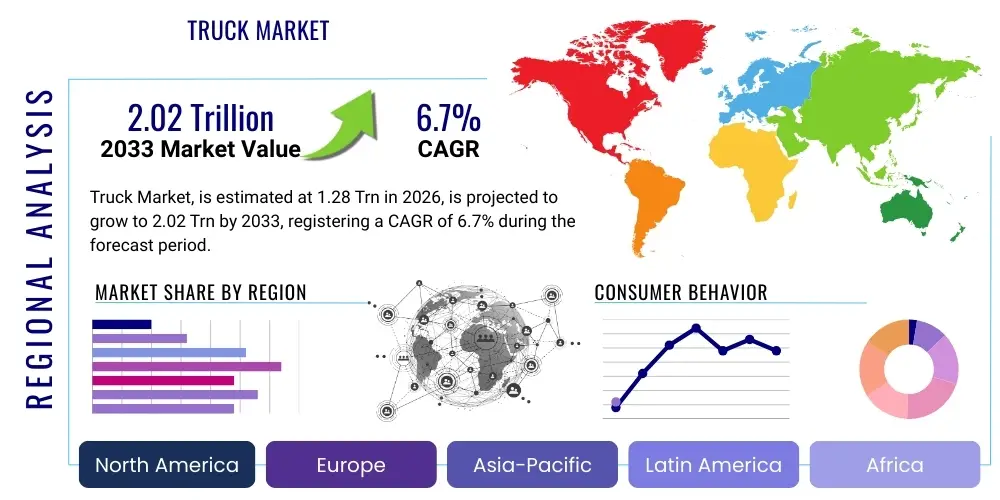

Truck Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440534 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Truck Market Size

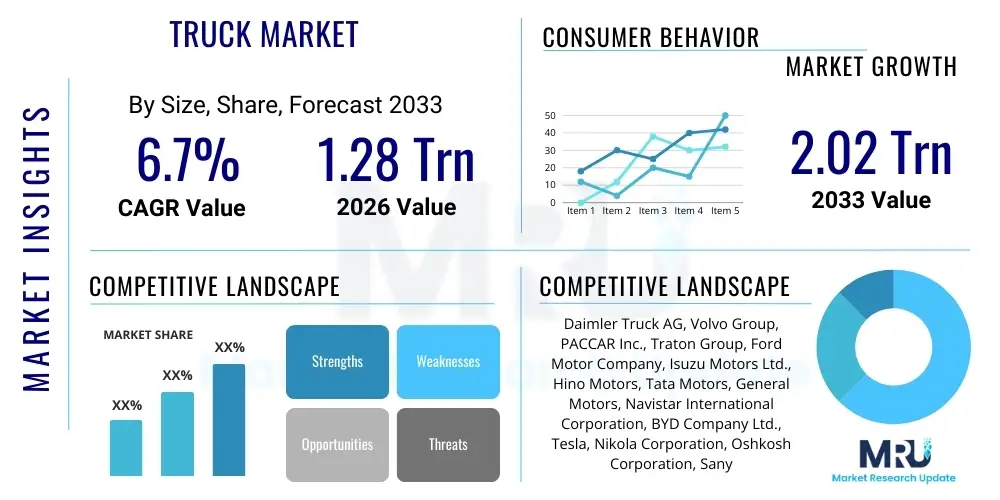

The Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 1.28 Trillion in 2026 and is projected to reach USD 2.02 Trillion by the end of the forecast period in 2033, driven by a confluence of factors including robust e-commerce expansion, significant global infrastructure development, and continuous technological advancements in vehicle design and logistics management. This substantial growth underscores the indispensable role of commercial vehicles in supporting economic activities, trade, and the efficient movement of goods across diverse industries worldwide, highlighting the market's resilience and adaptive capacity in response to evolving global demands and regulatory pressures.

Truck Market introduction

The global truck market encompasses a comprehensive range of commercial vehicles, including light-duty, medium-duty, and heavy-duty trucks, each engineered for specific operational demands such as cargo transportation, construction, mining, agriculture, and specialized municipal services. These vehicles serve as the fundamental backbone of global supply chains, enabling the seamless movement of raw materials, manufactured goods, and consumer products from production sites to distribution centers and ultimately to end-users. The market is characterized by intense competition among established manufacturers and emerging technology companies, all striving to innovate in areas such as engine efficiency, payload capacity, advanced safety systems, and connectivity features to meet increasingly stringent environmental regulations and evolving customer expectations for lower operational costs and enhanced reliability.

Major applications of trucks are incredibly diverse, spanning the critical sectors of logistics and freight transportation, where they facilitate both national and international trade and are pivotal in supporting the burgeoning e-commerce industry with efficient last-mile delivery solutions. In the construction and mining industries, specialized heavy-duty trucks like dump trucks, concrete mixers, and off-highway vehicles are indispensable for material handling, site development, and resource extraction, underscoring their robust utility in demanding environments. Furthermore, the agricultural sector relies heavily on trucks for transporting produce, livestock, and machinery, while waste management and emergency services utilize purpose-built vehicles to maintain public health and safety, showcasing the pervasive and essential nature of trucks across the industrial and public service landscape.

The core benefits derived from a robust truck market include significant improvements in supply chain efficiency, enabling faster and more reliable delivery of goods, which in turn stimulates economic growth and facilitates global trade. Key driving factors propelling this market forward are the exponential growth of e-commerce, necessitating a dense and agile logistical network; rapid urbanization and population growth, which generate higher demand for goods and services; substantial global investments in infrastructure development, requiring extensive heavy-duty transport; and continuous advancements in vehicle technology, including telematics, automation, and alternative powertrains. The growing global imperative for sustainable transportation also fuels innovation, accelerating the shift towards cleaner, more energy-efficient trucking solutions and fostering a long-term transition in the market's energy mix.

Truck Market Executive Summary

The truck market is currently navigating a period of profound transformation, influenced by dynamic business trends that emphasize operational efficiency, technological integration, and environmental sustainability. A prominent trend involves the escalating adoption of telematics and advanced fleet management systems, which are crucial for optimizing routes, monitoring driver performance, and facilitating predictive maintenance, thereby significantly reducing operating costs and enhancing overall logistical throughput. Simultaneously, there is a pronounced industry shift towards electrification and hydrogen fuel cell technologies, driven by global corporate sustainability mandates and supportive government incentives, leading to substantial investments in the development of charging and refueling infrastructure, alongside the production of innovative zero-emission commercial vehicles.

Regional dynamics exhibit considerable variance, reflecting disparate economic development levels, regulatory frameworks, and infrastructure capabilities worldwide. The Asia Pacific region, notably China and India, stands as the largest and most rapidly expanding market, propelled by accelerating industrialization, burgeoning e-commerce, and extensive governmental investments in transportation infrastructure. North America maintains a strong and stable demand, characterized by the consistent need for heavy-duty freight transport, cross-border trade, and a keen focus on upgrading existing fleets with advanced safety and connectivity features. Europe leads in the implementation of stringent emission standards and the proactive integration of electric and autonomous vehicle technologies, while emerging markets in Latin America and the Middle East & Africa present substantial growth potential, influenced by their developing logistical networks and resource-rich economies.

Segmentation trends reveal a clear trajectory towards specialized vehicle configurations and diversified powertrain options. The light-duty truck segment is experiencing robust expansion, primarily due to the explosive growth of e-commerce and the increasing demand for agile urban last-mile delivery solutions. Conversely, heavy-duty trucks continue to dominate essential sectors such as long-haul transportation, construction, and mining, with an escalating focus on incorporating sophisticated safety features and advanced driver-assistance systems (ADAS) to enhance operational security and driver comfort. Furthermore, while diesel powertrains remain prevalent, the market is rapidly diversifying with significant gains in battery-electric trucks (BETs), hybrid electric trucks (HETs), and vehicles powered by compressed natural gas (CNG), liquefied natural gas (LNG), and hydrogen fuel cells, signaling a definitive long-term transition towards cleaner, more sustainable energy sources in commercial transport.

AI Impact Analysis on Truck Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the truck market frequently center on its potential to revolutionize operational efficiency, bolster safety standards, and contribute to environmental sustainability. Users are keenly interested in the maturity and reliability of autonomous driving systems, inquiring about their readiness for widespread deployment and the associated regulatory and ethical considerations. There is also significant emphasis on the economic implications for fleet operators, specifically how AI-driven solutions like route optimization and predictive maintenance can translate into tangible cost savings and competitive advantages. Concerns often extend to the potential workforce displacement for truck drivers and the broader societal adjustments required by increasing automation in the logistics sector, underscoring a complex interplay of anticipation and apprehension regarding AI's transformative capacity.

The influence of AI extends far beyond the development of self-driving trucks, permeating various stages of the vehicle lifecycle, from advanced manufacturing processes to post-sale operational analytics. In manufacturing, AI-powered robotics and sophisticated data analytics are optimizing assembly lines, enhancing quality control through real-time defect detection, and accelerating the design and prototyping phases of new truck models. Post-purchase, AI algorithms are instrumental in processing and analyzing the vast amounts of telematics data generated by connected vehicles, providing invaluable insights into vehicle performance, fuel consumption patterns, driver behavior, and the early detection of potential maintenance issues. This data-driven approach facilitates proactive servicing, significantly reduces unexpected downtime, and extends the operational lifespan of vehicles, contributing directly to improved asset utilization and profitability for fleet owners.

Moreover, AI is pivotal in the development and refinement of highly sophisticated Advanced Driver-Assistance Systems (ADAS), which are crucial for augmenting vehicle safety by providing features such as adaptive cruise control, lane-keeping assist, automatic emergency braking, and driver fatigue monitoring. These systems represent foundational steps towards full autonomy, making roads safer for both commercial and passenger vehicles. The integration of AI also empowers smart logistics platforms, enabling dynamic route optimization that responds in real-time to traffic congestion, weather conditions, and delivery schedules, leading to substantial reductions in fuel consumption, transit times, and carbon emissions. As AI technologies continue to mature and become more integrated, their role in fostering a more intelligent, safer, and environmentally conscious trucking industry will undoubtedly intensify, establishing AI as a cornerstone for future market growth and sustainable evolution.

- Enhanced predictive maintenance and diagnostics, significantly reducing vehicle downtime and operational costs.

- Optimized route planning and logistics management, leading to improved fuel efficiency and punctual delivery times.

- Accelerated development and deployment of autonomous driving systems, addressing critical driver shortages and enhancing safety.

- Improved vehicle safety through sophisticated advanced driver-assistance systems (ADAS) and collision avoidance technologies.

- Real-time adaptation to dynamic environmental factors like traffic and weather for optimal operational adjustments.

- Integration with automated cargo loading/unloading systems and intelligent warehouse management solutions.

- Personalized driver training and performance monitoring, contributing to safer driving habits and greater operational efficiency.

- Development of AI-powered smart contracts and blockchain for transparent and secure supply chain transactions.

- Advanced cybersecurity protocols to protect connected truck systems and sensitive operational data from threats.

DRO & Impact Forces Of Truck Market

The truck market is intricately shaped by a dynamic interplay of driving forces, significant restraints, and emerging opportunities, all of which are subjected to broader impact forces. Key drivers propelling market expansion include the relentless growth of e-commerce, which mandates a sophisticated and high-capacity logistics network for last-mile and middle-mile delivery, alongside massive global investments in infrastructure development, requiring robust heavy-duty vehicles for construction and material transportation. The ongoing industrialization and rapid urbanization in emerging economies worldwide further stimulate demand for a diverse range of trucks, while continuous technological advancements in vehicle design, engine efficiency, and digital connectivity also play a pivotal role in market progression by offering more advanced and cost-effective solutions to fleet operators.

However, the market's growth trajectory is tempered by several formidable restraints. The substantial initial acquisition cost of modern trucks, particularly those equipped with advanced technologies like electric powertrains or autonomous features, can pose a significant barrier for smaller fleet owners and new entrants. Furthermore, increasingly stringent global emission regulations, while critical for environmental protection, necessitate complex engineering solutions that often elevate manufacturing costs and increase the overall price of vehicles. A persistent and worsening global shortage of skilled truck drivers continues to severely hamper operational capacity and efficiency across regions. Additionally, geopolitical instability, trade protectionism, and unpredictable economic downturns can significantly disrupt global supply chains and dampen demand for new truck purchases, creating a volatile and challenging market environment that requires cautious strategic planning from industry participants.

Despite these challenges, numerous opportunities exist for substantial market growth, particularly in the domain of sustainable and highly automated transportation solutions. The accelerating development and commercialization of electric and hydrogen fuel cell trucks present a monumental opportunity for manufacturers to meet evolving environmental targets and cater to a growing segment of environmentally conscious corporations and government agencies. The continued advancement of autonomous driving technologies offers a compelling solution to the driver shortage issue and promises significant enhancements in safety, fuel efficiency, and operational uptime, opening doors for entirely new business models and logistical paradigms. Moreover, the deeper integration of advanced telematics, Internet of Things (IoT), and Artificial Intelligence (AI) for smart logistics platforms and predictive maintenance creates vast avenues for delivering value-added services, optimizing fleet operations, and fostering a more connected, intelligent, and resilient trucking ecosystem for the future.

Segmentation Analysis

The truck market is meticulously segmented to reflect the vast array of applications, operational requirements, and technological preferences that vary significantly across diverse industries and geographic regions. This granular approach to segmentation is crucial for providing a comprehensive understanding of complex market dynamics, enabling manufacturers to precisely tailor product offerings and services to meet the distinct and evolving needs of their customer base. Key segmentation criteria typically include vehicle type, intended application, fuel type, axle configuration, and the specific end-use industry, each of which reveals unique growth patterns, competitive landscapes, and regulatory influences within the broader commercial vehicle sector. Analyzing these distinct segments provides invaluable insights into purchasing behaviors, technology adoption rates, and the impact of environmental and safety regulations, all of which are essential for effective strategic planning and product innovation.

By dissecting the market along these specific parameters, stakeholders can effectively identify high-growth niches, pinpoint emerging technological trends, and anticipate future shifts in demand. For instance, the light-duty truck segment is experiencing rapid expansion, largely propelled by the boom in e-commerce and the associated demand for efficient urban and last-mile delivery services. Conversely, the heavy-duty segment continues to assert its dominance in critical sectors such as long-haul logistics, construction, and mining, where durability, payload capacity, and robust performance are paramount. Similarly, the ongoing transition from traditional diesel powertrains to alternative fuel types, including battery-electric and hydrogen fuel cell technologies, is creating entirely new sub-segments with immense growth potential, driven by global sustainability agendas and carbon reduction commitments, thereby reshaping the competitive landscape and investment priorities across the industry.

The strategic importance of such detailed segmentation cannot be overstated for all market participants, including manufacturers, fleet operators, and technology providers. For manufacturers, a clear understanding of these segments enables targeted research and development efforts, ensuring that new vehicle models and integrated technologies are specifically designed to align with the unique operational requirements of, for example, specialized construction fleets versus general freight carriers. For investors and policymakers, this in-depth analysis offers a more precise perspective on market growth trajectories, competitive intensity, and the environmental implications of various truck categories. This granular insight facilitates more informed decision-making, from directing R&D investments to shaping regulatory frameworks, ultimately fostering the sustainable evolution of the entire commercial vehicle ecosystem and driving innovation that is precisely tailored to meet diverse global and local market requirements.

- By Type:

- Light-Duty Trucks (LCVs)

- Medium-Duty Trucks (MDVs)

- Heavy-Duty Trucks (HDVs)

- By Application:

- Logistics & Transportation

- Construction

- Mining

- Agriculture

- Waste Management

- Military & Defense

- Municipal Services & Utility

- Emergency & Fire Services

- By Fuel Type:

- Diesel

- Electric (Battery Electric Trucks - BETs)

- Hybrid Electric

- Compressed Natural Gas (CNG)

- Liquefied Petroleum Gas (LPG)

- Hydrogen Fuel Cell

- Gasoline

- By Axle Type:

- 2-Axle

- 3-Axle

- 4+ Axle

- By End-Use Industry:

- Retail & Consumer Goods

- Manufacturing & Industrial

- Energy & Utilities

- Government & Public Sector

- Food & Beverage

- Pharmaceuticals & Healthcare

- Logistics Service Providers

Value Chain Analysis For Truck Market

The value chain of the truck market constitutes a complex and interconnected ecosystem that commences with extensive upstream activities, primarily involving raw material suppliers and specialized component manufacturers. This initial stage includes the procurement of essential materials such as various grades of steel, aluminum alloys, high-performance plastics, and advanced semiconductors, alongside the sourcing of critical subsystems like engines, transmissions, axles, braking systems, and electronic control units. The efficiency, quality, and innovative capacity of these upstream suppliers directly influence the final product's performance, manufacturing cost, and overall reliability. Establishing robust and collaborative relationships with these suppliers is paramount for truck manufacturers to ensure a consistent supply of high-quality components, optimize inventory management, and facilitate the seamless integration of cutting-edge technologies from their specialized partners, thereby laying the groundwork for superior product development and market competitiveness.

Downstream activities in the truck market encompass the pivotal stages of manufacturing, assembly, and the establishment of comprehensive distribution channels. Truck manufacturers, functioning as Original Equipment Manufacturers (OEMs), meticulously assemble the procured components into complete, market-ready vehicles, a process that typically involves multiple intricate production stages and rigorous quality control checks to meet stringent industry standards. Once manufactured, these trucks are distributed through diverse channels, including direct sales engagements with large corporate fleet operators, government agencies, and major industrial buyers, as well as via extensive networks of independent dealerships and global distribution partnerships. These varied channels are collectively responsible for sales, offering diverse financing options, providing essential after-sales services, and ensuring the ready availability of spare parts, forming a critical link between the manufacturer and the end-user.

The distribution channels employed within the truck market can be broadly categorized into direct and indirect methods, each offering distinct advantages and strategic reach. Direct channels involve OEMs engaging in direct sales to major corporate clients, large-scale fleet buyers, and governmental organizations, often facilitated by dedicated sales teams and customized solution providers. This approach allows for highly personalized vehicle configurations, closer client relationships, and often a deeper understanding of specific operational requirements. Conversely, indirect channels primarily rely on a network of authorized dealerships and third-party distributors who purchase trucks from manufacturers and subsequently sell them to individual businesses, small to medium-sized enterprises (SMEs), and local government entities. These indirect networks provide broad market penetration, localized sales support, and crucially, an extensive array of after-sales services, including routine maintenance, complex repairs, and the provision of essential spare parts, thereby creating a comprehensive support infrastructure that is vital for truck owners throughout the entire operational lifecycle of their vehicles.

Truck Market Potential Customers

The potential customer base for the truck market is remarkably broad and diverse, primarily encompassing a wide spectrum of industries and organizations that fundamentally rely on the efficient transportation of goods, specialized materials, or the delivery of critical services. Large-scale logistics and freight transportation companies represent a colossal segment, consistently procuring extensive fleets of trucks for long-haul, regional, and intricate inter-city transportation operations. These major players typically prioritize vehicles that offer superior fuel efficiency, exceptional reliability, advanced telematics and connectivity features, and comprehensive after-sales service agreements to maximize uptime and minimize total cost of ownership. The burgeoning e-commerce sector and dedicated parcel delivery services constitute another rapidly expanding customer segment, demonstrating a high demand for agile light and medium-duty trucks specifically optimized for last-mile delivery and efficient urban operations, where maneuverability and lower operational costs in densely populated areas are paramount for competitive advantage.

Beyond the traditional logistics realm, the construction and mining sectors emerge as indispensable end-users, requiring a robust fleet of heavy-duty trucks such as specialized dump trucks, concrete mixers, and purpose-built off-highway vehicles for the transportation of raw materials, heavy equipment, and efficient waste management on large-scale infrastructure and resource extraction projects. Agricultural enterprises, ranging from expansive corporate farms to individual agricultural businesses, extensively utilize trucks for the secure and timely transportation of produce, livestock, and essential farm machinery. Similarly, municipal governments and specialized waste management companies are significant procurers of custom-built trucks for essential public services, including refuse collection, snow removal, and emergency response operations, where extreme durability, specific functional capabilities, and unwavering reliability are critical for ensuring public welfare and maintaining operational continuity.

Furthermore, a diverse array of manufacturing industries, spanning from automotive assembly to consumer goods production, are fundamentally dependent on trucks for the inbound transportation of components to their production lines and the outbound distribution of finished products to warehouses, distribution centers, or retail outlets. The dynamic energy sector, encompassing both traditional oil and gas exploration and the rapidly expanding renewable energy projects, also demands highly specialized heavy-duty trucks for transporting oversized equipment, essential materials, and personnel to often remote and challenging operational sites. Emerging segments, such as on-demand urban food delivery services, mobile service providers, and specialized utility maintenance companies, further contribute to the growing demand for smaller, more versatile, and fuel-efficient commercial vehicles. The highly diverse and evolving needs of these extensive end-users are a primary driver for continuous innovation in truck design, payload capacities, powertrain options, and integrated digital technologies, enabling manufacturers to effectively cater to a broad, dynamic, and ever-expanding global customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.28 Trillion |

| Market Forecast in 2033 | USD 2.02 Trillion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler Truck AG, Volvo Group, PACCAR Inc., Traton Group, Ford Motor Company, Isuzu Motors Ltd., Hino Motors, Tata Motors, General Motors, Navistar International Corporation, BYD Company Ltd., Tesla, Nikola Corporation, Oshkosh Corporation, Sany Heavy Industry, FAW Group, SAIC Motor Commercial Vehicle, Kenworth, Peterbilt, Freightliner, Ashok Leyland, Dongfeng Motor Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Truck Market Key Technology Landscape

The truck market's technological landscape is undergoing a rapid and profound evolution, primarily propelled by the dual imperatives of enhancing operational efficiency and achieving greater environmental sustainability. One of the most significant and transformative advancements is in the realm of powertrain electrification, with Battery Electric Trucks (BETs) and Hydrogen Fuel Cell Electric Trucks (FCETs) rapidly gaining prominence. These cutting-edge technologies directly address pressing environmental concerns by substantially reducing tailpipe emissions and noise pollution, compelling manufacturers to invest heavily in advanced battery development, the establishment of expansive charging infrastructure, and the expansion of hydrogen production and distribution networks. Hybrid electric trucks also serve as a crucial transitional technology, offering immediate improvements in fuel efficiency and reduced emissions without necessitating a complete overhaul of existing infrastructure, particularly suitable for medium-duty and regional haul applications. This fundamental shift also mandates continuous innovation in sophisticated battery management systems, power electronics, and the development of lightweight yet highly durable materials to maximize vehicle range, optimize payload capacity, and ensure long-term reliability.

Another critically transformative area shaping the market is the rapid advancement of autonomous driving technology, which spans a spectrum from highly sophisticated Advanced Driver-Assistance Systems (ADAS) to the ambitious goal of fully self-driving trucks. ADAS features such as adaptive cruise control, lane-keeping assist, automatic emergency braking, blind-spot detection, and driver fatigue monitoring are becoming increasingly standard, significantly enhancing vehicle safety, reducing driver workload, and mitigating the risk of accidents. The development of platooning technology, where multiple trucks travel in close, electronically linked convoys, promises substantial fuel savings through reduced aerodynamic drag and optimized traffic flow on highways. Fully autonomous trucks are currently undergoing extensive pilot testing in controlled environments and on designated long-haul routes, with the potential to revolutionize logistics by addressing the persistent driver shortage, operating around the clock, and fundamentally improving logistical efficiency. These sophisticated systems rely on a complex fusion of cutting-edge sensors, including Lidar, Radar, and high-resolution cameras, integrated with advanced Artificial Intelligence algorithms and high-precision digital mapping to perceive, analyze, and navigate their surroundings effectively.

Furthermore, pervasive digital connectivity and advanced telematics are becoming indispensable standard features in modern trucks, providing real-time data on vehicle performance, precise location tracking, detailed driver behavior analytics, and predictive maintenance alerts. The integration of Internet of Things (IoT) devices facilitates seamless communication between individual vehicles, surrounding infrastructure, and central fleet management systems, thereby enabling highly intelligent fleet management, dynamic route optimization that responds to real-time conditions, and enhanced cargo security. Robust cybersecurity measures are also becoming paramount to protect these increasingly connected and data-rich systems from potential external threats and unauthorized access, ensuring data integrity and operational resilience. Beyond electronics, materials science continues to contribute significantly with the development of lightweight yet highly durable composite materials and advanced metallurgy, which effectively reduce overall vehicle weight, improve fuel economy, and extend vehicle lifespan without compromising structural integrity or safety. These convergent technological advancements collectively aim to forge a safer, significantly more efficient, and environmentally sustainable trucking ecosystem, optimizing every facet of commercial vehicle operation from initial design and manufacturing through to active deployment and ongoing maintenance.

Regional Highlights

- North America: A mature and technologically advanced market characterized by robust demand for heavy-duty trucks, primarily driven by extensive long-haul freight operations, intermodal logistics, and substantial infrastructure development projects. There is a strong emphasis on integrating advanced telematics, sophisticated driver assistance systems, and an accelerating adoption of electric trucks for regional haul and last-mile delivery, particularly in dense urban centers. Significant ongoing investments in digital and physical infrastructure further stimulate demand for modernized and efficient trucking fleets across the United States, Canada, and Mexico.

- Europe: A global leader in adopting stringent emission regulations and rapidly integrating alternative fuel vehicles, particularly advanced electric and hydrogen fuel cell trucks into commercial fleets. The market prioritizes sustainable logistics, innovative urban mobility solutions, and the testing and deployment of truck platooning technologies to enhance efficiency and reduce environmental impact. Key contributing countries include Germany, France, the UK, and the Netherlands, which are actively promoting greener fleets and advanced smart transportation systems through supportive policies and significant public and private investments.

- Asia Pacific (APAC): Recognized as the largest and most rapidly expanding truck market globally, primarily fueled by unprecedented industrialization, the explosive growth of e-commerce, and massive governmental investments in infrastructure development across economies such as China, India, Japan, and Southeast Asian nations. The region is characterized by high demand for a diverse range of light and medium-duty trucks for varied applications, coupled with a burgeoning interest and rapid adoption of electric commercial vehicles driven by pressing air quality concerns in major metropolitan areas and strong government support for new energy vehicles.

- Latin America: An emerging and dynamic market significantly influenced by commodity exports, including mining products and agricultural produce, alongside expanding logistics networks and regional trade agreements. Brazil, Mexico, and Argentina are key players in this region, with a strong focus on modernizing aging truck fleets and improving road infrastructure to support growing economic activities. Economic stability, coupled with favorable trade policies and increasing foreign investment, plays a crucial role in stimulating market growth and driving the demand for new and technologically advanced commercial vehicles.

- Middle East & Africa (MEA): A growth market experiencing increasing demand primarily driven by robust oil & gas sector activities, extensive construction booms, and the strategic development of new trade routes and logistics hubs. The demand for heavy-duty trucks is particularly significant in construction and resource extraction industries. Governments across the region are investing heavily in logistics infrastructure and actively promoting economic diversification, which is leading to a growing demand for various truck types and a rapidly emerging interest in new energy vehicles as part of broader sustainability and economic development agendas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Truck Market.- Daimler Truck AG

- Volvo Group

- PACCAR Inc.

- Traton Group

- Ford Motor Company

- Isuzu Motors Ltd.

- Hino Motors

- Tata Motors

- General Motors

- Navistar International Corporation

- BYD Company Ltd.

- Tesla

- Nikola Corporation

- Oshkosh Corporation

- Sany Heavy Industry

- FAW Group

- SAIC Motor Commercial Vehicle

- Kenworth

- Peterbilt

- Freightliner

- Ashok Leyland

- Dongfeng Motor Corporation

Frequently Asked Questions

Analyze common user questions about the Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate and market size of the Truck Market?

The Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. It is estimated at USD 1.28 Trillion in 2026 and is forecast to reach USD 2.02 Trillion by 2033, driven by global logistics demand and e-commerce expansion.

What are the primary factors driving the Truck Market's expansion?

Key drivers include the significant growth of e-commerce, increasing global investments in infrastructure development, rapid urbanization, and continuous technological advancements in vehicle efficiency, safety, and connectivity solutions for logistics.

How is Artificial Intelligence (AI) impacting the Truck Market?

AI is profoundly impacting the market by enabling advanced driver-assistance systems, optimizing route planning, facilitating predictive maintenance, and accelerating the development of autonomous trucking, leading to enhanced safety, efficiency, and reduced operational costs.

What are the main segmentation types within the Truck Market?

The market is primarily segmented by vehicle type (Light-Duty, Medium-Duty, Heavy-Duty), application (Logistics, Construction, Mining), fuel type (Diesel, Electric, Hybrid, Hydrogen), axle type, and specific end-use industries, reflecting diverse operational needs.

Which regions are key contributors to the global Truck Market?

Asia Pacific is the largest and fastest-growing region due to industrialization and e-commerce, while North America and Europe are significant markets driven by technological adoption, stringent environmental regulations, and robust logistical demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Truck Landing Gear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- All Terrain Dump Truck Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Truck Washing System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Truck Tarps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Pressure Gas Transport Truck Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager