Military Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431398 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Military Market Size

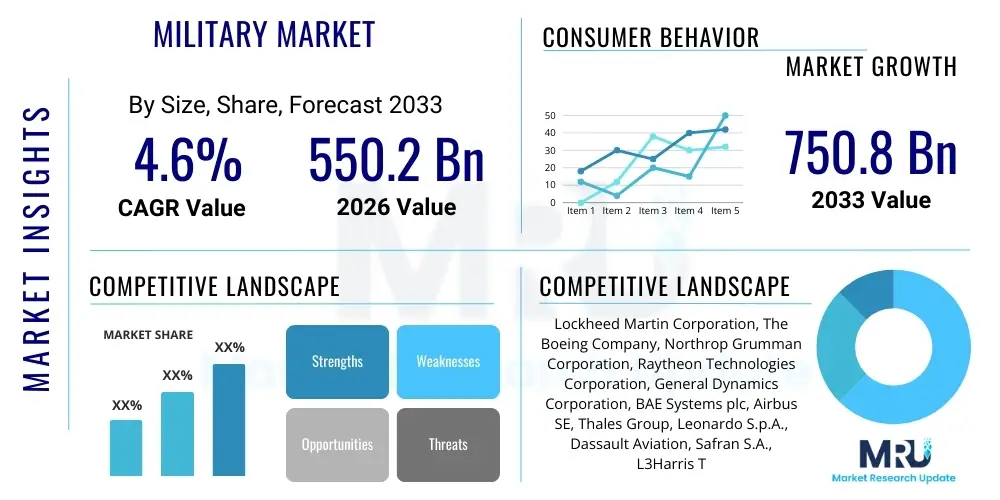

The Military Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.6% between 2026 and 2033. The market is estimated at USD 550.2 Billion in 2026 and is projected to reach USD 750.8 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by escalating geopolitical tensions across key regions, mandatory defense modernization programs initiated by major global powers, and the urgent need to integrate sophisticated digital technologies, such as artificial intelligence and autonomous systems, into existing and next-generation military platforms. The shift from traditional platforms to interconnected, resilient, and highly precise warfare capabilities is fundamentally redefining procurement priorities and driving significant long-term investments.

The consistent increase in defense expenditure globally, often exceeding mandated NATO spending targets in several European countries and reflecting strategic competition in the Indo-Pacific, underpins the market's trajectory. Furthermore, the persistent threat of asymmetric warfare, coupled with growing vulnerabilities in the cyber domain, necessitates continuous expenditure on advanced C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems and robust cybersecurity measures. These factors collectively push defense contractors towards rapid innovation and accelerated development cycles for platforms designed to operate effectively in highly contested environments. The projected growth reflects a consolidation of defense spending towards high-technology programs.

Military Market introduction

The Military Market encompasses the global industrial base dedicated to the research, development, production, and maintenance of defense equipment, systems, and services for national armed forces. This vast ecosystem includes everything from major platforms like fighter jets, naval vessels, and armored vehicles, to critical enabling technologies such as advanced radar systems, satellite communications, electronic warfare suites, and complex software-defined systems. Key products are increasingly focused on achieving information dominance and precision strike capabilities, moving away from legacy platforms that are less suited for modern, highly digitized battlefields. The market is characterized by high barriers to entry, lengthy procurement cycles, and intense governmental oversight due to the strategic nature of the products.

Major applications of military technology span across Air Superiority (e.g., 5th and 6th generation fighters), Maritime Security (e.g., aircraft carriers and anti-submarine warfare), Land Domain Operations (e.g., robotic combat vehicles and precision artillery), and emerging domains like Cyber and Space Warfare. The primary driving factors for market growth include persistent global security threats, territorial disputes, and the necessity for technological superiority against peer and near-peer adversaries. The benefits derived from investments in this market include enhanced national security, deterrence capability, technological spillover into civilian sectors (e.g., materials science, navigation technology), and maintaining strategic influence globally.

Recent shifts highlight a concentrated investment in areas that facilitate multi-domain operations (MDO), requiring seamless integration across air, land, sea, space, and cyber domains. This focus accelerates demand for modular, open-architecture systems that allow for rapid upgrades and interoperability among allied forces. Furthermore, the market is undergoing a significant transformation driven by the need for logistical resilience and predictive maintenance, leveraging big data analytics and digital twin technology to optimize readiness and reduce lifecycle costs for sophisticated military assets. This continuous technological imperative ensures sustained market growth and development.

Military Market Executive Summary

The Military Market is currently defined by significant volatility driven by escalating geopolitical dynamics, particularly in Eastern Europe and the South China Sea, forcing nations to dramatically re-evaluate their defense postures. Business trends indicate a strong move toward consolidation among major defense prime contractors, seeking to integrate niche technology providers specializing in AI, quantum sensing, and high-frequency communication systems. This strategic M&A activity is aimed at securing end-to-end capabilities required for complex, software-intensive platforms. Furthermore, the supply chain for critical military components, especially microelectronics and specialized materials, remains a key focus area, prompting governments to push for greater domestic sourcing and supply chain resilience measures to mitigate geopolitical risks and ensure continuous production capacity for strategic assets.

Regionally, North America maintains its dominance due to the extensive U.S. defense budget and aggressive modernization schedules across all branches of service. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by the defense spending increases of China, India, and Australia, primarily focused on enhancing naval capabilities, aerial surveillance, and missile defense systems to address regional security concerns. Europe is also witnessing accelerated growth, driven by the renewed commitment of NATO members to meet or exceed the 2% GDP defense spending target, leading to substantial procurement of next-generation fighter aircraft, missile systems, and advanced digital battlefield infrastructure. The Middle East remains a crucial export market, characterized by large-scale purchases of proven Western defense technology.

Segment trends demonstrate a pivotal shift in investment priority towards the Technology segment, specifically C4ISR and Cybersecurity, overshadowing traditional Platform segments like ground vehicles in terms of annual growth rate. Within the platform domain, unmanned systems (UAS, UGV, USV) are experiencing exponential growth, reflecting the desire for reduced human risk in high-threat environments and the increased effectiveness of coordinated autonomous swarms. Service segments, particularly Maintenance, Repair, and Overhaul (MRO), and specialized training and simulation services, are also expanding rapidly as the complexity of modern platforms mandates specialized industrial support and digital training methodologies throughout the asset lifecycle.

AI Impact Analysis on Military Market

User queries regarding the impact of Artificial Intelligence (AI) on the Military Market predominantly revolve around three critical themes: ethical and legal implications concerning autonomous weapon systems (AWS) and 'killer robots'; the tangible operational benefits, such as real-time decision support, predictive logistics, and accelerated intelligence processing; and concerns regarding the security and reliability of AI algorithms, particularly the risk of adversarial machine learning attacks. Users are highly interested in how AI can shift the balance of power, specifically focusing on the integration of AI into C4ISR networks (Joint All-Domain Command and Control - JADC2) and its role in accelerating the sensor-to-shooter loop, thereby shortening reaction times from hours to minutes or seconds. There is also significant curiosity about the cost-effectiveness of AI adoption relative to traditional platform acquisition.

The integration of AI is transforming military capabilities from being purely hardware-centric to increasingly software-defined. AI algorithms are crucial for processing the massive influx of data generated by modern sensors, turning raw data into actionable intelligence at the speed of relevance. This capability is vital for military planning, target recognition, and resource allocation in complex, multi-domain environments. Furthermore, AI-driven predictive maintenance is revolutionizing logistics, dramatically improving the operational readiness of expensive assets like fighter aircraft and naval vessels by anticipating component failures before they occur, reducing unexpected downtime and streamlining supply chain management for spare parts.

Despite the immense potential, the implementation of AI faces substantial challenges, including the need for robust ethical frameworks (especially concerning human oversight in combat), the reliance on high-performance computing infrastructure, and the complexity of ensuring AI systems are resilient against electronic jamming or adversarial manipulation. Addressing these challenges requires significant investment in trusted AI development environments and rigorous testing protocols to ensure system robustness and reliability in contested operational theaters. The competitive advantage in modern defense increasingly rests not on who possesses the most platforms, but who can effectively leverage AI to make better, faster, and more informed decisions under pressure.

- Enhanced speed of decision-making through sensor data fusion and real-time analysis.

- Development of highly autonomous and semi-autonomous platforms (drones, UGVs).

- Optimization of military logistics, supply chains, and maintenance via predictive analytics.

- Accelerated intelligence gathering, surveillance, and reconnaissance (ISR) capabilities.

- Improved effectiveness of electronic warfare (EW) through adaptive jamming techniques.

- Creation of advanced simulation and training environments using sophisticated AI modeling.

- Risk of algorithmic bias and the complexity of ensuring AI trust and transparency.

DRO & Impact Forces Of Military Market

The Military Market is heavily influenced by a confluence of accelerating Drivers, substantial Restraints, critical Opportunities, and pervasive Impact Forces that shape strategic decision-making and procurement timelines globally. The primary drivers include sustained geopolitical instability, characterized by great power competition and regional flashpoints, which compels nations to continuously increase defense expenditures and prioritize technological superiority. This is further exacerbated by the rapid proliferation of sophisticated, readily available military technology to non-state actors, necessitating advanced countermeasures and proactive defense postures. Furthermore, the inherent need to replace aging, legacy military hardware with digital, networked systems provides a continuous demand baseline for the industry.

Significant restraints inhibit faster market expansion, most notably the immensely high research and development (R&D) costs associated with cutting-edge military technologies such as hypersonics and 6th generation platforms, often requiring multi-billion dollar government contracts over decades. Stringent regulatory frameworks, particularly export controls (e.g., ITAR, Wassenaar Arrangement), severely restrict market access and technology transfer, confining high-end production primarily to a few established nations. Political budget uncertainties and complex, bureaucratic procurement processes often lead to significant project delays and cost overruns, deterring rapid investment cycles. Moreover, skilled labor shortages, particularly in specialized areas like cyber warfare, quantum engineering, and secure software development, pose a persistent challenge to industry capacity.

Conversely, significant opportunities exist in the domain of cyber resilience, space-based defense assets, and the integration of commercial off-the-shelf (COTS) technology into military systems to reduce costs and accelerate deployment. The rising focus on multi-domain operations (MDO) presents an enormous opportunity for systems integrators who can provide unified, interoperable command and control solutions across all services. The impact forces acting on the market are profound; primarily, the intense technological arms race demands constant innovation, forcing companies to allocate increasingly large portions of revenue to R&D. Furthermore, public scrutiny regarding military ethics and autonomous warfare systems exerts pressure on policy makers to define clear international norms, influencing the pace and nature of advanced weapons system development.

Segmentation Analysis

The Military Market is comprehensively segmented based on three primary dimensions: Platform Type, Technology, and Application, each reflecting distinct expenditure categories and operational priorities. Platform segmentation identifies the asset or domain where the system operates, such as airborne or naval assets, which typically represents the largest share of market value due to the high cost of large-scale military hardware. Technology segmentation focuses on the specific electronic, digital, or sensor capabilities integrated into the platforms, representing the fastest-growing area driven by the shift toward information warfare. Application segmentation delineates the system's primary operational role, distinguishing between combat-focused systems, logistical support, or training methodologies.

Detailed analysis of these segments reveals that while legacy platform modernization (such as fighter jet upgrades or new frigate builds) secures foundational revenue for major defense contractors, the future growth is highly concentrated in enabling technologies. Investments in electronic warfare systems, which are crucial for denying adversaries access to the electromagnetic spectrum, and cybersecurity solutions designed to protect critical infrastructure, are seeing double-digit growth rates globally. This trend underscores the strategic pivot towards non-kinetic warfare capabilities and resilience in the face of sophisticated digital threats, making technology segment analysis crucial for forecasting market shifts.

Furthermore, the emergence of the Space segment as a separate and increasingly crucial domain necessitates focused investment in satellite communication infrastructure, persistent earth observation capabilities, and responsive launch systems designed for military resilience. This high-growth niche is driven by the recognition that space superiority is essential for global command and control. Understanding the interplay between these segments allows industry stakeholders to target specific military requirements, optimize supply chains, and tailor technology offerings to meet the diverse and rapidly evolving procurement needs of national defense forces worldwide.

- By Platform:

- Airborne (Fixed-wing, Rotary-wing, UAVs/Drones)

- Naval (Submarines, Surface Combatants, Naval Aviation)

- Land (Armored Vehicles, Artillery Systems, Soldier Systems)

- Space (Satellites, Launch Services, Ground Stations)

- By Technology:

- C4ISR Systems (Communication, Networking, Data Links)

- Electronic Warfare (EW) Systems

- Cybersecurity and Threat Intelligence

- Missile Defense Systems

- Directed Energy Weapons (DEW)

- Autonomous Systems and Robotics

- By Application:

- Combat and Battlefield Operations

- Training and Simulation

- Logistics and Transport

- Surveillance and Reconnaissance

- Search and Rescue (SAR)

- By Service:

- Maintenance, Repair, and Overhaul (MRO)

- Upgrades and Modernization

- Consulting and Technical Services

Value Chain Analysis For Military Market

The Military Market value chain is highly complex, beginning with upstream analysis focused on the extraction and processing of specialized raw materials, including rare earth elements, advanced alloys, and high-performance composites necessary for aerospace and defense manufacturing. This stage involves specialized material providers and critical component manufacturers (e.g., semiconductor foundries, specialized optics manufacturers). These entities must adhere to extremely high-quality standards and often operate within tightly controlled national industrial bases to ensure material provenance and supply security. The stability and resilience of this upstream segment are fundamental to the overall market's operational capacity, given the long lead times and unique specifications required for defense-grade components.

The midstream of the value chain is dominated by Tier 1 and Tier 2 suppliers who manufacture subsystems, such as avionics, radar arrays, engine components, and sophisticated sensor packages. System Integrators (Original Equipment Manufacturers - OEMs), such as Lockheed Martin, Boeing, and BAE Systems, sit at the apex of the production process. They are responsible for the complex task of designing, assembling, testing, and integrating thousands of specialized components into final, operational platforms (e.g., fighter jets or ballistic missile systems). This integration phase is capital-intensive, requiring extensive engineering expertise and strict adherence to governmental military specifications (MIL-SPECs) throughout the entire production lifecycle.

The distribution channel is almost exclusively direct, involving governments or their designated procurement agencies (e.g., the U.S. DoD, UK MoD) acting as the sole buyers. Indirect sales are limited but may occur through Foreign Military Sales (FMS) programs or authorized governmental intermediaries when selling to allied nations, where the contracting government facilitates the transfer of technology and equipment. Downstream analysis focuses on post-delivery services, which include extensive logistical support, operator training, field service representatives, and long-term Maintenance, Repair, and Overhaul (MRO) contracts. These services segments, driven by the operational lifetime of platforms (often 30-50 years), represent a growing and stable revenue stream for OEMs, ensuring high customer lifetime value and continued engagement throughout the asset’s service life.

Military Market Potential Customers

The overwhelming majority of potential customers in the Military Market are national governments, specifically their Ministries of Defense (MoD) or equivalent cabinet-level security agencies. These centralized entities act as the primary end-users and procurement decision-makers, authorizing multi-year budgets for defense spending, system acquisition, and ongoing operational support. Their purchasing decisions are highly influenced by geopolitical assessments, national security mandates, technological peer comparisons, and commitments to regional defense alliances (like NATO or bilateral security treaties). The customer base is characterized by extremely high entry barriers for suppliers, demanding rigorous compliance, long-term technical support capability, and often technology transfer agreements.

Beyond traditional defense ministries, significant customer segments include homeland security agencies, border patrol forces, and critical national infrastructure protection entities (e.g., nuclear power plant security, port defense). These secondary customer groups focus heavily on surveillance, communication security, and counter-terrorism technologies, driving demand for specialized C4ISR systems, secure communication devices, and drone countermeasures. While their budgets are typically smaller than the core defense budget, their requirements for rapid, commercial-like deployment cycles offer different market opportunities compared to large, long-term platform acquisitions.

Furthermore, multinational organizations and cooperative defense alliances, such as NATO's procurement agencies or the European Defence Agency (EDA), represent important consortium customers, driving demand for standardized and interoperable equipment among member states. These organizations often facilitate joint R&D and acquisition programs, aiming for economies of scale and seamless operational integration across disparate national forces. Suppliers must focus their sales strategies on navigating complex, politically charged negotiation processes and aligning their offerings with specific national industrial return (offset) policies mandated by the purchasing government.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.2 Billion |

| Market Forecast in 2033 | USD 750.8 Billion |

| Growth Rate | 4.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, The Boeing Company, Northrop Grumman Corporation, Raytheon Technologies Corporation, General Dynamics Corporation, BAE Systems plc, Airbus SE, Thales Group, Leonardo S.p.A., Dassault Aviation, Safran S.A., L3Harris Technologies, Inc., Rheinmetall AG, Israel Aerospace Industries (IAI), Mitsubishi Heavy Industries, Reliance Naval and Engineering Ltd., Huntington Ingalls Industries, Hindustan Aeronautics Limited (HAL), Saab AB, Rolls-Royce plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Military Market Key Technology Landscape

The contemporary military technology landscape is defined by the convergence of several disruptive innovations aimed at achieving information superiority and maintaining deterrence. Central to this evolution are advancements in networking and data fusion, enabling Multi-Domain Operations (MDO) through systems like the US's JADC2 or similar allied concepts, which require instantaneous, secure data sharing across all operational theaters. Hypersonic technology, encompassing weapons systems capable of traveling at Mach 5 or faster, represents a strategic breakthrough, demanding massive R&D spending on specialized propulsion systems, thermal management, and advanced guidance and control mechanisms. Furthermore, the increasing miniaturization and proliferation of sophisticated sensors and electronic countermeasures (ECM) are driving demand for highly integrated electronic warfare suites that can adapt instantly to threats within the electromagnetic spectrum.

Another area of profound technological focus is Directed Energy Weapons (DEW), including high-energy lasers and high-power microwave systems, offering low-cost, high-speed defense against evolving threats such as swarming drones and incoming missiles. While still in advanced testing phases, the successful deployment of reliable DEW platforms could fundamentally alter battlefield defense dynamics. Simultaneously, the underlying backbone of modern defense is shifting towards secure computing. Research into quantum computing and quantum-resistant cryptography is critical for ensuring that highly sensitive military communications and classified data remain protected from future breaches by increasingly capable adversaries, cementing its position as a long-term strategic priority for all major military powers.

The rapid adoption of unmanned and autonomous systems across all domains—air, sea, and land—is transforming tactical execution. This is supported by advancements in Artificial Intelligence (AI) for perception, navigation, and collaborative mission planning (manned-unmanned teaming - MUM-T). The technology landscape emphasizes resilience through redundancy; hence, investments are surging in resilient satellite communication (SATCOM) networks, utilizing low-earth orbit (LEO) constellations to ensure continuous connectivity even when traditional high-orbit assets are threatened. These technological imperatives underscore the shift toward fighting wars of precision and information dominance, requiring defense contractors to pivot rapidly from hardware manufacturing to providing complex software and integration services.

Regional Highlights

The global Military Market exhibits substantial regional heterogeneity, driven primarily by differing threat perceptions, national defense budgets, and domestic industrial capacities. North America, dominated by the United States, represents the single largest consumer and producer in the global defense market. The region’s sustained defense spending is focused on maintaining qualitative military superiority, investing heavily in strategic modernization across nuclear deterrents, advanced aerospace platforms (NGAD), and sophisticated networked warfare capabilities like JADC2. The presence of the world’s leading defense OEMs ensures continuous R&D investment and technological leadership, making it the epicenter for innovation in autonomous systems and cybersecurity.

Asia Pacific (APAC) is recognized as the fastest-growing region, fueled by regional tensions, particularly those concerning China, Taiwan, and the South China Sea. Nations like India, Australia, South Korea, and Japan are undertaking massive defense buildup programs focused on strengthening naval power, developing long-range strike capabilities, and procuring advanced missile defense shields. China's rapid military modernization, specifically the expansion of its blue-water navy and investment in space and cyber warfare capabilities, acts as a primary catalyst for regional defense spending escalation. This growth is characterized by a mix of reliance on imports from the U.S. and Russia, alongside increasing efforts toward indigenous defense production, particularly in India and China.

Europe’s military spending landscape has been fundamentally reshaped by recent geopolitical events, leading to a profound acceleration in defense investments. NATO member states are strictly adhering to or surpassing the commitment to allocate 2% of GDP to defense, translating into significant immediate procurement demands for tactical air transport, precision-guided munitions stockpiling, and digital command systems interoperable across the alliance. The European Defence Fund (EDF) is stimulating collaborative R&D among EU member states, focusing on key capability gaps like next-generation fighter development (FCAS/Tempest) and advanced ground combat systems. The Middle East and Africa (MEA) region remains highly sensitive to geopolitical conflicts, maintaining strong demand for proven missile defense systems, armored vehicles, and surveillance technology, often procured through large, high-value contracts with US and European suppliers.

- North America: Dominant market share due to unparalleled US defense budget and rapid investment in sixth-generation aerospace platforms and networked warfare infrastructure. Focus on JADC2, hypersonics, and quantum technologies.

- Asia Pacific (APAC): Highest growth rate, driven by China's assertive military expansion and reactive defense modernization programs in India, Japan, and Australia, focusing on maritime domain awareness and long-range precision fires.

- Europe: Accelerated spending tied directly to NATO commitments and the need for replenishing stocks; key focus areas include ground combat vehicle replacement, integrated air and missile defense (IAMD), and collaborative future air systems development.

- Latin America: Stable market focused primarily on internal security, border control, and limited naval modernization; procurement often constrained by economic stability and debt levels, relying on basic upgrades and MRO services.

- Middle East and Africa (MEA): Critical export market characterized by strong demand for sophisticated air defense systems (e.g., THAAD, Patriot) and counter-insurgency capabilities, sustained by high oil revenues and regional security requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Military Market.- Lockheed Martin Corporation

- The Boeing Company

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- General Dynamics Corporation

- BAE Systems plc

- Airbus SE

- Thales Group

- Leonardo S.p.A.

- Dassault Aviation

- Safran S.A.

- L3Harris Technologies, Inc.

- Rheinmetall AG

- Israel Aerospace Industries (IAI)

- Mitsubishi Heavy Industries

- Reliance Naval and Engineering Ltd.

- Huntington Ingalls Industries

- Hindustan Aeronautics Limited (HAL)

- Saab AB

- Rolls-Royce plc

Frequently Asked Questions

Analyze common user questions about the Military market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Military Market?

The market growth is primarily driven by escalating geopolitical tensions, particularly among major global powers, mandating continuous defense modernization. Key drivers include the strategic shift towards multi-domain operations (MDO), the necessary replacement of aging legacy platforms, and increased spending on advanced asymmetric threat countermeasures, notably in the cyber and space domains.

How is Artificial Intelligence (AI) fundamentally changing military procurement priorities?

AI is accelerating the shift from hardware-centric platforms to software-defined warfare. Procurement is prioritizing systems that enable real-time sensor fusion, predictive maintenance, and autonomous decision support (e.g., autonomous combat vehicles and advanced C4ISR networks), aiming to dramatically compress the observe-orient-decide-act (OODA) loop.

Which geographical region exhibits the fastest growth in defense expenditure?

The Asia Pacific (APAC) region is projected to register the fastest growth, largely spurred by the rapid military expansion of China and consequential reactive defense investments by nations like India, Japan, and Australia, particularly in maritime surveillance, missile defense, and naval capacity expansion.

What is the current focus within the defense technology segmentation?

The key technological focus is on C4ISR systems, electronic warfare (EW) capabilities, and cybersecurity, reflecting the strategic imperative to achieve information dominance. There is significant ongoing investment in disruptive technologies such as hypersonics, directed energy weapons (DEW), and resilient satellite communication architectures (SATCOM).

What challenges do defense contractors face in the current market environment?

Major challenges include high initial R&D costs for next-generation systems, complex and restrictive export control regulations, inherent governmental budget volatility, and critical shortages of highly specialized technical talent required for advanced software and quantum technology integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Military Land Vehicles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Military Smart Weapons Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Commercial And Military Flight Simulation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Military Sleeping Bag Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Military Belt Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager