IoT, and advanced robotics, is profoundly enhancing efficiency and safety. AI-driven precision agriculture optimizes crop yield and minimizes resource use, while automated systems in processing plants ensure stringent quality control and reduce contamination risks. Furthermore, technologies like blockchain improve end-to-end traceability, allowing rapid response to safety incidents, thereby building consumer trust and dramatically reducing economic losses associated with food fraud and recalls.

Which geographical region is projected to experience the highest growth rate in the Food Market through 2033?

The Asia Pacific (APAC) region is consistently projected to exhibit the highest market growth rate through 2033. This growth is primarily attributable to massive population expansion, accelerating urbanization, and the substantial increase in the middle-class population across economies such as China, India, and Indonesia. This demographic shift translates into rapidly escalating demand for packaged, convenient, and diversified food products, necessitating significant parallel investment in cold chain and modern retail infrastructure.

What are the primary restraints hindering the sustained growth and stability of the global Food Market?

The primary restraints hindering the stability of the Food Market include the increasing volatility of global commodity prices, largely exacerbated by geopolitical tensions and environmental risks stemming from climate change (e.g., droughts, flooding). Additionally, the high capital requirements for establishing and maintaining robust cold chain logistics in emerging markets, coupled with the complexity of navigating fragmented and often inconsistent international food safety and trade regulations, pose substantial operational and financial challenges to global market participants.

How are food manufacturers adapting to the rising consumer preference for sustainable and ethical sourcing?

Manufacturers are adapting through strategic shifts in sourcing and production practices. This involves significant investments in regenerative agriculture programs, commitments to reducing carbon footprints across their operations, and transparent reporting on ethical labor practices. Furthermore, companies are reformulating product lines to favor plant-based ingredients and utilizing advanced packaging materials (e.g., biodegradable, compostable) to align corporate responsibility with stringent consumer and regulatory demands regarding environmental stewardship and waste reduction, leveraging sustainability as a key competitive differentiator.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Food Flavors and Additives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Greece Food and Drink Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Baby Food And Infant Formula Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Food Grade Calcium Sulfate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cat Food Subscription Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager